Zee Business Stock, Trading Guide: Things to Know Before Market Opens on 22nd September 2022

The BSE Sensex slipped 263 points of 0.44 per cent to 59,457 and Nifty50 dipped 98 points or 0.55 per cent to 17,718 at the close.

Zee Business Stock, Trading Guide: The Indian markets snapped two-day gaining streak ahead of US Fed FOMC (Federal Open Market Committee) outcome. The BSE Sensex slipped 263 points of 0.44 per cent to 59,457 and Nifty50 dipped 98 points or 0.55 per cent to 17,718 at the close.

Barring FMCG and media, most of the sectoral indices traded in tandem with the benchmark indices and ended lower around 1 per cent. Financials saw selling pressure, IndusInd Bank being top loser –down 3 per cent. While Britannia, HUL, ITC, Apollo Hospitals gain in a volatile session of trade.

Markets will first react to the Fed meet outcome in early trades on Thursday, besides, the scheduled weekly expiry would add to the volatility, Ajit Mishra, VP - Research, Religare Broking said.

Amid all, indications are in the favour of further consolidation so we suggest traders to stay light and focus more on the risk management part, Mishra said. “On index front,17,400-17,500 zone would acts a cushion in Nifty while rebound towards 17,900-18,000 zone may attract selling pressure.”

Here is a list of things to watch out for on 22 September 2022

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.55 per cent lower at 17,718.35. Key Pivot points (Fibonacci) support for the index is placed at 17673, 17631, and 17565 while resistance is placed at 17807, 17848, and 17915.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.64 per cent lower at 41,203.45. Key Pivot points (Fibonacci) support for the index is placed at 40964, 40819 and 40585 while resistance is placed at 41432, 41576, and 41810.

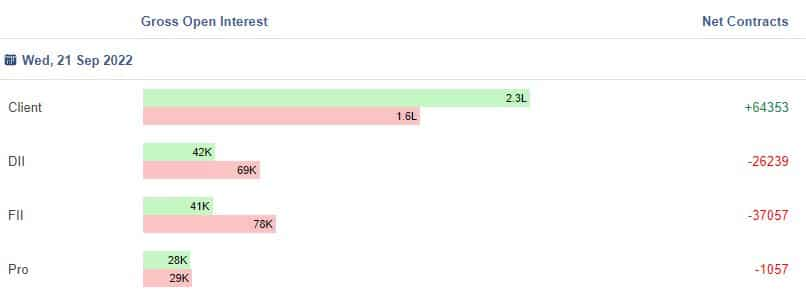

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Stocks in News:

Wipro terminates 300 employees found 'moonlighting'. Rishad Premji says 300 Wipro employees were found working for competitors.

Triveni Engg says it divested entire 21.85% stake in Triveni Turbine. 11.85% acquired by marquee global and domestic investors and 10% acquired by promoter through an inter-se promoter transfer.

Can Fin Homes relieved Girish Kousgi from the post of MD & CEO on Oct 20, 2022. Kousgi had resigned as MD & CEO of Can Fin Homes on Sep 19.

SBI raises Rs. 4,000 crore Basel III compliant Tier 2 bonds at coupon rate of 7.57%. Issue oversubscribed by about 5 times against the base issue size of Rs 2,000 crore.

Kirloskar Oil: La-Gajjar Machineries has become a 100% subsidiary of company.

Registrar Of Companies grants Future Ent extension for a period of 3 months to hold #AGM before Dec 31, 2022.

KPI Green gets new order of 5.40 MW (comprising of 5.40 MW Wind Turbine and 4 MWdc Solar) under Wind-Solar Hybrid Power Proiect under Captive Power Producer segment.

Spandana Sphoorty to issue NCDs up to Rs 25 crore on a private placement basis with a green shoe option up to Rs 25 crore.

Star Housing Finance: Board meet on Sep 26 to consider increasing authorised share capital of company & alteration of capital Clause of MoA.

IDBI Bank completes sale of entire stake of Ageas Federal Life Insurance Company.

Adani Transmission commits to reduce its absolute scope 1 & scope 2 GHG emissions by 72.7% by FY2032.

Ashoka Buildcon receives Letter Of Acceptance from South Western Railway for a project worth Rs 258.12 crore.

Heritage Foods board to consider raising funds via rights issue on September 30, 2022.

Escorts Kubota Agri & Construction Business President Shenu Agarwal resigns.

DGCA continues to keep SpiceJet under enhanced surveillance.

Corporate Action:

Bajaj Holdings & Investment: Interim Dividend 1100 per cent at Rs 110 per share

Elcid Investments: Final Dividend 150 per cent at Rs 15 per share

Polyplex Corporation: Final Dividend 210 per cent at Rs 21 per share

FII Activity on Wednesday:

Foreign portfolio investors (FPIs) remained net sellers for Rs 461.04 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 538.53 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

Airo Lam Limited: Tarak V Vora HUF sold 80,000 equity shares in the company at the weighted average price Rs 99.3 per share on the NSE, the bulk deals data showed.

Dodla Dairy Limited: Bharat Biotech International Ltd bought 20,26,434 equity shares in the company at the weighted average price Rs 525 per share on the NSE, the bulk deals data showed.

Hind Rectifiers Limited: Shah Sanjiv Dhireshbhai bought 1,03,269 equity shares in the company at the weighted average price Rs 226.89 per share on the NSE, the bulk deals data showed.

Triveni Turbine Limited: SBI Mutual Fund bought 75,45,788 equity shares in the company at the weighted average price Rs 226.7 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Delta Corp, Escorts, RBL Bank, Ambuja Cements, Can Fin Homes and PVR are placed under the F&O ban for Thursday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

04:08 PM IST

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022