Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022

The broader indices too traded in tandem and ended with a cut of over a percent each, while the Nifty Bank index falls 467 points to 42,959 at the close on Wednesday.

Zee Business Stock, Trading Guide: The Indian Markets traded under pressure and lost over a percent amid mixed cues. The Nifty50 and BSE Sensex gradually inched lower as the day progressed and finally settled around the day’s low to close at 18,042 and 60,657 levels, respectively.

The decline was widespread wherein realty, metal, and energy were among the top losers. The broader indices too traded in tandem and ended with a cut of over a percent each, while the Nifty Bank index falls 467 points to 42,959 at the close on Wednesday.

“On the global front, the head of the IMF has said that one-third of the world economy will be in recession in 2023. Rising interest rates, the Russia-Ukraine crisis, and the spread of the COVID case in China are also pressuring the market,” Pravesh Gour, Senior Technical Analyst, Swastika Investmart.

But still, the domestic market is showing strength as compared to the global market ahead of the Union Budget 2023 and Q3 earnings, the market analyst Gour noted.

Here is a list of things to watch out for on 30 December 2022

What should investors do?

This decline has engulfed the gains of the last four sessions in Nifty and selling pressure in the banking index, which was acting as a saviour so far, has further deteriorated the mood.

We feel the pressure may increase below 18000 levels in Nifty. Keeping in mind the scenario, it is prudent to limit leveraged positions and wait for clarity.

- By Ajit Mishra, VP - Technical Research, Religare Broking Ltd.

Technical View

Technically, Nifty has closed near an important support zone of 18050–18000, which is also acting as an immediate demand zone to buy any dip.

Below this, we may see some weakness towards the 100-DMA of 17900. On the upside, the vulnerable range is 18265–18300. Above 18300, we can expect a move towards 18370.

- Pravesh Gour, Senior Technical Analyst, Swastika Investmart Ltd

Key support & resistance levels for Nifty50:

The Nifty50 closed 1.04 per cent lower at 18,042.95. Key Pivot points (Fibonacci) support for the index is placed at 18017.21, 17964.72, and 17879.77, while resistance is placed at 18187.12, 18239.61, and 18324.57.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 1.07 per cent lower at 42,958.80. Key Pivot points (Fibonacci) support for the index is placed at 42856.97, 42687.1, and 42412.14, while resistance is placed at 43406.9, 43576.77, and 43851.73.

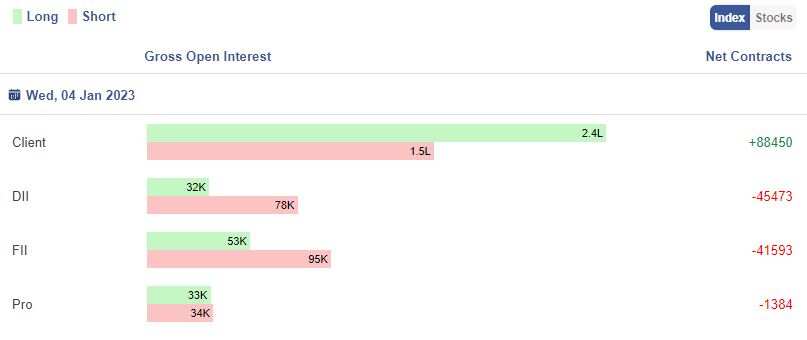

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source - Stockedge

Stocks in News

RBL Bank Q3 Update (Provisional): Total deposits up 11% at Rs 81,746 cr Vs Rs 73,639 cr (YoY) and CASA up 18% at Rs 29,948 cr Vs Rs 25,318 cr (YoY).

HPCL signs MoU with NTPC green energy ltd (NGEL). Company forays into petrochemical business with pre-marketing of ‘HP DURAPOL’ brand polymers.

SJVN: Union Cabinet approves investment of Rs 2,614 crore for the company’s 382 MW Sunni Dam Hydro Project.

Mahindra Finance: RBI lifts restrictions on recovery via outsourcing.

IRB Infra Stock-split: Co approves subdivision of 1 share into 10.

Reliance Capital’s clarification on reports of Torrent moving NCLT against Hinduja’s revised offer: Application filed by Torrent Investment before NCLT is currently sub judice.

Marico Q3 Update: FMCG sector witnessed some improvement in demand and expect modest growth in operating profit.

Adani Ports: December total cargo volume at 25.1 MMT, up 8% (YoY) and April-December total cargo volume at 253 MMT, up 8% (YoY).

FII Activity on Wednesday:

Foreign portfolio investors (FPIs) remained net sellers for Rs 2620.89 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 773.58 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source – Stockedge

Bulk Deals:

Rbm Infracon Limited: Jain Sanjay Popatlal bought 60,000 equity shares in the company at the weighted average price Rs 52.5 per share on the NSE, the bulk deals data showed.

Somany Ceramics Limited: PGIM India Mutual Fund bought 3,07,000 equity shares in the company at the weighted average price Rs 499.03 per share on the NSE, the bulk deals data showed.

HP Adhesives Limited: Renu Pittie bought 1,10,000 equity shares in the company at the weighted average price Rs 409.59 per share on the NSE, the bulk deals data showed.

Exxaro Tiles Limited: Colourshine Hosiery Private Limited bought 2,40,000 equity shares in the company at the weighted average price Rs 128.05 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

No stock is placed under the F&O ban for Thursday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Sectoral Mutual Funds With Best SIP Returns in 1 Year: No. 1 scheme has converted Rs 34,567 monthly SIP investment into Rs 5,40,565; know about others

SBI 400-day FD vs Bank of India 400-day FD: Where will investors get higher returns on investments of Rs 4,54,545 and Rs 6,56,565?

SBI Guaranteed Return Scheme: Know how much maturity amount you will get on Rs 2 lakh, 3 lakh, and Rs 4 lakh investments under Amrit Vrishti FD scheme

SBI Green Rupee Deposit 2222 Days vs Canara Bank Green Deposit 2222 Days FD: What Rs 7 lakh and Rs 15 lakh investments will give to general and senior citizens; know here

11:18 PM IST

Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 21 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 21 December 2022