Zee Business Stock, Trading Guide: 10 things to know before market opens on 21 December 2022

Recovery in select heavyweights trimmed the losses and both NSE Nifty50 and BSE Sensex settled around 18,385 and 61,702 levels, respectively.

Zee Business Stock, Trading Guide: The Indian market traded volatile and ended marginally lower, in continuation to the prevailing corrective phase. Weak global cues triggered a gap-down start in the benchmark indices which further deteriorated as the session progressed.

However, recovery in select heavyweights trimmed the losses and both NSE Nifty50 and BSE Sensex settled around 18,385 and 61,702 levels, respectively. The broader indices traded in tandem and shed nearly half a percent each.

Here is a list of things to watch out for on 21 December 2022

What should investors do?

Weak global cues have been weighing on sentiment however buying in select index majors is capping the damage so far. We feel the performance of the global markets will continue to dictate the trend, in absence of any major event.

Meanwhile, traders should limit positions and prefer a hedged approach until we see some stability.

- By Ajit Mishra, VP - Technical Research, Religare Broking Ltd.

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.2 per cent lower at 18,385.30. Key Pivot points (Fibonacci) support for the index is placed at 18253.73, 18206.01, and 18128.77, while resistance is placed at 18408.21, 18455.93, and 18533.17.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.12 per cent lower at 43,360. Key Pivot points (Fibonacci) support for the index is placed at 43067.19, 42956.08, and 42776.23, while resistance is placed at 43426.88, 43537.99, and 43717.83.

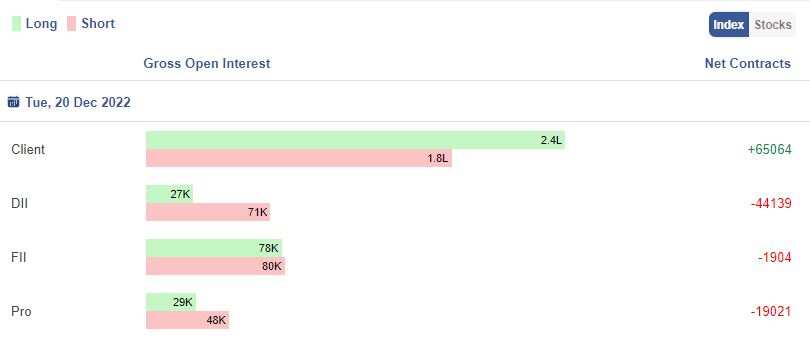

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Stocks in News

Shyam Metalics to conclude acquisition of Mittal Corp

Domino's launches 20-minute delivery service in 20 zones across 14 cities in India

Central Bank of India to consider the proposal of raising capital via tier ii bonds on Dec 26

Union Bank of India subscribes 2 cr shares of Star Union Dai-Ichi Life Insurance Company (SUD life) offered under RightsIssue by the company at Rs 25 per share aggregating to Rs 50.20 cr

City Union Bank: RBI, in its on-site Inspection For Supervisory Evaluation (ISE) for FY2021-22, finds divergence in additional gross NPA for FY22 amounting to Rs 259 cr

Airtel enters into an agreement for acquisition of ~8% stake in a technology startup, Immensitas Private Limited (Lemnisk)

UNO Minda Ltd. Signed TLA agreement with Korea’s Asentec Co Ltd.

CCI approves Brookfield's minority stake buy in UPL SAS

GIC Board Meet on Wednesday

Speciality Restraunts board to mull fund raising on 21st Dec

Zodiac Clothing Company will hold a meeting of the Board of Directors for fund raising

BSNL to raise up to Rs 4,200 crore via 10-year bonds on December 21

Business News

RBI Governor Shaktikanta Das in conversation at the Business Standard BFSI Insight Summit 2022 at 11.00 tomorrow.

Waning input cost pressure, rising investments herald upturn in capex cycle: RBI article

Sebi decides to gradually phase out share buyback through stock exchange route.

Sebi to reduce time taken for registration of FPIs to facilitate ease of doing business

Over 3 per cent of 84,874 drug samples tested in 2020-21 were found substandard: Govt

Sterling and Wilson Renewable Energy OFS For Retail Investors to open tomorrow.

Paytm Buyback to begin tomorrow (Period- 21st dec to 19 June 23, Price- 810)

Vedanta announces incentives for purchase of EVs by employees

Shyam Metalics to invest Rs 7,500cr in 4-5 yrs, forays into stainless steel biz

EPFO adds 12.94 lakh net subscribers in October

Hyundai has introduced its second electric car IONIQ 5 in India

PLI Incentives approved for Foxconn India and Padget Electronics.

FII Activity on Tuesday:

Foreign portfolio investors (FPIs) remained net buyers for Rs 455.94 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 494.74 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

New Delhi Television Limited: LTS Investment Fund Ltd sold 4,08,981 equity shares in the company at the weighted average price Rs 362.14 per share on the NSE, the bulk deals data showed.

Sudarshan Chemical: Norges Bank On Account Of The Government Pension Fund Global sold 7,03,620 equity shares in the company at the weighted average price Rs 377.01 per share on the NSE, the bulk deals data showed.

Pritika Eng Compo Ltd: Anshul Agarwal bought 56,000 equity shares in the company at the weighted average price Rs 41.13 per share on the NSE, the bulk deals data showed.

Atal Realtech Limited: Gajiwala Sweety Vikram sold 1,34,400 equity shares in the company at the weighted average price Rs 72 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Delta Corp, Indiabulls Housing Finance, IRCTC, PNB and GNFC are placed under the F&O ban for Wednesday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Mutual Funds With Highest Returns in 1 Year: Rs 6,54,321 in No 1 scheme has jumped to 10,38,996; what about others?

Stocks to buy for 2025: Anil Singhvi bets on 2 largecaps and 1 midcap stock for up to 48% potential gains

SBI Guaranteed Return Schemes: Here's what PSU bank is giving on Amrit Vrishti and other fixed deposit schemes to senior citizens and others

Power of Compounding: How can you create Rs 5 crore, 6 crore, 7 crore corpuses if your monthly salary is Rs 20,000?

Highest Senior Citizen FD Rates: Here's what banks like SBI, PNB, BoB, Canara Bank, HDFC Bank and ICICI Bank are providing on 1-year, 3-year, 5-year fixed deposits

PPF vs SIP: With Rs 12,000 monthly investment for 30 years; which can create highest retirement corpus

Top 7 Mutual Funds With Best SIP Returns in 1 Year: Rs 33,333 monthly SIP investment in No. 1 fund has generated Rs 5,12,069; know more details

10:24 PM IST

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022