Zee Business Stock, Trading Guide: Things to Know Before Market Opens on 20th September 2022

The BSE Sensex rose by 300 points or 0.5 per cent to 59,141 and the Nifty50 gained by 91 points or 0.5 per cent to 17,622 levels today.

Zee Business Stock, Trading Guide: The Indian markets closed with a minor gain after a rangebound session on Monday. The BSE Sensex rose by 300 points or 0.5 per cent to 59,141 and the Nifty50 gained by 91 points or 0.5 per cent to 17,622 levels today

The Nifty index witnessed a swift rebound in the first hour after the initial fall and remained range-bound thereafter, Ajit Mishra, VP - Research, Religare Broking said, adding that the sectoral trend was mixed as banking, FMCG, and auto saw buying interest while realty, energy, and metal declined.

Mishra expects choppiness to continue amid the feeble global cues so it’s prudent to place positions on both sides. Bank and financials are doing well on the expected lines and selective buying is visible in auto and FMCG also on dips, he added. “Participants should align their positions accordingly.”

On technical terms, the Nifty entered short-term correction mode in the last week and continuing with the bearish momentum from the last week, the index slipped in the initial trade on September 19, Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas said in his comment.

“It went down to test the 40 DEMA, which brought in some buying support. As a result, the Nifty bounced towards the 20 DMA, which acted as a cap for the day,” Ratnaparkhi added.

Here is a list of things to watch out for on 15 September 2022

Technical View on Nifty, Nifty Bank

By Rupak De, Senior Technical Analyst at LKP Securities

Nifty has remained range bound as investors await the FOMC outcome, due this week. On the lower end, Nifty found support above 17400, whereas bears protected the 17700 mark. The trend is likely to remain sideward over the near term.

Support for Nifty50 is placed at 17350-17400, a fall below 17350 may trigger a correction towards 17000. On the higher end, 17700 may act as crucial resistance. A decisive move above 17700 may induce a rally towards 17900/18100.

By Kunal Shah, Senior Technical Analyst at LKP Securities

The Bank Nifty index witnessed consolidation in the range of 40,500-41,500 and this is likely to continue ahead of the US FOMC meeting which is lined up this week.

On the derivative front, the highest open interest on the call side is built up at 41,500 and support is visible at 40,000 where the highest open interest is built up on the put side. Traders should place up for the volatility in the coming days and should trade on both sides.

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.52 per cent higher at 17,622.25. Key Pivot points (Fibonacci) support for the index is placed at 17482, 17426, and 17335 while resistance is placed at 17663, 17719, and 17810.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.31 per cent lower at 40,904.40. Key Pivot points (Fibonacci) support for the index is placed at 40608, 40449 and 40191 while resistance is placed at 41123, 41282, and 41540.

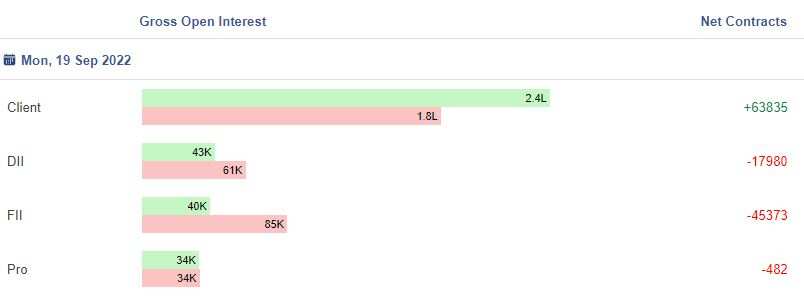

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Stocks in News

Kotak Mahindra Bank listed as a payment gateway on the recently launched income tax department’s TIN 2.0 platform

SAT Industries to consider, decide to sell company’s investment on September 23.

Adani Enterprises raises Rs 100 crore via NCDs.

Natco Pharma gets CTPR launch approval from Delhi High Court. Company estimates the current market size of CTPR containing products in India to be over Rs 2,000 crore.

Future Supply Chain board calls off plan to sell/dispose warehouse assets, to explore other opportunities for rehabilitation of business operations.

CEAT board allots NCDs (Non-Convertible Debentures) aggregating to Rs 150 cr, on a private placement basis.

Mishtann Foods to set up a 1000 KLPD grain-based ethanol manufacturing facility in Gujarat. The estimated cost of the project is Rs 2,250 crore.

Bombay Dyeing board to consider fund raise via rights issue on September 22.

Ircon International bags order worth Rs 256 cr by Mahanadi Coalfields.

Crompton Greaves approves the sale of 6% stake in subsidiary Butterfly Gandhimathi Appliances via Offer-For-Sale (OFS).

Hatsun Agro board approves raising up to Rs 400 cr via rights issue

FII Activity on Monday:

Foreign portfolio investors (FPIs) remained net buyers for Rs 312.31 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net sellers to the tune of Rs 94.68 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

Kshitij Polyline Limited: Jaya Jalan sold 52,665 equity shares in the company at the weighted average price Rs 106.15 per share on the NSE, the bulk deals data showed.

Coastal Corp Limited-RE: Achanta Satyasree sold 25,558 equity shares in the company at the weighted average price Rs 101.72 per share on the NSE, the bulk deals data showed.

TRF Limited: Mansi Shares & Stock Advisors Pvt Ltd sold 57,546equity shares in the company at the weighted average price Rs 324.35 per share on the NSE, the bulk deals data showed.

Ksolves India Limited: Deepali Verma sold 1,86,000 equity shares in the company at the weighted average price Rs 400.08 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Delta Corp, Escorts, RBL Bank, IndiaBulls Housing Finance, India Cement and PVR are placed under the F&O ban on Tuesday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

08:21 PM IST

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022