Zee Business Stock, Trading Guide: 10 things to know before market opens on 07 December 2022

Most of the sectoral indices traded in line with the benchmark and ended lower wherein IT, media and metal were among the top losers.

Zee Business Stock, Trading Guide: The Indian markets traded lackluster and lost nearly half a per cent, tracking feeble global cues. After the gap-down start, the Nifty hovered in a narrow range till the end and finally settled at 18,642.75 levels.

Most of the sectoral indices traded in line with the benchmark and ended lower wherein IT, media and metal were among the top losers. The broader indices too witnessed profit taking and shed nearly half a percent each.

Here is a list of things to watch out for on 07 December 2022

What should investors do?

Domestic markets are digesting the recent gains and it may take a few more sessions to resume the trend. Meanwhile, traders should focus on managing positions and gradually adding quality names from across sectors.

The decline in the auto and IT majors is offering a good opportunity to accumulate while pharma is not showing any sign of a reversal yet.

- Ajit Mishra, VP - Technical Research, Religare Broking Ltd.

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.31 per cent lower at 18,643. Key Pivot points (Fibonacci) support for the index is placed at 18595.79, 18577.62 and 18548.2 while resistance is placed at 18654.62, 18672.79, and 18702.2.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.45 per cent lower at 43,138.55. Key Pivot points (Fibonacci) support for the index is placed at 43085.91, 43031.52, and 42943.46, while resistance is placed at 43262.02, 43316.41, and 43404.46.

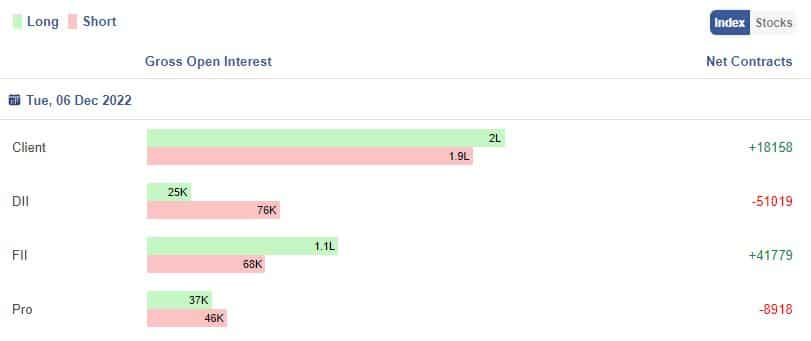

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Business News

RBI Monetary Policy outcome Tomorrow.

SEBI relaxes rules for govt for PSU disinvestment

CapitaLand to invest Rs 6,200 Cr in Telangana over next 5-7 years

Toyota Kirloskar recalls around 1K units of Urban Cruiser Hyryder

NCLT reserves order on Suraksha's bid to acquire Jaypee Infratech, complete 20k flats

Policy reforms, prudent regulatory mechanisms played key role in Indian economy's resilience: World Bank

Fitch retains India growth forecast at 7 pc for this fiscal, cuts projections for next 2 yrs

There is little chance of s decision on the GoM on online gaming, horse racing & casinos in the GST council meet on 17th December – source

Plumbing industry body IPA signs two agreements for water conservation, zero wastage.

Hinduja Tech acquires Drive System Design; to expand eMobility services

Stocks in News:

IDBI Bank to continue primary dealer business even if foreign bank acquires majority stake.

DoT proposes to drop Bharatnet infra from its asset monetisation plan

Simens Ltd won the bid for the electric locomotive project.

Ircon International Ltd received an order of around 122 Cr from Sri Lanka Railways.

KPI Green Energy Ltd receives new order for 1.10MW dc solar plant under captive power producer segment.

HDFC AMC promoter Abdrn Investment management sold entire stake in the company.

Vedanta to raise up to Rs 500 cr via debentures

FII Activity on Tuesday:

Foreign portfolio investors (FPIs) remained net sellers for Rs 635.35 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net sellers to the tune of Rs 558.67 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

Jindal Stainless Limited: Quant Mutual Fund -Small Cap Fund bought 26,30,000 equity shares in the company at the weighted average price Rs 182.97 per share on the NSE, the bulk deals data showed.

New Delhi Television: Vikasa India EIF I Fund sold 4,71,698 equity shares in the company at the weighted average price Rs 375.39 per share on the NSE, the bulk deals data showed.

Univastu India Limited: Manglam Financial Services bought 63,000 equity shares in the company at the weighted average price Rs 94.55 per share on the NSE, the bulk deals data showed.

Vip Clothing Ltd: Algoquant Fintech Limited bought 5,00,000 equity shares in the company at the weighted average price Rs 43.15 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

GNFC, IndiaBulls Housing Finance and PNB are placed under the F&O ban for Wednesday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

09:51 PM IST

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022