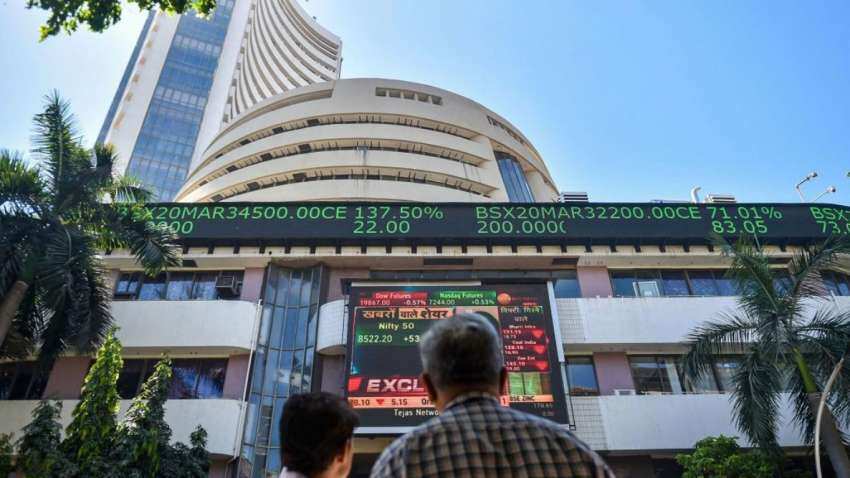

Zee Business Stock, Trading Guide: 10 things to know before market opens on 06 December 2022

Zee Business Stock, Trading Guide: The Indian markets made a muted start to the week and ended almost unchanged. The Nifty index oscillated in a narrow range and finally settled at the 18,701 level.

Meanwhile, a mixed trend on the sectoral front kept the participants busy wherein buying in metal, banking and realty space capped the downside. Amid all, the positive bias on the broader front pushed the market breadth to the advancing side.

“We’re seeing consolidation on the expected lines, which is healthy after the recent surge. We expect the resumption of the trend soon meanwhile focus on sectors that are attracting buying interest on every dip and select the stocks accordingly,” Ajit Mishra, VP - Technical Research, Religare Broking Ltd said in his post market comment.

Here is a list of things to watch out for on 06 December 2022

Technical View

The bulls need to surpass 18,900 levels to gain bullish momentum as the options seller is active near 19,000 levels with increased OI. The support for the Index is placed near 18,500 and any move below the same will extend the fall to 18,380 levels.

The celebrative mood at Dalal Street should continue with stock-specific action likely to command investors’ attention, especially in IT, Metal & Cement stocks.

Apurva Sheth, Head of Market Perspectives, Samco Securities

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.03 per cent higher at 18,701. Key Pivot points (Fibonacci) support for the index is placed at 18621.22, 18588.82 and 18536.37 while resistance is placed at 18726.11, 18758.52, and 18810.96.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.53 per cent higher at 43,332.95. Key Pivot points (Fibonacci) support for the index is placed at 43082.13, 42990.77, and 42842.9, while resistance is placed at 43377.87, 43469.23, and 43617.1.

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Business News

Tata Motors mulling price hike for passenger vehicles from next month

Air India to lease six Boeing 777 aircraft to expand its fleet

Delhi Govt bans playing of BS-III petrol, BS-IV diesel four- wheelers.

Suzlon Energy to seek shareholders' nod for top brass appointments

Govt taking steps to make Indian MSMEs stronger, globally competitive: Minister

Pfizer applies for FDA authorization for Omicron-retooled vaccine booster in kids under 5

New tactical tools needed to check sale of drugs through dark net, social media, crypto

Stocks in News:

Natco Pharma receives favourable verdict in patent infringement case.

Bajaj Consumer to consider share buyback on December 9.

Ahluwalia Contracts bags order worth Rs 175 crore for construction of public auditorium at Guwahati

BCL Industries LTD order received for ethanol supply.

JSW Energy LTD subsidiary JSW Renew Energy two commissions 450 MW wind power project.

AU Small Finance ties up with ICICI Lombard for Bancassuarance.

LIC of India HDFC stake increased by 0.012 per cent

Karur Vysya Bank hikes lending rates by 25 bps across tenures effective from December 7

Kalpatru Power Transmission board to consider fund raising via NCDs on private placement basis on December 8

Srinivasan Trust sells 25.7 lakh shares of TVS Motor at an average price of Rs 1,020.03/share via BulkDeal on BSE

FII Activity on Monday:

Foreign portfolio investors (FPIs) remained net sellers for Rs 1139.07 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net sellers to the tune of Rs 2607.98 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

Gujarat Fluorochem Ltd: Inox Leasing And Finance Limited sold 18,00,000 equity shares in the company at the weighted average price Rs 3275.44 per share on the NSE, the bulk deals data showed.

Go Fashion India Ltd: Sequoia Capital India Investments IV bought 20,00,000 equity shares in the company at the weighted average price Rs 1140.14 per share on the NSE, the bulk deals data showed.

Cyber Media Res & Ser Ltd: Sanjay Minerals LLP bought 23,200 equity shares in the company at the weighted average price Rs 285.38 per share on the NSE, the bulk deals data showed.

Rainbow Children Med Ltd: Government of Singapore bought 6,64,500 equity shares in the company at the weighted average price Rs 735 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Delta Corp, GNFC, IndiaBulls Housing Finance are placed under the F&O ban for Tuesday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

09:34 PM IST

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022