Zee Business Stock, Trading Guide: 10 things to know before market opens on 31 October 2022

Most sectors ended lower however strong traction in two heavyweights such as Reliance Industries and Maruti helped auto and energy to close higher.

Zee Business Stock, Trading Guide: The Indian markets oscillated in a range and ended marginally higher, in continuation to the prevailing consolidation phase. The Nifty index opened with an uptick however profit-taking trimmed gains as the day progressed.

Most sectors ended lower however strong traction in two heavyweights such as Reliance Industries and Maruti helped auto and energy to close higher. While the broader indices underperformed and lost in the range of 0.4-1 per cent.

Ajit Mishra, VP - Research, Religare Broking Ltd, “We may see further consolidation in the index and expect a similar trend on the global front as well. After the recent outperformance, banking may also take a breather and index majors from other sectors are likely to fill in the gap.”

Mishra advised that the market participants should maintain their focus on sector/stock selection and utilise dips to add during consolidation.

Here is a list of things to watch out for on 31 October 2022

Technical Outlook

Technically, the overall structure is bullish, but momentum is slowing down as the Nifty has multiple resistance levels between 17800 and 18100. On the downside, 17600-17400 is a strong demand zone. The Nifty may remain volatile to sideways with a positive bias. However, sector and stock-specific outperformance are likely to continue.

Banknifty is facing resistance in the 41500–42000 zone while the 10-DMA around 40800 is immediate support. Below this, 40300–40000 will be the next support area. On the upside, if it manages to take out the 42000 level, then we can expect a move toward the 42500-43000 zone.

– Pravesh Gour, Senior Technical Analyst, Swastika Investmart Ltd.

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.28 per cent higher at 17,786.8. Key Pivot points (Fibonacci) support for the index is placed at 17739.13, 17711.94, and 17667.93 while resistance is placed at 17827.14, 17854.33, and 17898.34.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.75 per cent higher at 40,990.85. Key Pivot points (Fibonacci) support for the index is placed at 40858.54, 40706.76, and 40461.1 while resistance is placed at 41349.86, 41501.63, and 41747.3.

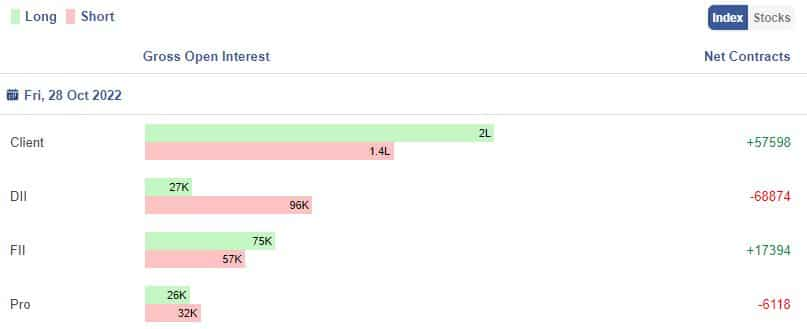

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Stocks in News:

Sugar stocks in focus: Govt extends restrictions for sugar export by one year through October 2023

IndiGo stock: DGCA to carry out a detailed investigation to ascertain the cause, to take suitable action on airline’s engine stall

Aurobindo Pharma gets US FDA ANDA nod for Rufinamide & Pyrimethamine

Zydus Lifesciences gets final US FDA nod for Acetaminophen injection.

Laurus Labs: US FDA issues Form 483 with 1 observation for Laurus Labs Parawada unit, observation is procedural in nature.

JSW Energy board approves raising up to Rs 2,500 cr via bonds.

Q2 Earnings

Indian Oil Corporation Q2: Net loss at Rs 272.3 crore versus Rs 1,992 crore QoQ and revenue down 7.5 per cent at Rs 2.1 lakh crore versus Rs 2.2 lakh Cr QoQ.

NTPC Q2: standalone Net Profit up 5.5 per cent to Rs 3,331 crore against Rs 3,156.7 crore YoY and standalone margin at 23.2 per cent from 26.2 per cent YoY.

JSW Energy Q2: Net profit up 37.3 per cent at Rs 465.7 crore versus Rs 339.2 crore YoY and revenue up 14.4 per cent at Rs 2,387.5 crore versus Rs 2,087.5 crore YoY.

CCL Products India reports Q2: Net profit up 17.1 per cent at Rs 57.8 crore versus Rs 49.3 crore YoY and revenue up 50.5 per cent at Rs 506.6 crore versus Rs 336.6 crore YoY.

Blue Dart Express reports Q2: Net profit up 3.4 per cent at Rs 93.6 crore versus Rs 90.6 crore YoY and Revenue up 17.9 per cent at Rs 1,325.3 crore versus Rs 1,123.6 crore YoY.

Eveready reports Q2: Net profit down 52.6 per cent at Rs 14.7 crore versus Rs 31 crore YoY and revenue up 5.15 per cent at Rs 375.8 crore versus Rs 357.5 crore YoY.

FII Activity on Friday:

Foreign portfolio investors (FPIs) remained net sellers for Rs 613.37 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 1,568.75 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

GSS Infotech Limited: Raj Kumar bought 1,00,000 equity shares in the company at the weighted average price Rs 290 per share on the NSE, the bulk deals data showed.

Liberty Shoes Ltd: Rohan S Hegde sold 1,29,234 equity shares in the company at the weighted average price Rs 303.1 per share on the NSE, the bulk deals data showed.

Nandani Creation Limited: Anuj Mundra sold 55,000 equity shares in the company at the weighted average price Rs 81.58 per share on the NSE, the bulk deals data showed.

Tourism Finance Corp: Rajasthan Global Securities Pvt Ltd bought 7,65,086 equity shares in the company at the weighted average price Rs 80.85 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

No stock was placed under the F&O ban for Monday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

05:31 PM IST

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022