Zee Business Stock, Trading Guide: 10 things to know before market opens on 14 December 2022

Continued buoyancy in the banking pack combined recovery in the IT majors played a key role in recovery while others traded mixed.

Zee Business Stock, Trading Guide: The Indian markets witnessed a breather and gained over half a percent, tracking firm global cues. After the initial uptick, the Nifty and Sensex gradually inched higher and settled around the day’s high to close at 18608 and 62,533 levels.

Continued buoyancy in the banking pack combined recovery in the IT majors played a key role in recovery while others traded mixed. The market breadth was also positively inclined, thanks to noticeable buying in midcap and smallcap space.

Here is a list of things to watch out for on 13 December 2022

What should investors do?

Indications are in the favour of further rebound however a lot would depend upon how the US market reacts to the inflation data. On the index front, Nifty could find a hurdle around 18,750 and the banking index may take a breather around 44,250 levels.

Amid the prevailing consolidation, we reiterate our positive tone and suggest continuing with the “buy on dips” approach.

- Ajit Mishra, VP - Technical Research, Religare Broking Ltd.

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.6 per cent higher at 18,608. Key Pivot points (Fibonacci) support for the index is placed at 18523.28, 18493.31 and 18444.8 while resistance is placed at 18620.31, 18650.28, and 18698.8.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.54 per cent higher at 43,946. Key Pivot points (Fibonacci) support for the index is placed at 43816.89, 43765.91, and 43683.4, while resistance is placed at 43981.91, 44032.89, and 44115.4.

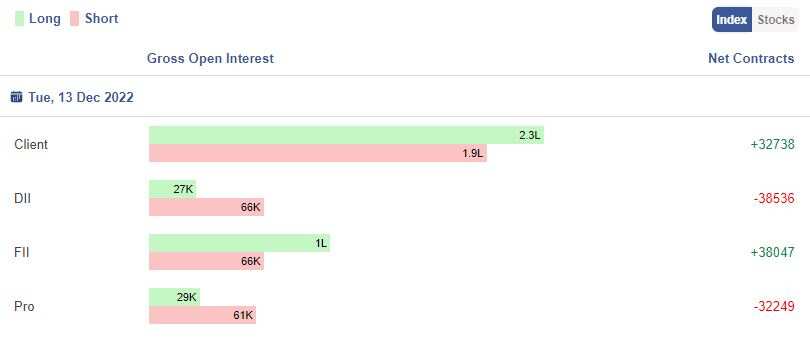

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Business News

Aviation Ministry directs airlines to deploy adequate staff at check-in counters

Govt likely to issue green bonds in Jan-March quarter

80 startups in India have potential to go for IPO in next 5 years: Redseer Report

Gold ETFs log Rs 195 crore outflow in Nov on profit booking

Abans Holdings IPO subscribed 28 pc on Day 2 of offer

Sula Vineyards IPO subscribed 59 pc on Day 2 of offer

KFin Technologies IPO set to open on December 19, to raise Rs 1,500 crore

Stocks in News

HDFC: BSE and NSE give in-principle approval to merger with HDFC Bank

Paytm board approves Open Market share Buyback up to Rs 850 cr at max Rs 810 per share

UltraTech Cement commissions 1.9 mtpa greenfield clinker backed grinding capacity at Pali, Rajasthan

Piramal Enterprises arm, Piramal Capital & Housing Finance acquires 100% stake in PRL Agastya for Rs 90 cr

Bayer CropScience temporarily discontinues operations at its formulations plant in Himatnagar, Gujarat effective December 12

Kotak Mahindra Bank investment arm raises Rs 5,328 crore

Patel Engineering to consider fund raise via Rights Issue on December 16

NTPC's 240 MW Devikot solar project begins commercial operation

Poonawalla Fincorp rises as board to mull fund raising

Kamat Hotels (India) will hold a meeting of the Board of Directors of the Company on 14 December 2022.

Sula Vineyards- IPO to Close on Wednesday

FII Activity on Tuesday:

Foreign portfolio investors (FPIs) remained net buyers for Rs 619.92 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 36.75 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

Baheti Recycling Ind Ltd: Varun Krishnavtar Kabra sold 69,000 equity shares in the company at the weighted average price Rs 106.92 per share on the NSE, the bulk deals data showed.

Bodhi Tree Multimedia Ltd: Vihaan Jayesh Savla bought 66,000 equity shares in the company at the weighted average price Rs 88.09 per share on the NSE, the bulk deals data showed.

IIFL Wealth Mgmt Ltd: General Atlantic Singapore Fund Pte Ltd sold 31,15,981 equity shares in the company at the weighted average price Rs 1810.09 per share on the NSE, the bulk deals data showed.

SecUR Credentials Limited: Khanak Budhiraja bought 1,00,000 equity shares in the company at the weighted average price Rs 125 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

BHEL, Delta Corp, and GNFC are placed under the F&O ban for Wednesday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

10:49 PM IST

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 29 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 27 December 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 26 December 2022