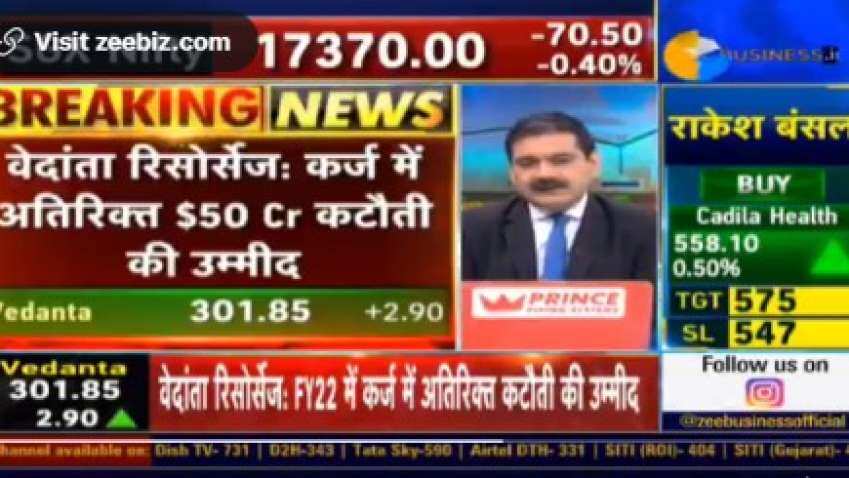

Vedanta Resources mulls $50 cr debt cut in FY22; check what strategy market guru Anil Singhvi suggests – How it will impact Vedanta share price

As Vedanta Resources is planning to reduce an additional $500 million debt in the financial year 2021-22, Zee Business Managing Editor and Market Guru Anil Singhvi list out the reasons for investors to watch out for further growth in the movement of Vedanta group stocks.

As Vedanta Resources is planning to reduce an additional $500 million debt in the financial year 2021-22, Zee Business Managing Editor and Market Guru Anil Singhvi list out the reasons for investors to watch out for further growth in the movement of Vedanta group stocks.

Singhvi says, the market recently witnessed the dividend issued by Vedanta and believes it’s time for Hindustan Zinc’s dividend, which is due for a long-time now. Hind Zinc is a subsidiary of Vedanta Group.

See Zee Business Live TV Streaming Below:

The market guru says, from Hind Zinc it will go to Vedanta and eventually to Vedanta PLC and Vedanta Resources. Moreover, almost all those commodities that Vedanta group deals in are surging, be it metal or oil, the managing editor adds.

Singhvi also pointed out that the way Vedanta Resources is moving ahead to reduce its debt, it becomes quite obvious that they would soon announce Hind Zinc’s dividend. The shares of Hind Zinc are trading flat with a positive bias, it touched a day’s high of Rs 331 per share on the BSE intraday.

FY22 में अतिरिक्त $50 करोड़ कर्ज की कटौती की जा सकती है : वेदांता रिसोर्सेज

वेदांता के शेयरहोल्डर्स जरूर देखें ये वीडियो#Vedanta #dividend #stockmarkets @AnilSinghvi_ @deepdbhandari pic.twitter.com/k9zTBSre5J

— Zee Business (@ZeeBusiness) September 13, 2021

Similarly, the shares of Vedanta Limited are surging over 2 per cent to trade near the day’s high level of Rs 308.45 per share on the BSE intraday. In this regard, the market guru says, the current price around Rs 302 + Rs 18.5 dividend price is equal to Rs 320 apiece is actual Vedanta Limited’s price.

The stock is also trading near its 52-week high level of Rs 341.25 per share on the BSE, hit on August 16, 2021. While in the last 6 months the counter has jumped over 36 per cent on the BSE.

Vedanta on September 1, 2021 in its filing to exchanges had said, “The Board of Directors of the company in its meeting have approved First Interim Dividend of Rs 18.50 per equity share on the face value of Re. 1/- per share for the Financial Year 2021-22 amounting to Rs 6,877 crores.”

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

12:35 PM IST

Vedanta shares fall 2% post its fourth dividend announcement; Citi bullish on the largecap stock

Vedanta shares fall 2% post its fourth dividend announcement; Citi bullish on the largecap stock Vedanta to raise Rs 2,500 crore in non-convertible debentures

Vedanta to raise Rs 2,500 crore in non-convertible debentures Vedanta dividend: Board to meet on this date to consider 1st payout of 2023-24

Vedanta dividend: Board to meet on this date to consider 1st payout of 2023-24  Govt's Hind Zinc stake sale only after clarity on proposed global asset transfer; may miss revised divestment target

Govt's Hind Zinc stake sale only after clarity on proposed global asset transfer; may miss revised divestment target Exclusive: Vedanta has enough cash flow to prepay debts, says chairman Anil Agarwal

Exclusive: Vedanta has enough cash flow to prepay debts, says chairman Anil Agarwal