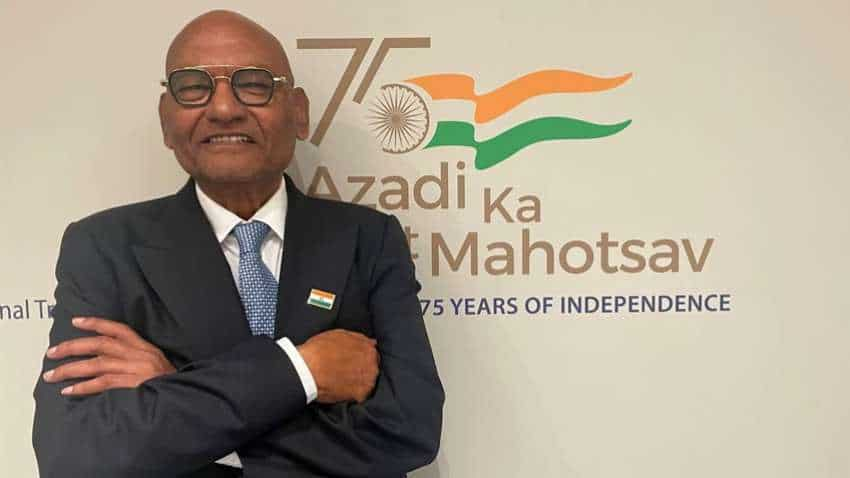

Exclusive: Vedanta has enough cash flow to prepay debts, says chairman Anil Agarwal

The comments by Vedanta Resources chairman assume significance as it comes in the backdrop of S&P Global Ratings stating that the company's credit ratings may 'come under pressure' if it is unable to raise USD 2 billion and/or sell its international zinc assets.

Vedanta Resources chairman Anil Agarwal on Monday said that the company's debt is within manageable limits. In an exclusive conversation with Zee Business Managing Editor Anil Singhvi, he reaffirmed that the company has enough means to meet debt repayment liabilities and has always met its repayment commitments.

“We can manage our debt comfortably and have more than expected cash flow to prepay debts,” Agarwal said.

“Our debt is comparatively less than other big conglomerates in the world,” he added.

The comments by Vedanta Resources chairman assume significance as it comes in the backdrop of S&P Global Ratings stating that the company's credit ratings may 'come under pressure' if it is unable to raise USD 2 billion and/or sell its international zinc assets.

“We operate at a profit run-rate of 30 per cent and can never default on debt repayment,” the billionaire said, adding that "the company is aiming to repay the debt in the next 1-1.5 years".

Vedanta Limited (Vedanta Resources has a 70 per cent stake) has proposed sale of the international zinc business to Hindustan Zinc Limited (Vedanta Limited has 65 per cent ownership) for nearly USD 3 billion. The government is, however, averse to the deal as it is a related party transaction and will hit its own share sale plan. Valuation of the assets is among several concerns flagged by the government, which holds a 29.54 per cent stake in HZL, which was privatised more than two decades ago.

वेदांता ग्रुप का कैश फ्लो अच्छा है, हम हर हाल में सभी कर्ज समय पर चुकाएंगे: अनिल अग्रवाल, चेयरमैन, वेदांता

अब वेदांता ग्रुप में क्या होगा नया? जानिए Vedanta के @AnilAgarwal_Ved से @AnilSinghvi_ की खास बातचीत में@VedantaLimited #HoliWithZee

पूरा शो- https://t.co/ItmULUFvVa pic.twitter.com/nsYWwbbJ44

— Zee Business (@ZeeBusiness) March 6, 2023

He indirectly pointed out that the controversy related to debt repayment is somehow aimed at targeting the new semiconductor chip plant in India with Foxconn.

Notably, a joint venture of Vedanta and Foxconn in September last year signed a Memorandum of Understanding (MoU) with the Gujarat government to invest Rs 1,54,000 crore to set up the semiconductor and display manufacturing facility in the state.

Last week, Vedanta Resources, in a bid to assuage investor concerns around its financial position, said that the management is confident of meeting debt repayment liabilities in the coming quarters.

The company in a statement said that it has pre-paid all of its debt that was due for repayment till March 2023, deleveraging by USD 2 billion in the past 11 months. Further, it is confident of meeting its liquidity requirements for the quarter ending June 2023.

Vedanta, it said, continues to deliver healthy cash flows and does not have any pledge except 6.8 per cent of Hindustan Zinc shares.

Also Read: Vedanta cuts debt by $2 billion ahead of plans

Also Watch: Vedanta shares tank over 6%, hit four-month low amid heavy volumes

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

12:15 PM IST

Vedanta shares fall 2% post its fourth dividend announcement; Citi bullish on the largecap stock

Vedanta shares fall 2% post its fourth dividend announcement; Citi bullish on the largecap stock Vedanta to raise Rs 2,500 crore in non-convertible debentures

Vedanta to raise Rs 2,500 crore in non-convertible debentures Vedanta dividend: Board to meet on this date to consider 1st payout of 2023-24

Vedanta dividend: Board to meet on this date to consider 1st payout of 2023-24  Govt's Hind Zinc stake sale only after clarity on proposed global asset transfer; may miss revised divestment target

Govt's Hind Zinc stake sale only after clarity on proposed global asset transfer; may miss revised divestment target Q3 Results 2023: Vedanta net drops 41%, Patanjali Foods PAT up 15% - HIGHLIGHTS

Q3 Results 2023: Vedanta net drops 41%, Patanjali Foods PAT up 15% - HIGHLIGHTS