Trading Guide: HNIs & Family Office are accepting importance of economic cycle & business cycle investing, decodes Prashant Joshi

The past two years have been a roller coaster ride for the economy, but equity markets globally were on a different path altogether.

The past two years have been a roller coaster ride for the economy, but equity markets globally were on a different path altogether.

The rally finally came to a halt with the metaphoric rise in global inflation, and the correction became evident with the onset of geo-political tensions between Russia & Ukraine.

See Zee Business Live TV Streaming Below:

Demand for risk mitigation strategies in the current macroeconomic conditions have gone up. With so many moving parts (economic factors, social factors, geo-political events, etc.) and structural changes underway, the HNI’s & Family Office investment approach and portfolio allocation are reshaping.

As a result, the investment environment is continuously transforming for the better amidst unforeseen challenges, which, in turn, are ushering in new investment opportunities.

Prashant Joshi, Co-Founder and Partner, Fintrust Advisors highlights some essential HNI equity investing trends in 2022:

HNI’s & Family Office are embracing the “core & satellite approach” in equity investment. This is a departure from their earlier “Buy & Hold strategy” stance.

Gradually HNI’s & Family Office are accepting the importance of economic cycle & business cycle investing and hence are carving out an allocation for the same.

This may sound risky on the surface; however, when done wisely, economic & business cycle investing brings the much-needed diversification to a “long-only” portfolio in addition to agility, market adaptability and a robust portfolio structure.

A business cycle is generally defined as periods of expansion, contraction, slump and recovery. For instance, cyclical stocks tend to outperform during the early expansion phase.

On the other hand, the defensive sectors such as health care, consumer staples, etc., tend to do well in the contraction period because of their stable cash flows and dividend yields.

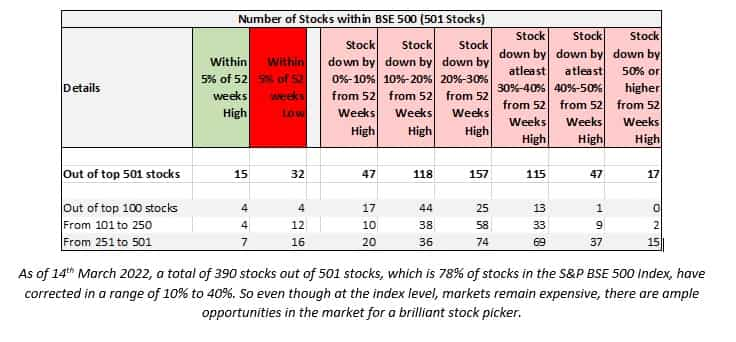

Given today’s markets, Banking & Finance and defence sectors look promising. Many stocks have corrected substantially (Refer Table A) and it provides a good hunting ground for cyclical and long-only quality stocks.

(Disclaimer: The views/suggestions/advices expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

5X15X25 SIP Strategy: Is it possible to create Rs 1,64,20,369 corpus with Rs 5,000 monthly SIP investment?

SBI Green Rupee Deposit 2222 Days vs Canara Bank Green Deposit 2222 Days FD: What Rs 7 lakh and Rs 15 lakh investments will give to general and senior citizens; know here

Power of Compounding: In how many years, investors can achieve Rs 6.5 cr corpus with monthly salaries of Rs 20,000, Rs 25,000, and Rs 30,000?

12:44 PM IST

Traders' Diary: Buy, sell or hold strategy on Tata Motors, Wipro, Varun Beverages, ICICI Prudential, Coromandel International, Jubilant FoodWorks, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on Tata Motors, Wipro, Varun Beverages, ICICI Prudential, Coromandel International, Jubilant FoodWorks, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on Axis Bank, TCS, Coforge, Hindalco, Vodafone Idea, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on Axis Bank, TCS, Coforge, Hindalco, Vodafone Idea, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on BHEL, Infosys, MOIL, Hindustan Zinc, NALCO, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on BHEL, Infosys, MOIL, Hindustan Zinc, NALCO, over a dozen other stocks today Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 05 January 2022 Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022

Zee Business Stock, Trading Guide: 10 things to know before market opens on 30 December 2022