Traders Watchlist: Top 12 data points to know before the stock market opening bell on Monday

The Indian markets during Friday’s session witnessed massive selling as Sensex plummeted nearly 1700 points and Nifty50 closed little above the 17000-mark at the close.

The Indian markets during Friday’s session witnessed massive selling as Sensex plummeted nearly 1700 points and Nifty50 closed little above the 17000-mark at the close. Metal, Auto, Banking and Financial stocks dragged the market most at the close on the first day of the December series.

Sectorally, selling interest was visible in metal, auto, banking and financial, media, realty indices and buying was seen in only pharma and some FMCG stocks.

See Zee Business Live TV Streaming Below:

Parth Nyati, Founder, Tradingo said, it was expected that today we could have a dull day amid a holiday in the US market but surprisingly we wake up with negative cues of a new covid variant from South Africa that led to black Friday on global markets.

Other than the Covid new variant, FIIs' selling is a key concern for the Indian equity market because they are selling relentlessly in our market for the last many days, Nyati said in post market comment.

Pharma stocks outperformed on the back of rising covid concerns globally while defensive FMCG names also witnessed resilience. The major pressure was seen in FIIs' favorite large-cap names therefore we can again expect a large selling figure by FIIs in today's trading session.

On the technical front, the analyst says, “Nifty is continuing its southward journey following the breakdown of a bearish head and shoulder formation and it has also slipped below its critical support of 100-DMA of 17088 with bearish marubozu candlestick formation that has opened the door for further weakness towards 16700/16400 levels.”

On the upside, now 17100 will act as an immediate hurdle while 17350-17400 will be the next critical resistance zone, the Tradingo founder said before concluding.

Here is a list of 12 data points that will help you in making a profitable trade

Key support & resistance levels for Nifty50:

The Nifty50 closed 2.91 percent lower at 17,026. Key Pivot points (Fibonacci) support for the index is placed at 16981, 16894, 16752, and while resistance is placed at 17263, 17350, and 17492.

Key support & resistance levels for Nifty Bank:

The NiftyBank closed 3.58 per cent lower at 36,026. Key Pivot points (Fibonacci) support for the index is placed at 35897, 35669, 35301 while resistance is placed at 36634, 36862, and 37230.

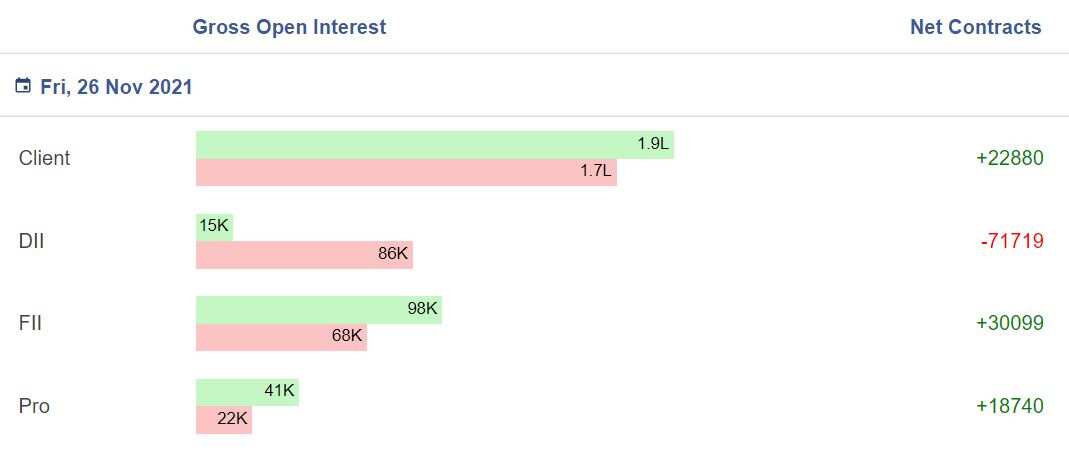

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Options Data:

Since it’s the beginning of the series, option data is scattered at various far strikes. On Option front, Maximum Call OI is at 18000 then 19000 strike while Maximum Put OI is at 17000 then 16000 strike.

“Option data suggests a trading range in between 16500 to 17500 zones,” Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services Limited, said.

6 Stock seeing new Long Positions:

If price increases and open interest increases, then participants are having more of long positions.

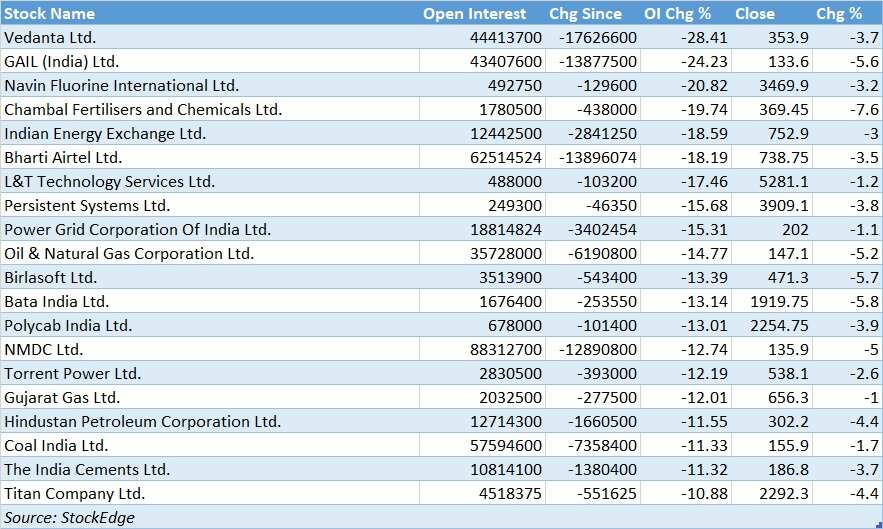

As many as 132 stocks witnessing Long Cover, below are the top 20:

If the price decreases and open interest decreases, then participants are long covering their contracts.

29 stocks witnessing short positions:

If price decreases and open interest increases, then participants are having more of short positions.

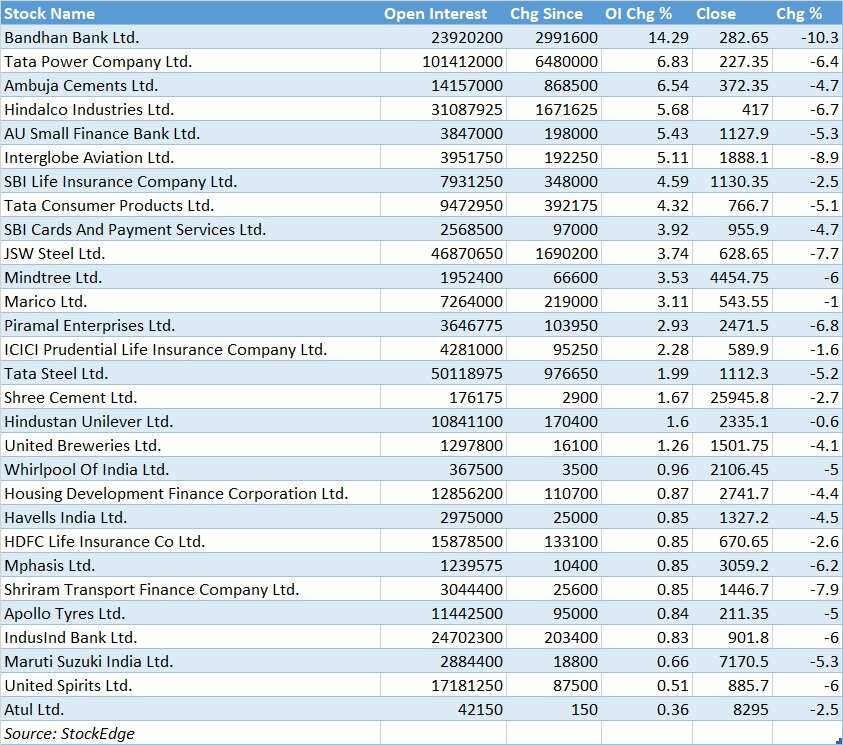

21 stock witnessing short covering:

If the price increases and open interest decreases, then Participants are short covering their contracts.

FII Activity:

Foreign portfolio investors (FPIs) remained net sellers for Rs 5785.83 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 2294.11 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Bulk Deals:

Meghmani Organics: Sunil Singhania-backed Abakkus Asset Manager LLP picked up 27,41,787equity shares in the company at the weighted average price Rs 85 per share on the NSE, the bulk deals data showed.

Trasons Products: Pacific Assets Trust PLC bought and 6,14,773 equity shares in the company at the weighted average price Rs 15.6 per share on the NSE, the bulk deals data showed.

Welspun Corp: Capri Global Holdings Private Limited bought 15,00,000 equity shares in the company at the weighted average price Rs 65 per share on the NSE, the bulk deals data showed.

Bright Solar Limited: Piyushkumar Thumar sold 5,19,000 equity shares in the company at the weighted average price Rs 24.5 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

One stock: Indiabulls Housing Finance placed under the F&O ban on Monday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

(Disclaimer: The views/suggestions/advices expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

25-year Home Loan vs 10-year SIP investment: Which can help one reach faster to purchase Rs 55 lakh home; see calculations

Top 7 Large Cap Mutual Funds With Highest SIP Returns in 3 Years: Rs 23,456 monthly SIP investment in No. 1 fund is now worth Rs 14,78,099

SBI Green Rupee Deposit 2222 Days vs Canara Bank Green Deposit 2222 Days FD: What Rs 7 lakh and Rs 15 lakh investments will give to general and senior citizens; know here

Top 7 SBI Mutual Funds With Highest SIP Returns in 15 Years: No. 1 scheme has turned Rs 12,222 monthly SIP investment into Rs 1,54,31,754; know about others too

02:16 PM IST

Traders Watchlist: Top 12 data points to know before the opening bell on January 3

Traders Watchlist: Top 12 data points to know before the opening bell on January 3 Traders Watchlist: Top 12 data points to know before the opening bell on December 31

Traders Watchlist: Top 12 data points to know before the opening bell on December 31 Traders Watchlist: Top 12 data points to know before the opening bell on December 30

Traders Watchlist: Top 12 data points to know before the opening bell on December 30 Traders Watchlist: Top 12 data points to know before the opening bell on December 29

Traders Watchlist: Top 12 data points to know before the opening bell on December 29 Traders Watchlist: Top 12 data points to know before the opening bell on December 28

Traders Watchlist: Top 12 data points to know before the opening bell on December 28