Traders Watchlist: Top 12 data points to know before stock market opening bell on Thursday

The Indian market ended in the red after a positive opening on Wednesday, as Sensex and Nifty50 each slipped around half a per cent at the close, led by auto, IT and FMCG stocks.

The Indian market ended in the red after a positive opening on Wednesday, as Sensex and Nifty50 each slipped around half a per cent at the close, led by auto, IT and FMCG stocks.

Sectorally, selling interest was visible in auto, IT, Pharma, realty, FMCG indices and buying was seen in media, metal, banking and financial stocks.

See Zee Business Live TV Streaming Below:

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas said, “In the case of Nifty, the recent bounce retraced 38.2 per cent of the previous decline from 18210 to 17216. The key Fibonacci level, which is near 17600 acted as a crucial barrier.”

He added, “Thereon the index nosedived towards the end of the session. Nevertheless, today’s late selloff appears to be a part of the pullback, which is breaking up into lower degree waves. The index is expected to attract buying support again near the lower end of the falling channel.”

“Thus on the downside, 17300-17200 is a cushion for the Nifty. Unless that breaks on a closing basis, the index is expected to witness gradual recovery”, Ratnaparkhi said in a comment.

Similarly, Ajit Mishra, VP - Research, Religare Broking Ltd said, “Markets resumed the corrective phase after a day of pause and lost half a percent. The move was lackluster for most of the session and the benchmark hovered in a narrow range amid mixed cues.”

According to Mishra, “The news of the COVID situation worsening globally has started weighing on the sentiment along with the inflation fear. And since there’s no major event on the domestic front, markets will continue to take cues from global counterparts.”

“At the same time, the scheduled monthly expiry would keep the traders busy on Thursday. We suggest continuing with negative bias on the index while keeping a check on leveraged positions. Nifty has next major support around 17,150 zone, the market analyst said in post market note.

Here is a list of 12 data points that will help you in making a profitable trade

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.5 percent lower at 17,415. Key Pivot points (Fibonacci) support for the index is placed at 17362, 17304, 17209, and while resistance is placed at 17550, 17608, and 17703.

Key support & resistance levels for Nifty Bank:

The NiftyBank closed 0.45 per cent higher at 37,441. Key Pivot points (Fibonacci) support for the index is placed at 37274, 37119, 36870 while resistance is placed at 37773, 37928, and 38177.

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Options Data:

Option front, Maximum Call OI is at 18000 then 17800 strike while Maximum Put OI is at 17000 then 17300 strike. Call writing is seen at 17600 then 17500 strike while Put writing is seen at 17200 then 17100 strike.

“Option data suggests yet another shift in trading range in between 17200 to 17600,” Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services Limited, said.

13 Stock seeing new Long Positions:

If price increases and open interest increases, then participants are having more of long positions.

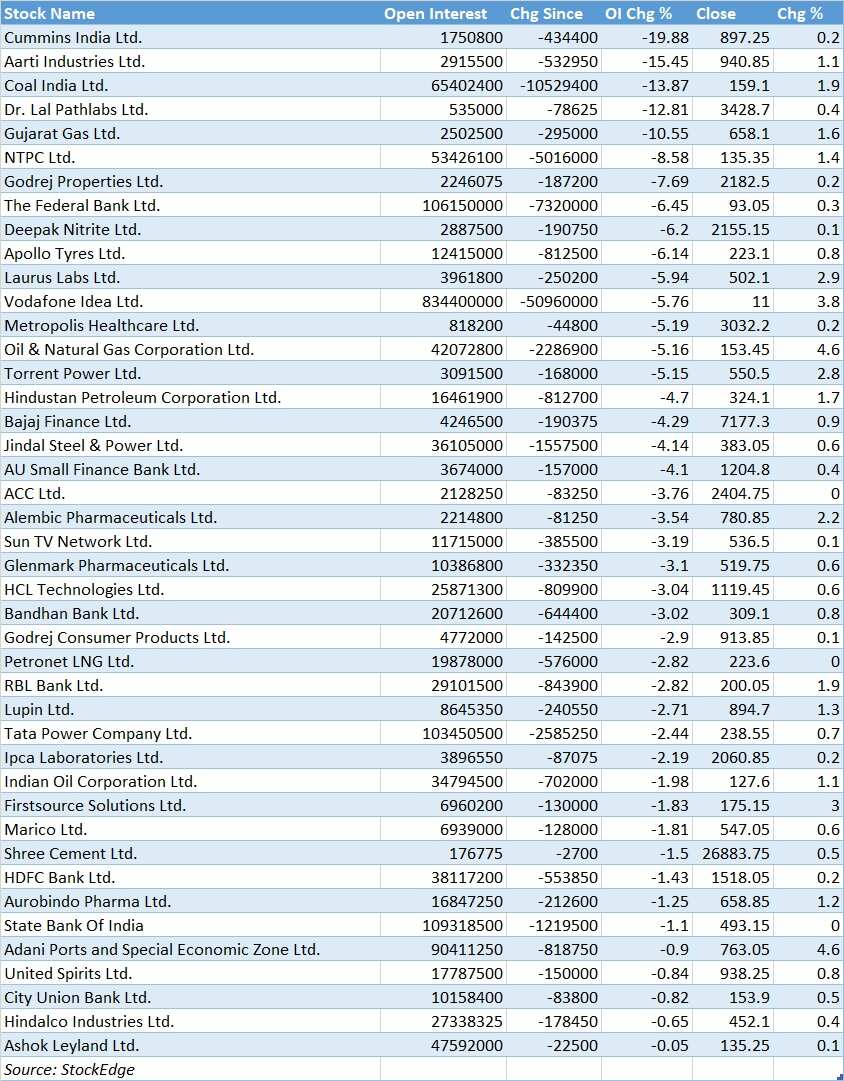

At least 87 stock witnessing Long Cover, below are the top 20:

If the price decreases and open interest decreases, then participants are long covering their contracts.

Top 20 stocks witnessing short positions:

If price decreases and open interest increases, then participants are having more of short positions.

43 stock witnessing short covering:

If the price increases and open interest decreases, then Participants are short covering their contracts.

FII Activity:

Foreign portfolio investors (FPIs) remained net sellers for Rs 5122.65crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 3809.62 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Bulk Deals:

NXT Digital: Alpha Leon Enterprises LLP has bought 50,000 equity shares in the company at the weighted average price Rs 31.9 per share on the NSE, the bulk deals data showed.

Party Cruisers Limited: Apurva Jain bought 50,000 equity shares in the company at the weighted average price Rs 33.1 per share on the NSE, the bulk deals data showed.

Bal Shiv Aum Steels Limited: Bipin C Shah sold 75,000 equity shares in the company at the weighted average price Rs 65 per share on the NSE, the bulk deals data showed.

Mcleod Russel India: Santosh Industries Ltd bought 5,75,000 equity shares in the company at the weighted average price Rs 28.5 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Two stocks: Escorts, Indiabulls Housing Finance have been placed under the F&O ban on Tuesday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

(Disclaimer: The views/suggestions/advices expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Highest Senior Citizen FD rates: See what major banks like SBI, PNB, Canara Bank, HDFC Bank, BoB and ICICI Bank are providing on special fixed deposits

Power of Compounding: How many years it will take to reach Rs 10 crore corpus through Rs 10,000, Rs 15,000, and Rs 20,000 monthly SIP investments?

25-year Home Loan vs 10-year SIP investment: Which can help one reach faster to purchase Rs 55 lakh home; see calculations

Top 7 Large Cap Mutual Funds With Highest SIP Returns in 3 Years: Rs 23,456 monthly SIP investment in No. 1 fund is now worth Rs 14,78,099

09:46 PM IST

Traders Watchlist: Top 12 data points to know before the opening bell on January 3

Traders Watchlist: Top 12 data points to know before the opening bell on January 3 Traders Watchlist: Top 12 data points to know before the opening bell on December 31

Traders Watchlist: Top 12 data points to know before the opening bell on December 31 Traders Watchlist: Top 12 data points to know before the opening bell on December 30

Traders Watchlist: Top 12 data points to know before the opening bell on December 30 Traders Watchlist: Top 12 data points to know before the opening bell on December 29

Traders Watchlist: Top 12 data points to know before the opening bell on December 29 Traders Watchlist: Top 12 data points to know before the opening bell on December 28

Traders Watchlist: Top 12 data points to know before the opening bell on December 28