Traders Watchlist: Top 12 data points to know before opening bell on Monday

The Indian market snapped a three-day fall and ended higher on Friday. Both the benchmark indices Sensex and Nifty reclaimed key levels of 60000 and 18000, while Bank Nifty closed at level 38733.35 with a gain of 173.15 points.

The Indian market snapped a three-day fall and ended higher on Friday. Both the benchmark indices Sensex and Nifty reclaimed key levels of 60000 and 18000, while Bank Nifty closed at level 38733.35 with a gain of 173.15 points.

On the sectoral front, IT, power, capital goods, and realty indices were up 1 percent each while media ended in the red. The market breadth was positive with 42 of the Nifty 50 stocks closing on a green note.

See Zee Business Live TV Streaming Below:

Stocks like Tech Mahindra, Hindalco, HDFC, HDFC Life & Wipro were the top gainers while Bajaj Auto, Tata Steel, Heron Moto, and Axis Bank were the prime laggards.

“Technically, the index has formed a bullish candle on the daily time frame with the support of 50 DMA, which suggests strength in the counter. The Index has given a breakout of the falling trendline, which points out strength in the counter,” Palak Kothari, Research Analyst at Choice Broking said.

“Also, the Stochastic indicator bounced and showed positive crossover, which points out strength in the counter for the next trading session. At present, the index has a support level of 17900, while resistance is at 18250 levels,” she added.

Here is a list of 12 data points that will help you in making a profitable trade

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.8 percent lower at 17,873. Key Pivot points (Fibonacci) support for the index is placed at 17826, 17909, and 17960 while resistance is placed at 18126, 18178, and 18261.

Key support & resistance levels for Nifty Bank:

The NiftyBank closed 1.19 per cent lower at 38,560. Key Pivot points (Fibonacci) support for the index is placed at 38319.6, 38455, 38539 while resistance is placed at 38810, 38894, and 39029

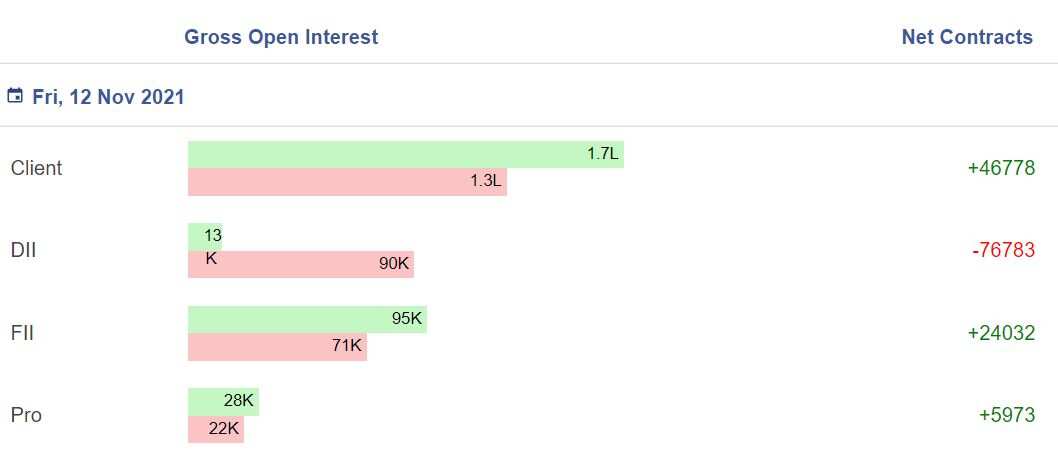

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Options Data:

On Option front, Maximum Call OI is at 18500 then 19000 strike while Maximum Put OI is at 17500 then 18000 strike. Call writing is seen at 18400 then 18700 strike while Put writing is seen at 18000 then 17800 strike.

“Option data suggests a trading range in between 17800 to 18350 zones, Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services Limited, said.

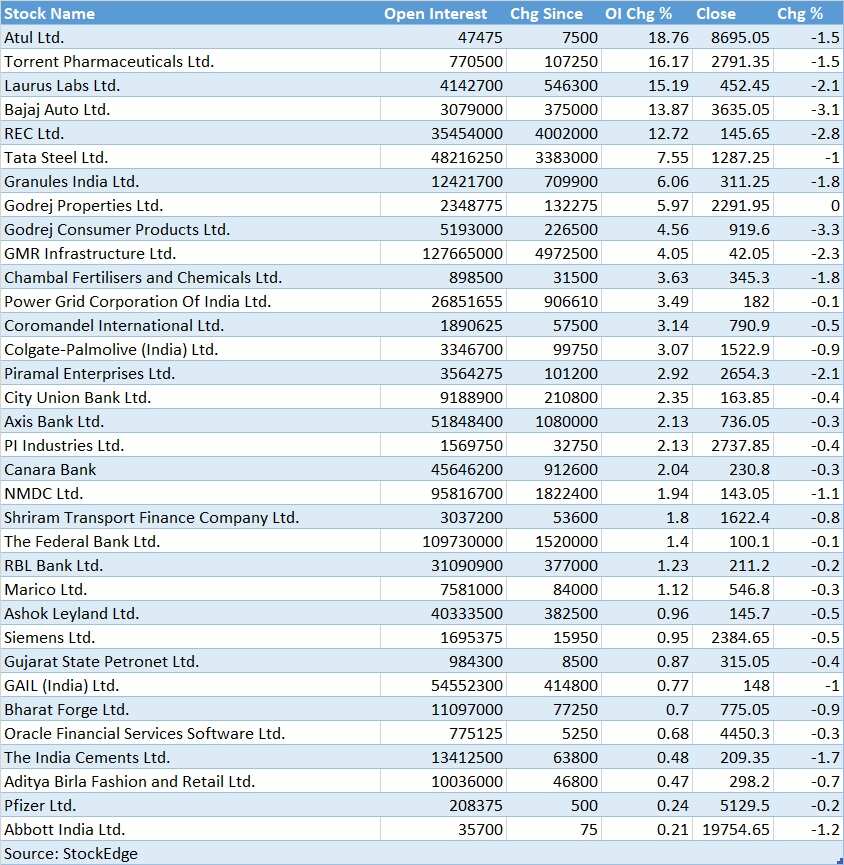

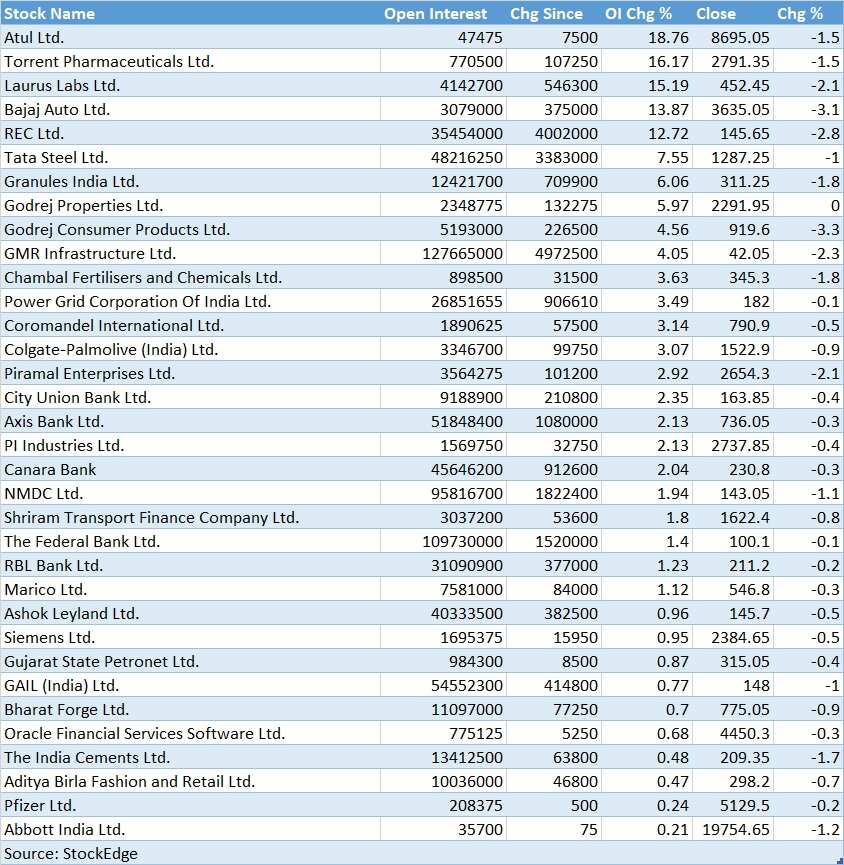

34 Stock seeing new Long Positions:

If price increases and open interest increases, then participants are having more long positions.

20 stock witnessing Long Cover:

If the price decreases and open interest decreases, then participants are long covering their contracts.

34 stocks witnessing short positions:

If price decreases and open interest increases, then participants are having more of short positions.

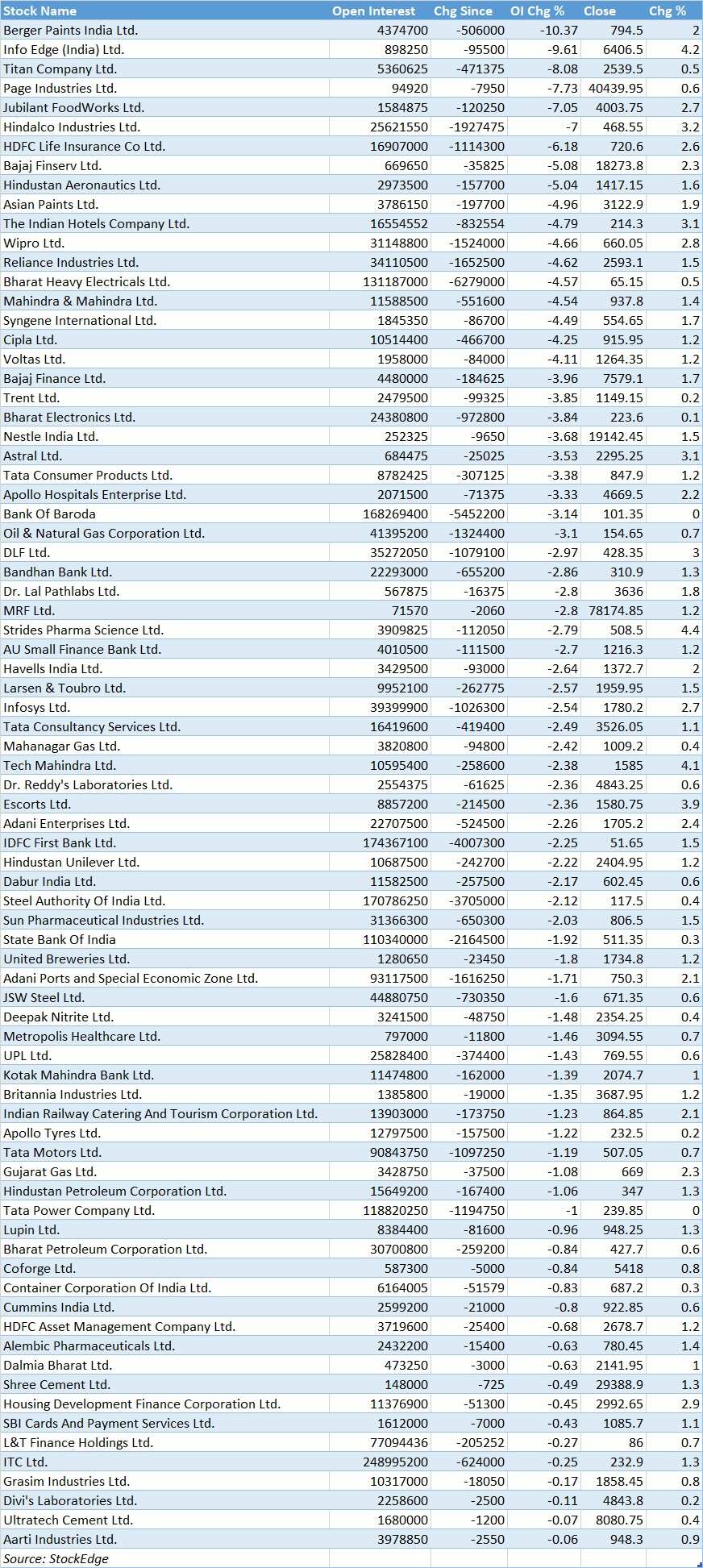

79 stock witnessing short covering:

If the price increases and open interest decreases, then Participants are short covering their contracts.

FII Activity:

Foreign portfolio investors (FPIs) remained net buyers for Rs 511.1 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 851.41 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Bulk Deals:

Aurum PropTech: Porinju V. Veliyath has picked up 2,00,000 equity shares in the company at the weighted average price Rs 110.95 per share on the NSE, the bulk deals data showed.

Fino Payments Bank: Societe Generale sold 12,10,187 equity shares in the company at the weighted average price Rs 528.86 per share on the NSE, the bulk deals data showed.

ASL Industries: ASL Enterprises Limited picked up 2,00,000 equity shares in the company at the weighted average price Rs 1.1 per share on the NSE, the bulk deals data showed.

Nitin Fire Protection: Nishith Atulbhai Shah bought 1,00,00,000 equity shares in the company at the weighted average price Rs 1.25 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Eight stocks: Punjab National Bank, Sun TV, Bank of Baroda, BHEL, Indiabulls Housing Finance, SAIL, National Aluminium and Escorts have been placed under the F&O ban on Monday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

(Disclaimer: The views/suggestions/advices expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Highest Senior Citizen FD rates: See what major banks like SBI, PNB, Canara Bank, HDFC Bank, BoB and ICICI Bank are providing on special fixed deposits

Power of Compounding: How many years it will take to reach Rs 10 crore corpus through Rs 10,000, Rs 15,000, and Rs 20,000 monthly SIP investments?

25-year Home Loan vs 10-year SIP investment: Which can help one reach faster to purchase Rs 55 lakh home; see calculations

Top 7 Large Cap Mutual Funds With Highest SIP Returns in 3 Years: Rs 23,456 monthly SIP investment in No. 1 fund is now worth Rs 14,78,099

10:29 PM IST

Traders Watchlist: Top 12 data points to know before the opening bell on January 3

Traders Watchlist: Top 12 data points to know before the opening bell on January 3 Traders Watchlist: Top 12 data points to know before the opening bell on December 31

Traders Watchlist: Top 12 data points to know before the opening bell on December 31 Traders Watchlist: Top 12 data points to know before the opening bell on December 30

Traders Watchlist: Top 12 data points to know before the opening bell on December 30 Traders Watchlist: Top 12 data points to know before the opening bell on December 29

Traders Watchlist: Top 12 data points to know before the opening bell on December 29 Traders Watchlist: Top 12 data points to know before the opening bell on December 28

Traders Watchlist: Top 12 data points to know before the opening bell on December 28