Traders Watchlist: Top 12 data points to know before market opening bell on Thursday

The Indian market witnessed a minor cut at the close on Wednesday. Despite ending in negative both benchmark indices Sensex and Nifty hold key levels of 60350 and 18000.

The Indian market witnessed a minor cut at the close on Wednesday. Despite ending in negative both benchmark indices Sensex and Nifty hold key levels of 60350 and 18000.

Sectorally, selling pressure was seen in banking, financial, FMCG, media, realty, IT, and metals, while buying interest was visible only in auto and pharma stocks on Tuesday.

See Zee Business Live TV Streaming Below:

Emkay Global Financial Services, Sales Trading, S Hariharan says, “The market sentiment has been somewhat weaker with respect to institutional flows over the last week – FIIs have been net sellers worth Rs 4000 crore in cash segment and Rs 2500 crore in stock futures in November so far.”

He adds, “Retail long leverage through stock futs continues to be very strong – net long open interest is up to $14 bn, which is a life high. Exuberant participation in primary issuances and high leverage, combined with peaking of earnings upgrade cycle, poses a major risk in the near-term for broader markets.”

According to Hariharan, “Auto sector has been benefiting from cooling off of metals prices, which have acted a headwind to margins, as well as a cut in fuel excise duties. While pharma sector faces price erosion headwinds in US market and can be a likely under-performer going ahead.”

Here is a list of 12 data points that will help you in making a profitable trade

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.15 percent lower at 18,017. Key Pivot points (Fibonacci) support for the index is placed at 17941, 17907, and 17941 while resistance is placed at 18053, 18088, and 18144.

Key support & resistance levels for Nifty Bank:

The NiftyBank closed 0.88 per cent lower at 39,023. Key Pivot points (Fibonacci) support for the index is placed at 38906, 38824, 38692 while resistance is placed at 39171, 39253, and 39385.

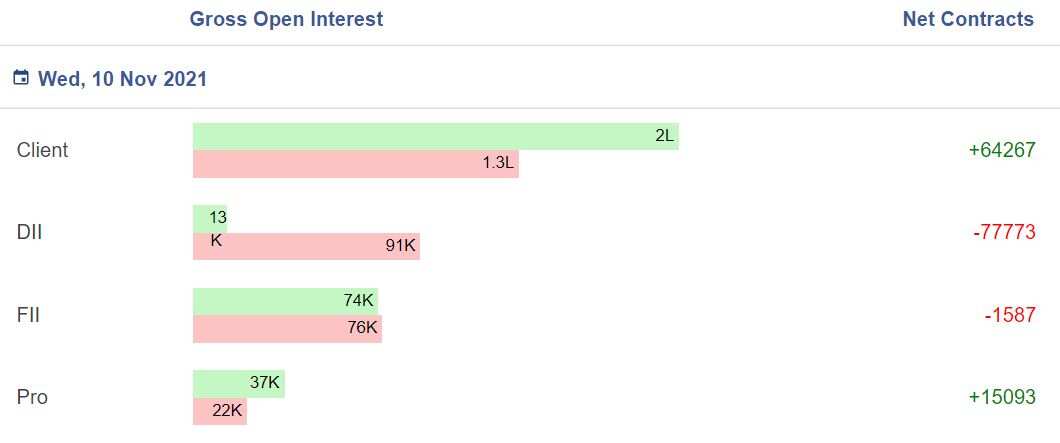

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Options Data:

On Option front, Maximum Call OI is at 19000 then 18500 strike while Maximum Put OI is at 17500 then 17000 strike. Call writing is seen at 18000 then 18400 strike while Put writing is seen at 17400 then 17500 strike.

“Option data suggests a wider and bigger trading range in between 17500 to 18300 zones.,” Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services Limited, said.

16 Stock seeing new Long Positions:

If price increases and open interest increases, then participants are having more of long positions.

08 stock witnessing Long Cover:

If the price decreases and open interest decreases, then participants are long covering their contracts.

33 stocks witnessing short positions:

If price decreases and open interest increases, then participants are having more of short positions.

22 stock witnessing short covering:

If the price increases and open interest decreases, then Participants are short covering their contracts.

FII Activity:

Foreign portfolio investors (FPIs) remained net sellers for Rs 469.5 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 766.95 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Bulk Deals:

Vikas WSP Ltd: Multiplier S And S Adv Pvt Ltd sold 11,13,499 equity shares in the company at the weighted average price Rs 3.72 per share on the NSE, the bulk deals data showed.

Vikas Lifecare Limited: Puneet Rajkumar Behr sold and 10,38,095 equity shares in the company at the weighted average price Rs 0.8 per share on the NSE, the bulk deals data showed.

Oriental Trimex Limited: Nishchaya Tradings Private Limited bought 3,28,826 equity shares in the company at the weighted average price Rs 9.8 per share on the NSE, the bulk deals data showed.

Fairchem Organics Limited: FIH Mauritius Investments LTD sold 5,00,000 equity shares in the company at the weighted average price Rs 1875 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Seven stocks: Punjab National Bank, Sun TV, Bank of Baroda, BHEL, Indiabulls Housing Finance, SAIL and Escorts have been placed under the F&O ban on Monday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

(Disclaimer: The views/suggestions/advices expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

25-year Home Loan vs 10-year SIP investment: Which can help one reach faster to purchase Rs 55 lakh home; see calculations

Top 7 Large Cap Mutual Funds With Highest SIP Returns in 3 Years: Rs 23,456 monthly SIP investment in No. 1 fund is now worth Rs 14,78,099

SBI Green Rupee Deposit 2222 Days vs Canara Bank Green Deposit 2222 Days FD: What Rs 7 lakh and Rs 15 lakh investments will give to general and senior citizens; know here

Top 7 SBI Mutual Funds With Highest SIP Returns in 15 Years: No. 1 scheme has turned Rs 12,222 monthly SIP investment into Rs 1,54,31,754; know about others too

09:44 PM IST

Traders Watchlist: Top 12 data points to know before the opening bell on January 3

Traders Watchlist: Top 12 data points to know before the opening bell on January 3 Traders Watchlist: Top 12 data points to know before the opening bell on December 31

Traders Watchlist: Top 12 data points to know before the opening bell on December 31 Traders Watchlist: Top 12 data points to know before the opening bell on December 30

Traders Watchlist: Top 12 data points to know before the opening bell on December 30 Traders Watchlist: Top 12 data points to know before the opening bell on December 29

Traders Watchlist: Top 12 data points to know before the opening bell on December 29 Traders Watchlist: Top 12 data points to know before the opening bell on December 28

Traders Watchlist: Top 12 data points to know before the opening bell on December 28