Traders Watchlist: Top 12 data points to know before market opening bell on December 3

The Indian market on Monday closed on a positive note as Sensex gained over 775 points and Nifty50 reclaimed 17400-mark for the first time in 9 sessions, led by positive multiple positive triggers.

The Indian market on Monday closed on a positive note as Sensex gained over 775 points and Nifty50 reclaimed 17400-mark for the first time in 9 sessions, led by positive multiple positive triggers.

All sectoral indices ended in the green with maximum buying interest seen in IT, auto, FMCG, and metal stocks.

See Zee Business Live TV Streaming Below:

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas said, “The Nifty witnessed strong momentum on the upside on Thursday. The bulls managed to stretch their arms as the index broke out from the dynamic falling channel.”

“The index has also broken out from an Inside bar pattern on the daily chart. The Nifty is now heading towards its key daily moving averages, which are near 17620-17650,” he added.

“If the index manages to surpass these crucial short term moving averages then it will unlock significant upside potential for itself. On the other hand, the near term support zone now shifts higher to 17200-17250,” Ratnaparkhi further said in a comment.

Here is a list of 12 data points that will help you in making a profitable trade

Key support & resistance levels for Nifty50:

The Nifty50 closed 1.37 per cent higher at 17,401. Key Pivot points (Fibonacci) support for the index is placed at 17220, 17156, 17052, and while resistance is placed at 17427, 17491, and 17594.

Key support & resistance levels for Nifty Bank:

The NiftyBank closed 0.4 per cent lower at 36,508. Key Pivot points (Fibonacci) support for the index is placed at 36261, 36167, 36016 while resistance is placed at 36564, 36658, and 36809.

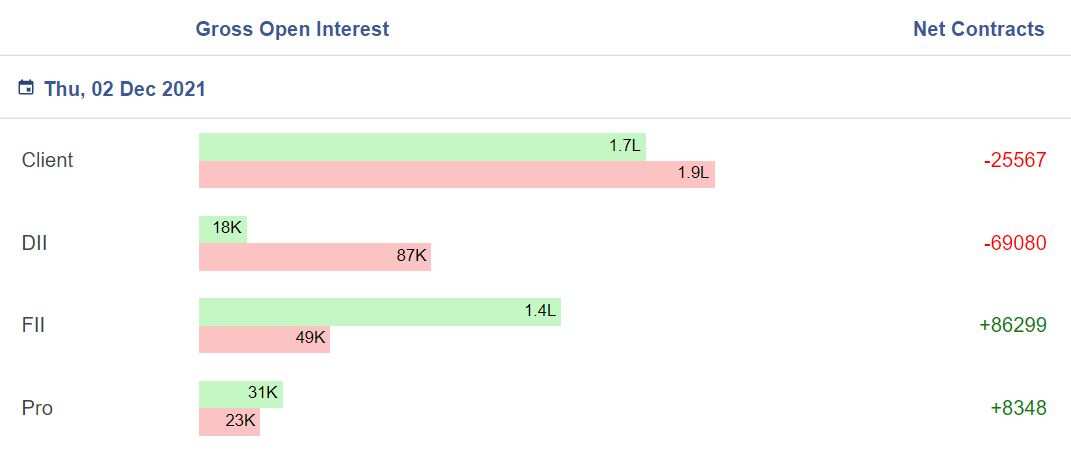

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Options Data:

On Option front, Maximum Call OI is at 18000 then 19000 strike while Maximum Put OI is at 17000 then 16000 strike. Call writing is seen at 17300 then 18000 strike while Put writing is seen at 17300 then 17000 strike.

“Option data suggests a wider trading range in between 17000 to 17750 zones,” Chandan Taparia, Vice President | Analyst-Derivatives at Motilal Oswal Financial Services Limited, said.

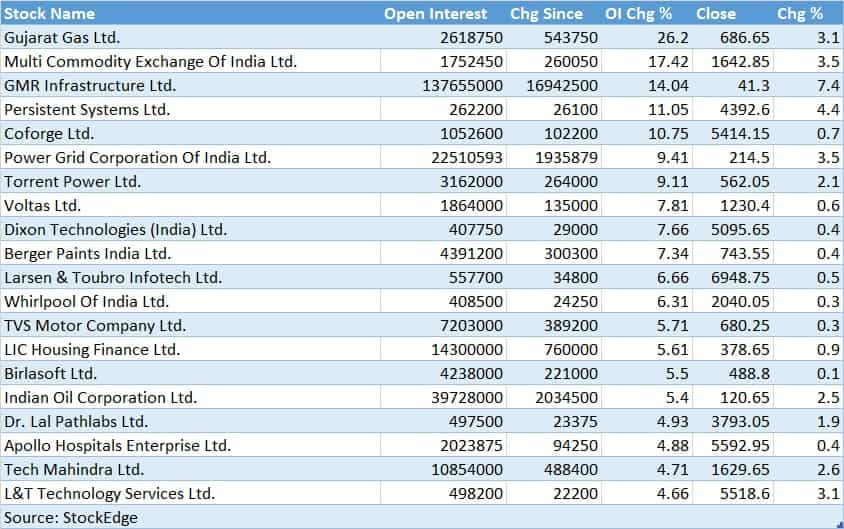

88 Stock seeing new Long Positions, below are the top 20:

If price increases and open interest increases, then participants are having more of long positions.

06 stock witnessing Long Cover:

If the price decreases and open interest decreases, then participants are long covering their contracts.

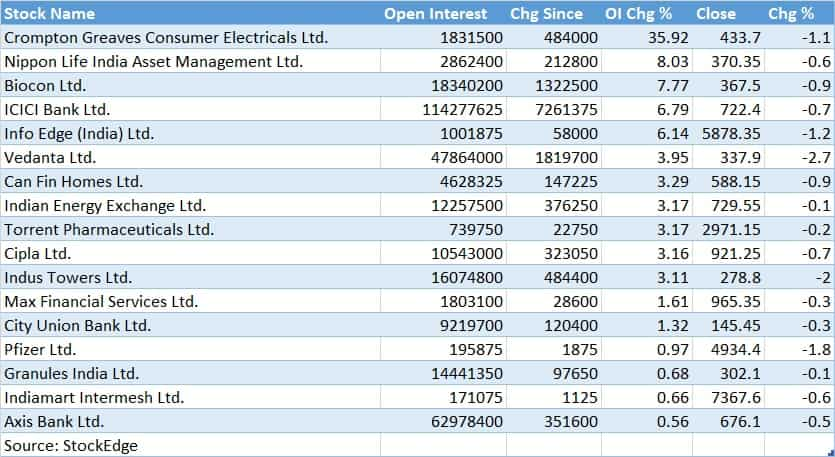

22 stocks witnessing short positions:

If price decreases and open interest increases, then participants are having more of short positions.

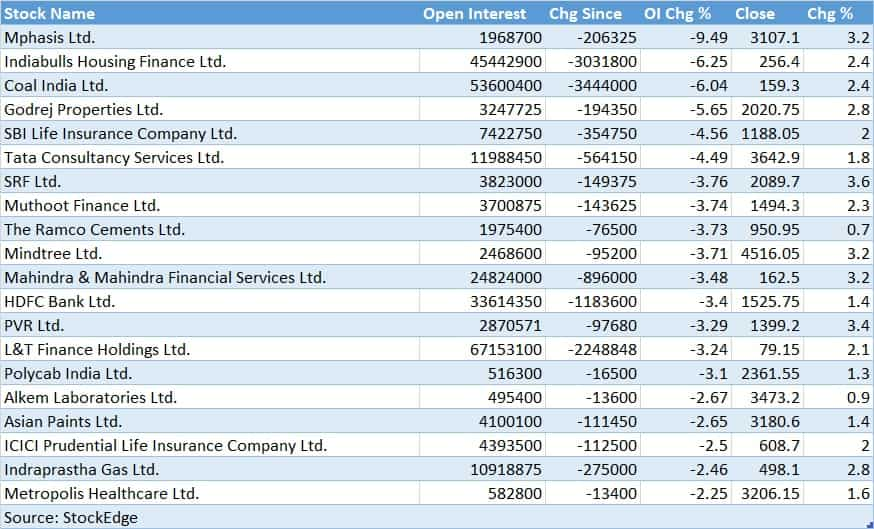

76 stock witnessing short covering, below are top 20:

If the price increases and open interest decreases, then Participants are short covering their contracts.

FII Activity:

Foreign portfolio investors (FPIs) remained net sellers for Rs 909.71 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 1372.65 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Bulk Deals:

Karda Constructions: Societe Generale bought 36,00,000 equity shares in the company at the weighted average price Rs 16.65 per share on the NSE, the bulk deals data showed.

Kirloskar Oil Eng Ltd: Nalanda India Fund Ltd sold 29,71,430 equity shares in the company at the weighted average price Rs 180.92 per share on the NSE, the bulk deals data showed.

Debock Sale Marketing Ltd: Shilpa Ashok Gandhi sold 60,000 equity shares in the company at the weighted average price Rs 103.45 per share on the NSE, the bulk deals data showed.

Crown Lifters: Asif Hussain Jaria each dumped 6,85,000 equity shares in the company at the weighted average price Rs 26.3 per share on the NSE, the bulk deals data showed.

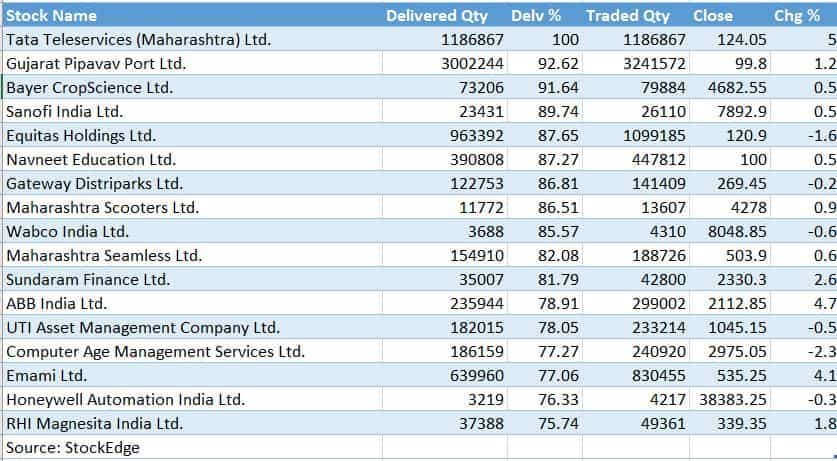

As many as 17 stocks witness high volume delivery percentage:

(Disclaimer: The views/suggestions/advices expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Large Cap Mutual Funds With Highest SIP Returns in 3 Years: Rs 23,456 monthly SIP investment in No. 1 fund is now worth Rs 14,78,099

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Top 7 SBI Mutual Funds With Highest SIP Returns in 15 Years: No. 1 scheme has turned Rs 12,222 monthly SIP investment into Rs 1,54,31,754; know about others too

09:59 PM IST

Traders Watchlist: Top 12 data points to know before the opening bell on January 3

Traders Watchlist: Top 12 data points to know before the opening bell on January 3 Traders Watchlist: Top 12 data points to know before the opening bell on December 31

Traders Watchlist: Top 12 data points to know before the opening bell on December 31 Traders Watchlist: Top 12 data points to know before the opening bell on December 30

Traders Watchlist: Top 12 data points to know before the opening bell on December 30 Traders Watchlist: Top 12 data points to know before the opening bell on December 29

Traders Watchlist: Top 12 data points to know before the opening bell on December 29 Traders Watchlist: Top 12 data points to know before the opening bell on December 28

Traders Watchlist: Top 12 data points to know before the opening bell on December 28