Traders Watchlist for Monday: Top 12 data points to know before the share market opening bell

Indian market on Friday witnessed a record closing for the second consecutive day amid strong global cues. The S&P BSE Sensex breached 60,000-mount for the first time in history and Nifty50 is 150 points away touching 18000 levels.

Indian market on Friday witnessed a record closing for the second consecutive day amid strong global cues. The S&P BSE Sensex breached 60,000-mount for the first time in history and Nifty50 is 150 points away touching 18000 levels.

Sectorally, selling pressure was visible in metals, FMCG, public sector banks, and media indices while buying interest was seen in information and technology along with banking and financial stocks.

“Nifty Index formed a Bearish candle on the daily scale but a Bullish candle on the weekly scale and continues to form higher highs - higher lows from the last eight weeks. Now it has to continue to hold above 17777 zones, for an up move towards 18000 zones whereas support is placed at 17700 and 17500 zones, Motilal Oswal Financial Services Vice President | Analyst-Derivatives Chandan Taparia said.

He added, “India VIX moved up by 2.45 per cent from 16.49 to 17 levels. Spurt in India VIX in last few sessions have given a volatile swing and now it has to cool down below 15-14 zones to continue the smooth ride of the market.”

Here is a list of 12 data points that will help you in making a profitable trade:

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.17 percent lower at 17,853 on Friday. Key Pivot points (Fibonacci) support for the index is placed at 17824, 17794, and 17745 while resistance is placed at 17922, 17952, as well as 18001.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.16 per cent lower at 37,830 on Friday. Key Pivot points (Fibonacci) support for the index is placed at 37709, 37606, and 37441 while resistance is placed at 38039.55, 38141.65, as well as 38306.

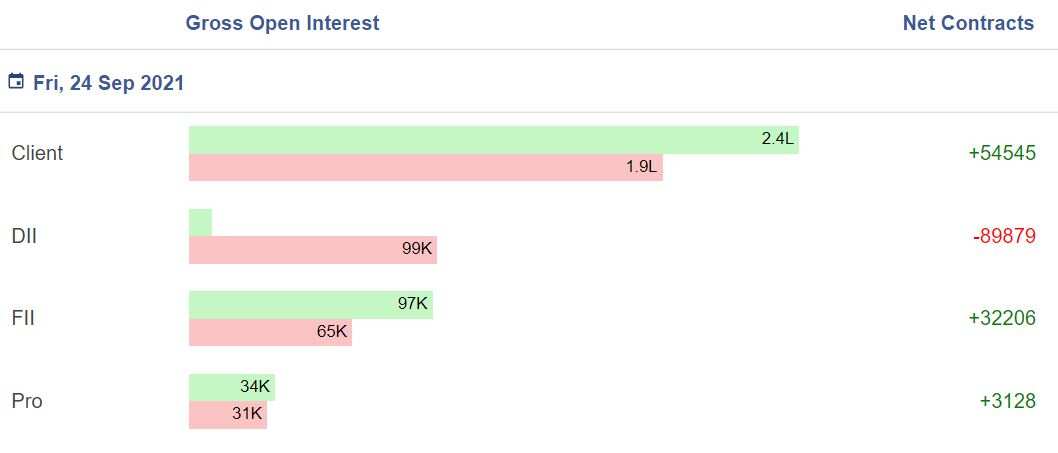

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

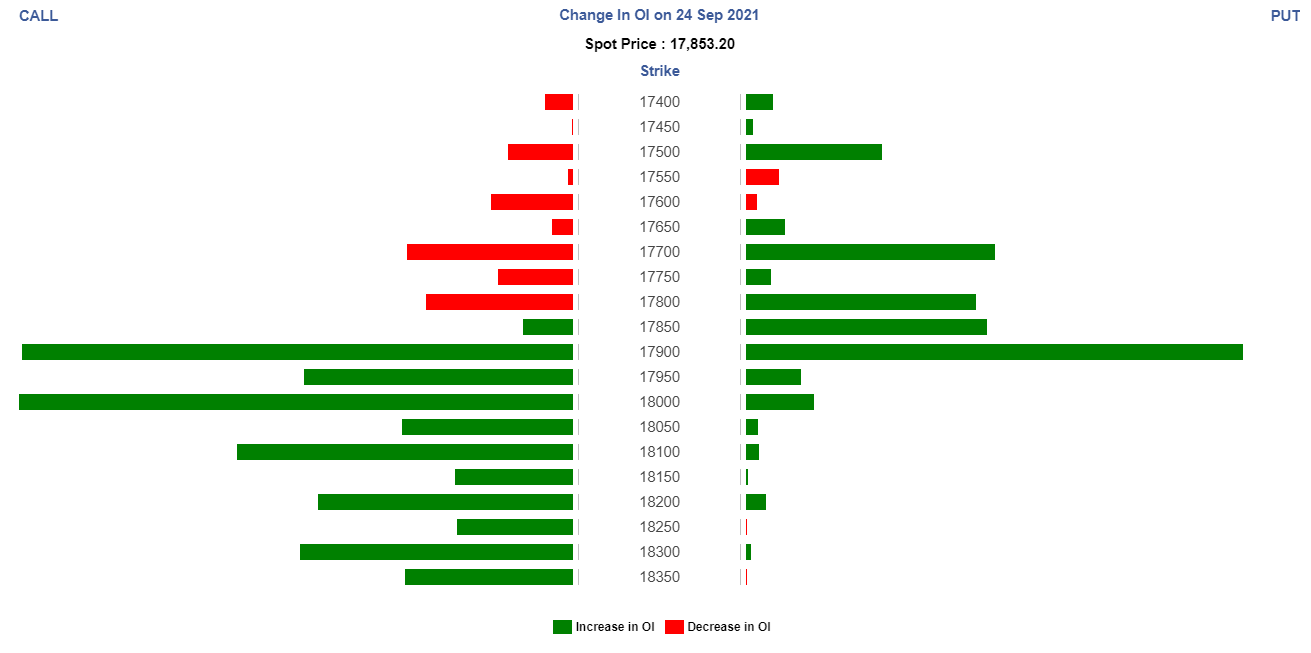

Options Data:

“On Option front, Maximum Put OI is at 17000 followed by 17500 strike while maximum Call OI is at 18000 followed by 18500 strike. Call writing is seen at 18500 then 18000 strike while Put writing is seen at 17900 then 17800 strike. Option data suggests a broader trading range in between 17500 to 18000 zones,” Taparia mentioned.

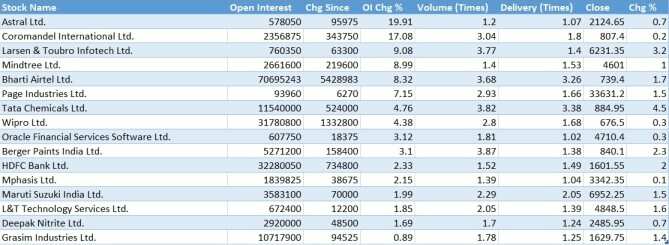

16 Stock seeing new Long Positions:

If price increases and open interest increases, then participants are having more of long positions.

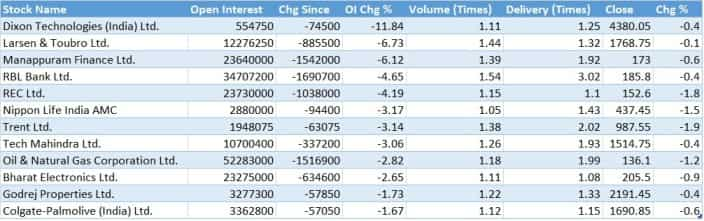

12 stock witnessing Long Cover:

If the price decreases and open interest decreases, then participants are long covering their contracts.

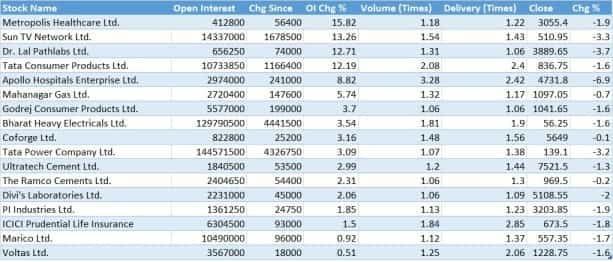

17 stocks witnessing short positions:

If price decreases and open interest increases, then participants are having more of short positions.

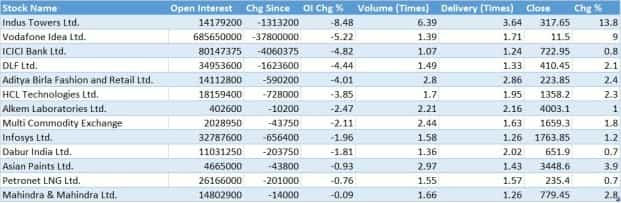

13 stock witnessing short covering:

If the price increases and open interest decreases, then Participants are short covering their contracts.

FII & DII Activity:

Foreign portfolio investors (FPIs) remained net buyers for Rs 442.49 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net sellers to the tune of Rs 515.85 cr, provisional data showed on the NSE.

FII Index and Stock F&O:

Bulk Deals:

Andhra Cements: Topgain Finance Private bought 15,17,053 equity shares in the company at the weighted average price Rs 17.15 per share on the NSE, the bulk deals data showed.

Bright Solar Limited: Rakhi Gupta bought 2,91,000 equity shares in the company at the weighted average price Rs 5 per share on the NSE, the bulk deals data showed.

Libas Consu Products Ltd: Mahimtura Nishant Mitrasen sold 2,72,590 equity shares in the company at the weighted average price Rs 51.8 per share on the NSE, the bulk deals data showed.

Bodhi Tree Multimedia Ltd: Mi Lifestyle Marketing Global Private Limited bought 9600 equity shares in the company at the weighted average price Rs 114.63 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Eight stocks – Canara Bank, Escorts, Indiabulls Housing Finance, Idea, IRCTC, PNB, SAIL and ZEEL - are under the F&O ban. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

(All the above data is sourced from StockEdge)

(Disclaimer: The views/suggestions/advice expressed here in this article are solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How many years it will take to reach Rs 10 crore corpus through Rs 10,000, Rs 15,000, and Rs 20,000 monthly SIP investments?

SBI Green Rupee Deposit 2222 Days vs Canara Bank Green Deposit 2222 Days FD: What Rs 7 lakh and Rs 15 lakh investments will give to general and senior citizens; know here

Top 7 Large Cap Mutual Funds With Highest SIP Returns in 3 Years: Rs 23,456 monthly SIP investment in No. 1 fund is now worth Rs 14,78,099

Highest Senior Citizen FD rates: See what major banks like SBI, PNB, Canara Bank, HDFC Bank, BoB and ICICI Bank are providing on special fixed deposits

07:08 PM IST

Vedanta shares go ex-dividend tomorrow; last chance for Rs 8.5 payout

Vedanta shares go ex-dividend tomorrow; last chance for Rs 8.5 payout Final Trade: Sensex up 500 points, Nifty stays above 23,700; financials and IT lead the charge

Final Trade: Sensex up 500 points, Nifty stays above 23,700; financials and IT lead the charge Steel stocks rally: Tata Steel, JSW Steel lead as DGTR probes surge in imports

Steel stocks rally: Tata Steel, JSW Steel lead as DGTR probes surge in imports Sensex rebounds 800 points, Nifty reclaims 23,800 on strong global cues

Sensex rebounds 800 points, Nifty reclaims 23,800 on strong global cues Anil Singhvi Market Strategy December 23: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 23: Important levels to track in Nifty50, Nifty Bank today