Bank stocks in focus: Why brokerages are bullish on ICICI Bank, Kotak Mahindra, BoB, IndusInd?

Bank of America maintains a buy on Bank of Baroda with a price target of Rs 190. It was recommended at a price of Rs 163. It sees a sustainable credit growth potential of 13-15%

Following the overall weak sentiment in the domestic market, the banking index moved in tandem with the frontline index and in the red. In the 12-stock index, five were trading positively with Federal Bank, ICICI Bank, Bank of Baroda, Punjab National Bank and IndusInd Bank being the gainers.

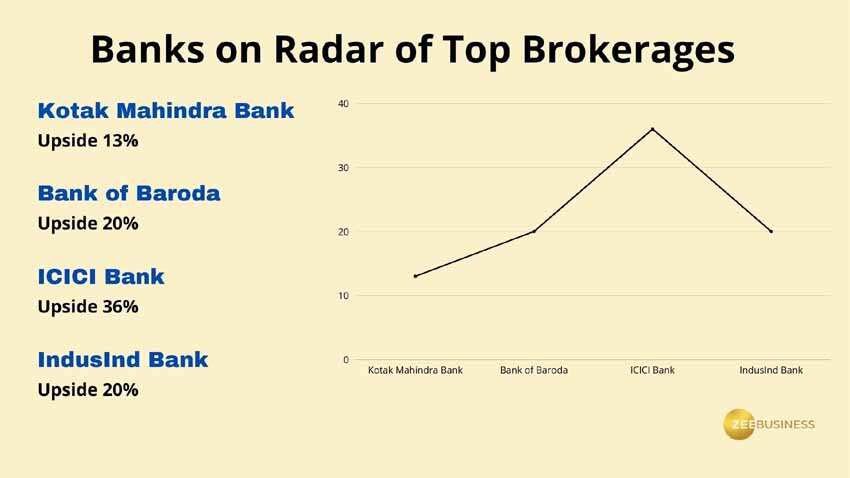

Banking stocks are in the radar of many top brokerages with large caps including ICICI Bank, IndusInd Bank among the top favourites.

Kotak Mahindra Bank: Upside 13%

Morgan Stanley is also bullish on Kotak Bank shares and maintains an 'Equalweight’ rating. The stock has been recommended at a price of Rs 1966 for a price target of Rs 2215. An upside of 13 per cent is seen in this stock. Kotak Bank shares were trading at Rs 1,950.50 on the NSE today and were down by Rs 15.40 or 0.78 per cent.

The optimism is on the back of sharp improvement in margins over the past year which is likely to continue going forward, the brokerage noted. The loan growth remains strong with no significant moderation. Asset quality benign and best it has been in many years, the brokerage said. Among negatives operating costs remain elevated.

Also Read: Stock Markets LIVE UPDATES: Sensex, Nifty open in red; Tata Motors, Hindalco top losers

Bank of Baroda – Upside 20%

Meanwhile, Bank of America maintains a buy on Bank of Baroda with a price target of Rs 190. It was recommended at a price of Rs 163. It sees a sustainable credit growth potential of 13-15 per cent. At 0.75x P/B, risk-reward is very attractive, BofA said. It is a fit candidate for re-rating as investor perception improves, the brokerage house said.

Among negatives, Morgan Stanley mentioned management’s concerns on upside risk to its 12 per cent YoY loan growth guidance for FY23. The brokerage, however, remains overweight on the counter with a price target of Rs 195. Margin Expansion remains on track, this brokerage noted adding that the asset quality remains strong.

ICICI Bank: upside 36 per cent

Morgan Stanley remains overweight on ICICI Bank with a price target of Rs 1250. The stock has been recommended at a price of Rs 914. The stock was trading at Rs 917.95, up 0.48 per cent.

IndusInd Bank: Upside 20%

Goldman Sachs maintains a buy on Indusind Bank. The brokerage has cut the target from Rs 1389 to Rs 1377. It was recommended at a price of Rs 1144. The stock was trading flat at Rs 1,144.20.

Credit:Vainavi Mahendra

Credit:Vainavi Mahendra

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

01:07 PM IST

Midday Market Update: Nifty, Sensex slump 500 points; 5th consecutive day of losses

Midday Market Update: Nifty, Sensex slump 500 points; 5th consecutive day of losses Final Trade: Final Trade: Sensex sinks 821 pts, Nifty at 5-month low as weak earnings batter investor sentiment

Final Trade: Final Trade: Sensex sinks 821 pts, Nifty at 5-month low as weak earnings batter investor sentiment Midday Market Update: Sensex jumps 436 points, Nifty gains 129 points as auto, IT stocks rally

Midday Market Update: Sensex jumps 436 points, Nifty gains 129 points as auto, IT stocks rally Final Trade: Sensex down 55 pts in volatile trade; Nifty falls below 24,150 as LIC, Tata Motors dive 2% each

Final Trade: Sensex down 55 pts in volatile trade; Nifty falls below 24,150 as LIC, Tata Motors dive 2% each First Trade: Sensex slides 400+ points; Nifty slips below 24,150; Lupin, Emami in focus

First Trade: Sensex slides 400+ points; Nifty slips below 24,150; Lupin, Emami in focus