Stock to Buy: Attractive valuations, strong fundamentals make AIA Engineering a top long term pick, says analyst

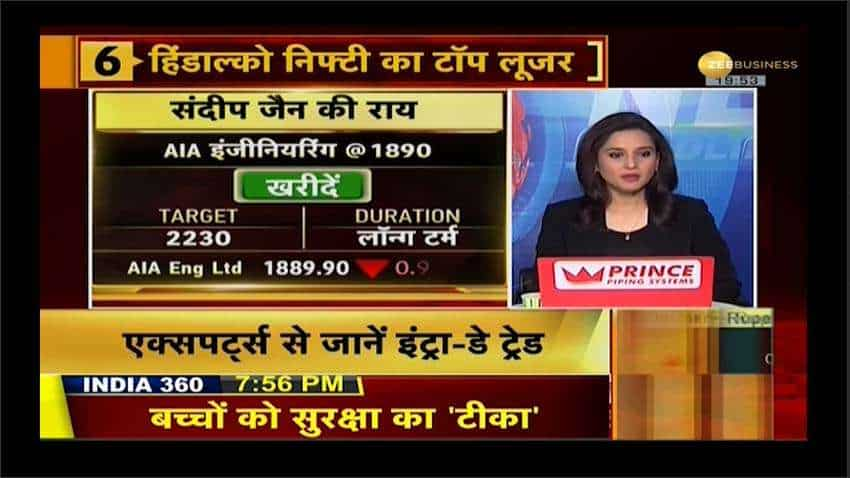

Stock to Buy: Market expert Sandeep Jain picks AIA Engineering as his long term pick. Stock ended almost flat on Friday at Rs 1889.90 on the NSE. It is one stock which has achieved its targets every time it was recommended previously, the Tradeswift Director tells Zee Business in ‘Bazaar Agle Hafte’

Stocks to Buy: Market expert Sandeep Jain has picked AIA Engineering Limited as his long term pick calling it a fundamentally strong company. The stock ended almost flat on Friday at Rs 1889.90 on the NSE. It is one stock which has achieved its targets every time it was recommended previously, the Tradeswift Director tells Zee Business in ‘Bazaar Agle Hafte’.

The stock has corrected from its high of Rs 2222, it hit on 7 July 2021 and is now available at levels, right for making an entry, Jain further said.

See Zee Business Live TV Streaming Below:

He said that the stock is fundamentally strong.

The company which specialises in the design, development, manufacture, installation and servicing of high chromium wear, corrosion and abrasion resistant castings used in the cement, mining and thermal power generation industries, has been in operations since 1979.

Jain said that the AIA Engineering is a quality company which is world’s second largest in high chrome casting work.

In terms of fundamentals of the company, the return on capital employed and return on equity (ROE) is around 17-18 per cent.

Exuding confidence on the company promoters, he said that their stake in AIA Engineering is over 58 per cent.

The foreign and domestic institutional investors have also raised their stakes in the company and which account for a combined 38-40 per cent stake, Jain claimed.

The public shareholding is quite small at 2.7 per cent which means that the stock is in very strong hands, the Tradeswift Director said.

He remains bullish on this stock and sees an upside in it from the current levels.

He recommends a buy in it for a price target of Rs 2230 with a 6-9 month-view.

On the overall markets amid existing volatility, his advice to investors is to adhere to strict stop losses. He said that targets must be booked for profit as and when they are achieved.

Watch Zee Business Tweet Video Below:

अगले हफ्ते कैसे खुलेंगे बाजार, किन बातों का रखें ध्यान?

जानने के लिए देखिए #BazaarAgleHafte अनिल सिंघवी के साथ।@rainaswati | @AnilSinghvi_ https://t.co/54cDyFnsPR

— Zee Business (@ZeeBusiness) April 22, 2022

Domestic stock markets ended the week, mixed, with benchmark indices BSE Sensex and Nifty50 falling on three occasions. There is high volatility in the markets which is largely range bound, market expert Jain tells. It is unlikely that the Nifty will cross levels of 17600-17700 without big effort.

There is a selling spree from the Foreign Institutional Investors (FIIs) and amid news of a 50 bps rate hike from US Federal Reserve in early May, it is advised not to show exuberance while making positions, the Tradeswift Director said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

05:04 PM IST

AIA Engineering shares fall after board approves Rs 500 crore share buyback

AIA Engineering shares fall after board approves Rs 500 crore share buyback Mid-Cap Picks with Anil Singhvi: AIA Engineering, Jamna Auto and GIC Housing Finance are stocks to buy

Mid-Cap Picks with Anil Singhvi: AIA Engineering, Jamna Auto and GIC Housing Finance are stocks to buy