SIP Stock with Anil Singhvi: Healthy order book! Here is why Market Guru recommends this stock from infra space - 6 TRIGGERS cited

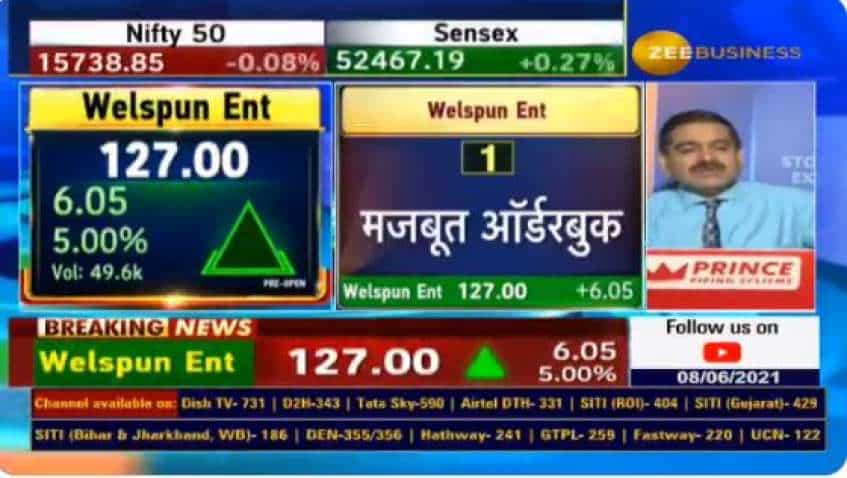

In the SIP Stock show on Tuesday, Zee Business Managing Editor Anil Singhvi recommended a stock from infrastructure space—Welspun Enterprises.

In the SIP Stock show on Tuesday, Zee Business Managing Editor Anil Singhvi recommended a stock from infrastructure space—Welspun Enterprises. Talking about this share, the Market Guru said the most important thing about this company is that it has a very healthy order book.

See Zee Business Live TV Streaming Below:

Speaking about this infra company, Varun Dubey, research analyst at Zee Business, said that company's past record and future prospects infuse confidence in this company. " Last 3 years data shows 80 per cent CAGR growth in revenue and 134 % CAGR growth was seen in PBT. Also, against 47.3 % stake held by promoters in December 2019, it rose to 50.25 now, showing promoters interest in the company. It is also likely to get more order book given the buzz in the infrastructure sector."

मजबूत ऑर्डरबुक और आकर्षक वैल्युएशंस वाली शानदार कंपनी

बेहतरीन फंडामेंटल वाला 'SIP STOCK' Strong Investment Portfolio

बाजार खुलने से ठीक पहले जानें शेयर जो है अनिल सिंघवी को पसंद #SIPStock #StockMarket #Investment @AnilSinghvi_ @VarunDubey85 pic.twitter.com/iDNICBmfSD

— Zee Business (@ZeeBusiness) June 8, 2021

Recommending Welspun Enterprises, Zee Business Managing Editor Anil Singhvi said that as per sector rotation, this share perfectly fits the SIP pick category.

"The company has a very robust order book of Rs 5,500 crore in hybrid asset model. On top of it, Welspun Enterprises also has around Rs 1100 crore order. The order book is such strong that the company can work for more than 3 years without any new order. Secondly, the company has an asset light model. It has projects worth Rs 8,500 crore, of which 60 % share is of the company, while rest is shared by the government. This gives the company almost fixed annuity income of Rs 500 crore. Third, the company is also cash rich. Fourth, it has also entered into JV with Adani group which can also be a big trigger going forward. Promoters interest in this company is another factor that makes it a good buy. Besides, it is available at attractive valuation too and can achieve a target of Rs 200 to Rs 225 in 12 to 18 months," concluded Anil Singhvi.

Welspun Enterprises closed the day on Rs 124.90, up 3.27 %, on NSE on Tuesday.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

05:14 PM IST

Welspun Enterprises Q2 Results: Net profit falls 11% to Rs 61.56 crore

Welspun Enterprises Q2 Results: Net profit falls 11% to Rs 61.56 crore Welspun Enterprises dividend 2024: Infrastructure developer announces Rs 3/ share payout

Welspun Enterprises dividend 2024: Infrastructure developer announces Rs 3/ share payout  Welspun Enterprises gain more than 3% on acquiring majority stake in Michigan Engineers for Rs 137 crore

Welspun Enterprises gain more than 3% on acquiring majority stake in Michigan Engineers for Rs 137 crore Welspun Enterprises share price jumps 3% ahead of board meeting for buyback, dividend

Welspun Enterprises share price jumps 3% ahead of board meeting for buyback, dividend  Welspun Enterprises Deal: Stock jumps nearly 9% after firm announces to sell highway portfolio | All you need to know

Welspun Enterprises Deal: Stock jumps nearly 9% after firm announces to sell highway portfolio | All you need to know