Fed meeting outcome, Budget 2023 impact, weekly expiry among 10 factors that may determine Sensex, Nifty movement on Thursday

US Fed’s FOMC Outcome: While a 25bps interest rate hike is expected, Fed Chair Jerome Powell’s commentary on inflation, US GDP and hint on the point of pivot will dictate how US stock market trade on Wednesday; Indian markets to take cues from their US peers

Stock Markets on Thursday, 2 February 2023: Indian frontline indices S&P BSE Sensex and NSE Nifty50 did a major somersault on Wednesday tanking from day’s highs. The markets started on a positive note and gained momentum as the Finance Minister delivered her last full Budget 2023 speech of Narendra Modi 2.0 government. The fall was even dramatic as Sensex managed to end with 160 points lead over the previous close. The 30-stock index traded in a 2,000-point range during the session. As for broader market Nifty50, the trading range was 620 and the 50-share index closed 45 points lower.

When markets reopen on Thursday, they will take cues from a host of local and global triggers. We have collated 10 factors that could determine who ends on top – Bulls or Bears.

1) US Fed’s FOMC Outcome: While a 25bps interest rate hike is expected, Fed Chair Jerome Powell’s commentary on inflation, US GDP and hint on the point of pivot will dictate how US stock market trade on Wednesday. Today’s closing of its frontline indices Dow 30, S&P 500 and Nasdaq Composite will be an important indicator for domestic markets.

At the time of filing of the story, Dow 30 was trading at 33,859.30, down by 226.72 points or 0.67 per cent while S&P 500 was trading at 4,066.98, lower by 9.62 points or 0.24 per cent. Nasdaq Composite was trading at 11,567.90, down by 16.63 points or 0.14 per cent.

The domestic markets will also take cues from movement in Dow Futures and SGX Nifty futures which are an early indicator of movement in Nifty50.

2) Budget 2023: A popular opinion from industry about this budget was one of positive and probably the best from Finance Minister Nirmala Sitharaman, so far. Today’s correction rode on massive selling in Adani Group stocks. It is to be seen how markets open tomorrow open based on budget related announcements. The government has made key announcements related to capex, real estate, electric vehicles, green energy, agriculture, Indian Railways and much more. We could see stock and sector specific action.

“This is a growth-oriented budget, one of the best in years, with a focus on both infrastructure and job creation, while reducing income tax for pretty much everyone, and lots of money to states. The fiscal deficit has been reduced from 6.4% to 5.9% of GDP, with a clear path to reach 4.5% in the next three years. The focus on infrastructure, as seen in the rising capex outlay from Rs7.5lakh crore to Rs10 lakh crore, combined with PM Gati Shakti and this Government's ability to execute, would be visible through roads, railways, ports and airports and would translate into demand for basic materials like cement and steel on one hand, and consumption goods from all sections of the society, jobs on the other. The Budget would support growth and the Indian consumption story, keep us in good stead, given global headwinds in China and developed markets, and until the rest of the world eases." -- Ashish Kumar Chauhan, MD& CEO, NSE

3) Q3 Results: Several listed companies announced their December quarter earnings today including Jubilant Foodworks, Ashok Leyland, Mahindra Logistics, Tata Chemicals and Raymond. Britannia Industries beat street's estimates, reported 2.5 times increase in net profit.

Many listed companies will declare their October-December quarter earnings on Thursday. Among them were 3i Infotech, Aegis Logistics, Apollo Tyre, Bajaj Electricals, Berger Paints, Birla Soft, Coromandel, Dabur India, Godrej Properties, HDFC and others.

4) Stocks in Ban: Securities in Ban for trade on 2 February 2023 is Ambuja Cements.

5) FII /DII Action: Buying returned for foreign institutional investors as they were net buyers at Rs 1,785 crore while domestic institutional investors were net sellers of Indian equities at Rs 529.47 crore.

6) Bulk Deals: Over a dozen companies bulk deal action on Wednesday. Among them were Nureaca, AKG Exim, Chaman Metallics, Jet Freight Logistics and others. Investors must keep an eye on these stocks.

7) Stocks in News: Tata Steel buys 2.7 million shares in subsidiary Tata Steel Utilities and Infrastructure; Sameer Goel ceases to be Coromandel MD; Hero MotoCorp January sales better than street’s estimates; Ujjivan Small Finance Bank getting RBI nod for amalgamation with Ujjivan Financial Services with the bank; Adani Enterprises calls off fully subscribed FPO; money to be returned to investors

8) Rupee Vs Dollar: The rupee pared initial gains and settled 2 paise lower at 81.90 (provisional) against the US dollar on Wednesday after Finance Minister Nirmala Sitharaman presented the Union Budget for 2023-24. Forex traders said investors stayed on the sidelines, as they are waiting for the outcome of the US Federal Reserve meeting later in the evening. At the interbank foreign exchange market, the rupee opened at 81.76 against the greenback and finally settled at 81.90, down 2 paise over its previous close. During the session, the rupee touched an intraday high of 81.68 and a low of 82.03 against the American currency.

On Tuesday, the rupee depreciated by 36 paise to close at a three-week low of 81.88 against the US dollar after the Economic Survey 2022-23 said the domestic unit may remain under pressure on account of plateauing of exports and subsequent widening of the current account deficit. PTI

“Rupee was volatile as the budget which was a growth oriented one with Capex going up to 10 lakh crores and an Increase of 33 per cent in the same and had something for everyone was fully digested as FPI sold stocks and bought USD despite the fact that Asian currencies were all up and the dollar index was down below 102,” Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP said. The range for tomorrow is at 81.70 to 82.20, he said.

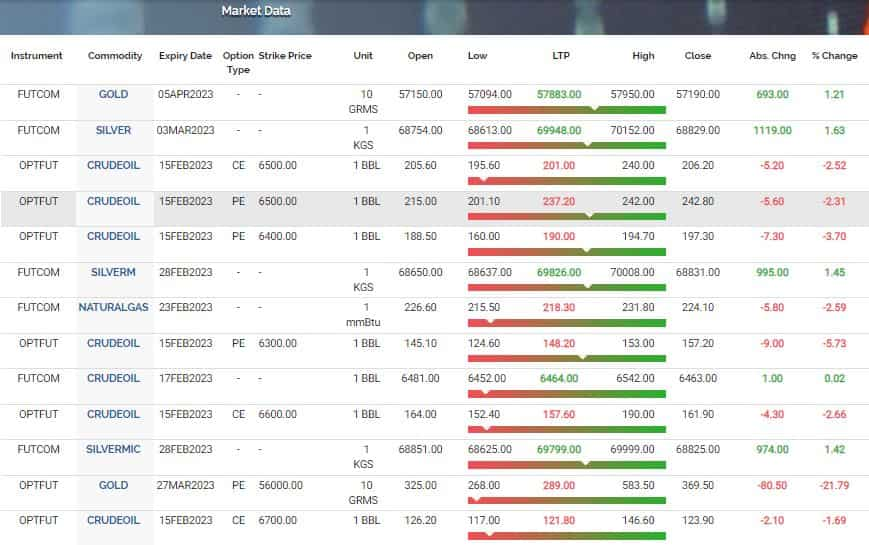

9) Commodity LIVE: April Gold futures were trading at Rs 57,890 per 10 gram on MCX, up by Rs 700 or 1.22 per cent at the time of filing the story. Meanwhile, February Silver futures were trading at Rs 69,958 up by Rs 1,129 or 1.64 per cent. February crude oil 6,423 futures were trading at Rs 6,542 per bbl and were down by Rs 40 or 0.62 per cent. Prices in key commodities will hinge on how Dollar moves against major currencies on Thursday, once the Fed announcements are made.

10) Expert Take

"Markets witnessed a roller coaster ride on the Union Budget day but eventually settled with a marginal cut. The bulls were in control in the first half but the tone reversed completely as the session progressed. Consequently, the Nifty index settled at 17,616.30; down by 0.26%. Meanwhile, a mixed trend on the sectoral front kept the traders busy wherein FMCG and IT showed tremendous resilience.

Markets will react to the outcome of the US Fed meeting in early trade on Thursday. Besides, the overhang of the Union budget and scheduled weekly expiry would further add to the choppiness. A decisive close below the 17550 zone in Nifty would strengthen the bears. We thus reiterate our negative view and suggest limiting trades until we see some stability." -- Ajit Mishra, VP - Technical Research, Religare Broking Ltd. -- Ajit Mishra, VP - Technical Research, Religare Broking Ltd

The Budget is expected to boost the consumption space with increase in income tax rebate and decrease in surcharge rate under the new tax regime. Increased Infrastructure capex outlay will ramp up the virtuous cycle of employment generation and investments, attracting interest in this space from large global investors looking at stable yields especially SWFs, pension funds and insurance companies. Special attention given to net zero objectives and 'green growth' as well as custom duty reliefs will make the green energy space attractive for large institutional investors. Additionally, manufacturing and capital goods themes are expected to perform well in the coming years, which will lead to higher capex plans, thus eventually making companies in the space fundraise through both equity as well as debt routes." -- Gaurav Sood, Managing Director and Head, Equity Capital Markets, Avendus Capital

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How soon will monthly SIP of Rs 8,000, Rs 12,000, and Rs 15,000 reach Rs 6 crore corpus target?

Top Multicap Mutual Funds by SIP Returns: Rs 5,000 monthly investment in these schemes has grown up to Rs 6.65 lakhs in 5 year

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

11:34 PM IST

FIRST TRADE: Nifty hits record high, Sensex up over 200 pts; Bajaj Auto surges over 3%

FIRST TRADE: Nifty hits record high, Sensex up over 200 pts; Bajaj Auto surges over 3% FIRST TRADE: Indices open at record highs; Nifty trades above 20,100; Sensex up 250 pts

FIRST TRADE: Indices open at record highs; Nifty trades above 20,100; Sensex up 250 pts FIRST TRADE: Indices open flat; Sensex above 67,100; Nifty tests 20,000

FIRST TRADE: Indices open flat; Sensex above 67,100; Nifty tests 20,000 FIRST TRADE: Nifty hits new high of 20,110.35; Sensex up over 300 pts; L&T rises over 2.5%

FIRST TRADE: Nifty hits new high of 20,110.35; Sensex up over 300 pts; L&T rises over 2.5% FIRST TRADE: Sensex up over 190 pts; Nifty above 19,880; all sectoral indices trade in green

FIRST TRADE: Sensex up over 190 pts; Nifty above 19,880; all sectoral indices trade in green