Sansera Engineering IPO open now: Should you put your money or avoid this issue? negatives, positives and more, Anil Singhvi answers them all

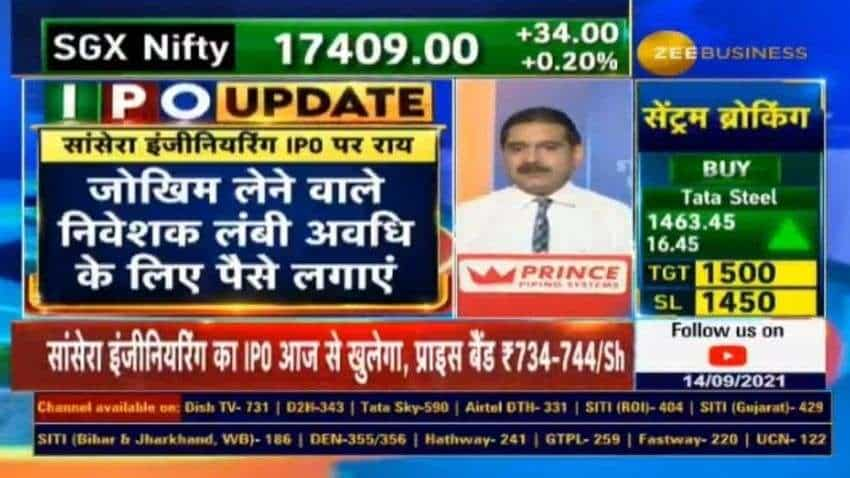

Sansera Engineering Ltd's initial public offering (IPO) opened for subscription on Tuesday, September 14, 2021. Talking about the IPO and if investors should invest in it, Anil Singhvi, Managing Editor at Zee Business said that the investors who can take risk and can hold the stock for long-term can invest or else can avoid as well.

Auto component maker Sansera Engineering Ltd's initial public offering (IPO) opened for subscription on Tuesday, September 14, 2021. The IPO is entirely an offer for sale (OFS) of 17,244,328 equity shares by promoters and investors. The issue, with a price band of Rs 734-744 a share, will conclude on September 16.

Talking about Sansera Engineering's IPO and if investors should invest in it, Anil Singhvi, Managing Editor at Zee Business said that the company is ok and suggested that the investors who can take risk and can hold the stock for long-term can invest or else can avoid as well.

See Zee Business Live TV Streaming Below:

The Market Guru said that investors should look at the valuations of the IPO and how it is compared to other listed companies.

Talking about the positive aspects of Sansera Engineering, he said the track record of promoters is very good. Professionals with good industry experience have been appointed at different posts.

Sansera Engineering के IPO में पैसा लगाएं या नहीं?

कंपनी में क्या पॉजिटिव, क्या निगेटिव?

जानने के लिए देखिए अनिल सिंघवी का ये वीडियो#EditorsTake #SanseraEngineeringIPO @AnilSinghvi_

डाउनलोड करें Zee Business मोबाइल एप:https://t.co/n3bURESey1 pic.twitter.com/3zqeCF1nSl

— Zee Business (@ZeeBusiness) September 14, 2021

The company has a good track record considering its growth and capex, he said. The Market Expert added that the company is a global market leader in products which it makes in automotive segment. The company is also trying to bring diversification in its products by entering into defence, aerospace, he added.

He said that the company is also preparing to make products for electric two wheelers. He added that several international funds are there in the anchor book which is very interesting and impressive.

While talking about the negative aspects, the Market Expert said that the promoters holding will reduce to 36-36.5 percent after the IPO. He said that the company is going to do a capex of Rs 250 crore and has a debt of around Rs 550 crore, still all the amount is on offer for sale, this is the biggest negative point.

He added that the valuation of the company is also not cheap and said that long term investors and those who can take high risk can invest that too only because the anchor book of the company is good.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Power of Compounding: How many years it will take to reach Rs 10 crore corpus through Rs 10,000, Rs 15,000, and Rs 20,000 monthly SIP investments?

11:45 AM IST

Sansera Engineering listing today: Anil Singhvi expects listing in 'this' range, what to do post listing? Check Market Guru's strategy

Sansera Engineering listing today: Anil Singhvi expects listing in 'this' range, what to do post listing? Check Market Guru's strategy Sansera Engineering IPO ends, issue subscribed 11.47 times on the final day – check Anil Singhvi’s view here

Sansera Engineering IPO ends, issue subscribed 11.47 times on the final day – check Anil Singhvi’s view here Sansera Engineering IPO: TIMELINE ALERT! Check allotment, listing and other important dates

Sansera Engineering IPO: TIMELINE ALERT! Check allotment, listing and other important dates Sansera Engineering IPO subscribed 53% on the first day of subscription - check details here

Sansera Engineering IPO subscribed 53% on the first day of subscription - check details here Ami Organics, Vijaya Diagnostic IPO LISTING, Sansera Engineering IPO opening to drive primary market today—Check Anil Singhvi's views on 2 IPOs to be listed on bourses

Ami Organics, Vijaya Diagnostic IPO LISTING, Sansera Engineering IPO opening to drive primary market today—Check Anil Singhvi's views on 2 IPOs to be listed on bourses