Metal Sector Q4 Results Preview: Base metal firms likely to shine, steelmakers' margins may remain under pressure

The overall revenue for the sector is expected to decline 6.6 per cent on a year-on-year basis to Rs 2,206.5 crore, according to Antique. Here's what else investors can expect from the quarterly financial results of metal companies.

)

As investors await the onset of a new earnings season on Dalal Street, all eyes are on the metal basket in the final three months of the financial year 2023-24 following a quarter that saw the profits for players grow more than 65 per cent. This time around, many analysts anticipate a margin contraction for steelmakers within the metals space amid lower price realisations and higher coking coal consumption costs despite a pickup in volumes in a seasonally strong quarter.

Meanwhile, the Nifty Metal rose 3.5 per cent in the March quarter as against a 2.7 per cent rise in the headline Nifty50 index.

What to expect in March-quarter (Q4 FY24) earnings reports of metal players

Axis Securities expects a good fiscal fourth quarter for base metal companies under its coverage, with margins at Hindalco and NALCO anticipated to expand both on quarter-on-quarter and year-on-year basis, but sees steel firms logging margin contraction owing to persistent demand uncertainty in China’s property sector that continues to hamper steel demand.

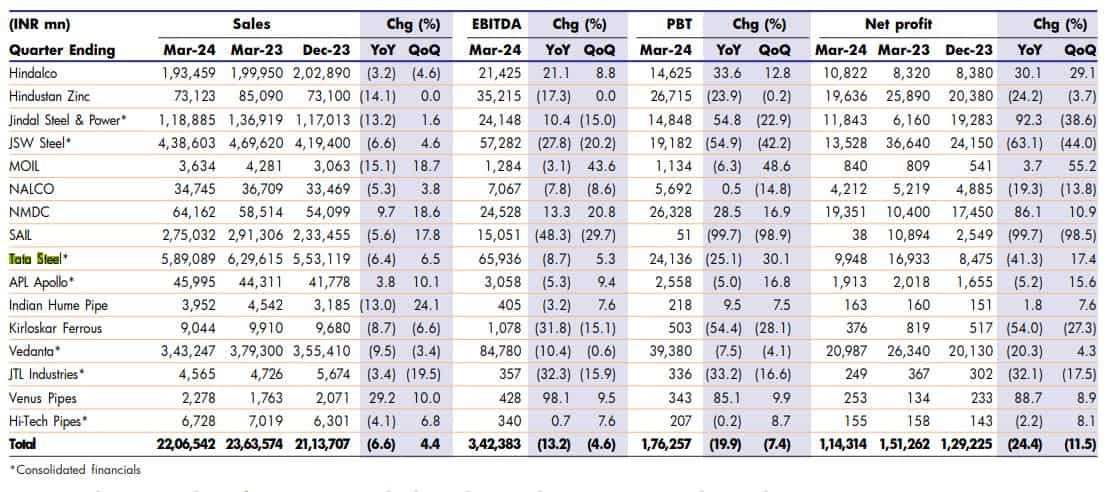

Net profit

Analysts at Antique Stock Broking peg the overall PAT of the metal companies under its coverage at around Rs 11,431 crore in the March quarter, marking a fall of more than 24 per cent on a year-on-year basis and 11.5 per cent on a quarter-on-quarter basis. The overall quarterly revenue for the sector is expected to decline 6.6 per cent and increase 4.4 per cent to Rs 2,206.5 crore, respectively, according to the analysts.

Company-wise performance

Analysts believe that margins for ferrous metals will contract. Ferrous metals refer to any metal that contains iron.

According to Axis Securities, steel companies' margins will be under pressure due to decreased steel price realisations where average hot-rolled coil (HRC) benchmark prices are down 7 per cent YoY and 5 per cent QoQ in Q4FY24, and increased coking coal consumption costs. Realisation is the point in time when revenue is generated. HRC is steel that has been roll-pressed at very high temperatures.

Analysts at Philip Capital expect realisations for ferrous metals to stand at Rs 2,000-2,500/tonne and volumes to improve by 5-10 per cent. They peg earnings before interest, tax, depreciation, and amortisation per tonne (EBITDA/t) to fall by Rs 2,500-4,000/t for most players.

Antique Stock Broking estimates the EBITDA to decline 13.2 per cent to Rs 34,238.3 crore YoY. The brokerage expects non-ferrous metals such as aluminum, zinc, and lead to remain balanced in slight surplus globally, with the demand scenario expected to recover in CY24. Additionally, largely range-bound metal prices and rupee depreciation will likely aid realisations. Lower thermal coal prices will support the margins of Indian non-ferrous companies, the report added.

According to Axis Securities, apart from the tailwind of the Fed rate cuts in the future, aluminum prices have found support due to the concerns over the slow recovery of production in China's Yunnan province due to dry weather conditions restricting hydropower supply.

Echoing similar views, analysts at Philip Capital said Q4 is traditionally better concerning volumes of non-ferrous metal companies as most companies will see stable to marginally better volumes quarter-on-quarter (QoQ). Moreover, operating performance from all of the non-ferrous metal companies will be marginally better sequentially.

Furthermore, Axis Securities expects another good quarter for base metal stocks on the back of higher shipments, stable LME, and lower coal/power costs.

They estimate structural steel tube companies' quarter to be slightly muted led by lower steel price realizations in the quarter.

What to expect in 1QFY25?

Antique Stock Broking reckons lower spot coking coal prices to flow in from 1QFY25 and to aid spreads. As per Philip Capital, blended EBITDA/tonne levels for most of the steel players are likely to improve in 1QFY25 as a sharp fall in realisations is unlikely.

As per Philip Capital, spot LME aluminum/zinc and lead are up by 11 per cent/7 per cent and 2 per cent while CoP remains rangebound, thus most non-ferrous players may see further improvement in operating performance in 1Q.

Catch the latest stock market updates here. For all other news related to business, politics, tech and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

07:18 PM IST

Metal stocks NALCO, Hindalco, Vedanta gain up to 13%: Here's why

Metal stocks NALCO, Hindalco, Vedanta gain up to 13%: Here's why From Tata Steel to JSW Steel: Here's what analysts make of metal sectors stocks

From Tata Steel to JSW Steel: Here's what analysts make of metal sectors stocks Tata Steel Q4 Results Preview: Net profit likely to drop 20%, domestic EBITDA per tonne may shrink 5%

Tata Steel Q4 Results Preview: Net profit likely to drop 20%, domestic EBITDA per tonne may shrink 5% Should you buy, hold or sell Hindustan Copper shares? Multibagger PSU stock poised to almost double in 2 years, say analysts

Should you buy, hold or sell Hindustan Copper shares? Multibagger PSU stock poised to almost double in 2 years, say analysts Metal stocks shine in weak market; are there good long-term opportunities for investors?

Metal stocks shine in weak market; are there good long-term opportunities for investors?