Nifty50 continues gaining rally for second straight month in November: Banks, Financials, Metal among top gainers

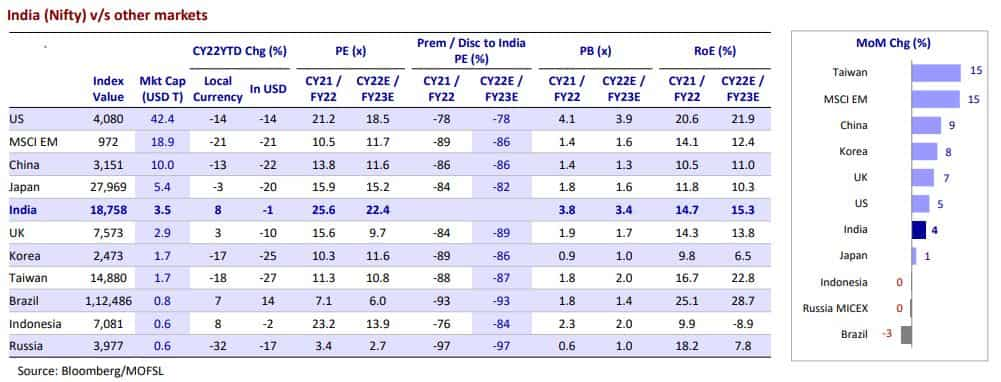

According to domestic brokerage Motilal Oswal, the benchmark index Nifty touched a fresh high of 18,816 levels, ending over 4 per cent higher month-on-month (MoM) at 18,758 in November 2022.

The Indian equity markets closed as one of the top gainers across the world in November. Aided by strong foreign institutional investors (FIIs) flow, global recovery, and moderation in some commodity prices, it witnessed a gaining rally for the second straight month.

According to domestic brokerage Motilal Oswal, the benchmark index Nifty touched a fresh high of 18,816 levels, ending over 4 per cent higher month-on-month (MoM) at 18,758 in November 2022.

The Nifty has reported around 8 per cent year-to-date (YTD) growth as FIIs recorded inflows for the second consecutive month at USD 4.7 billion and DIIs (domestic investors) turned sellers at USD 0.8 billion in November.

Image Source: Motilal Oswal

From the broader markets, midcaps and smallcaps underperformed large caps by 2.2/1.1 per cent in November, while over the last 12 months, largecaps/midcaps rose by 10/8 per cent, respectively, while smallcaps have declined by 6 per cent during the same period.

Image Source: Motilal Oswal

PSU Banks gained 16 per cent, Metals up 11 per cent, Technology up 6 per cent, and Financials up 4 per cent were the top gainers, whereas Utilities, Autos, and Healthcare were the only laggards in the previous month.

Image Source: Motilal Oswal

Corporate results in the second quarter of the financial year 2022-23 came in better than estimates, despite several headwinds, with Financials leading once again, the brokerage said, adding that the earnings spread were decent, with 66 per cent either meeting or exceeding profit expectations.

Image Source: Motilal Oswal

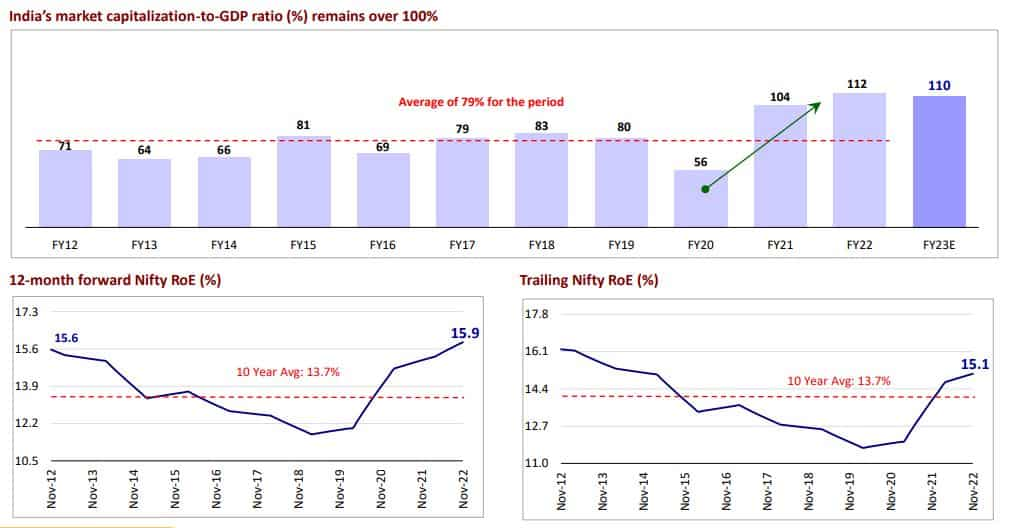

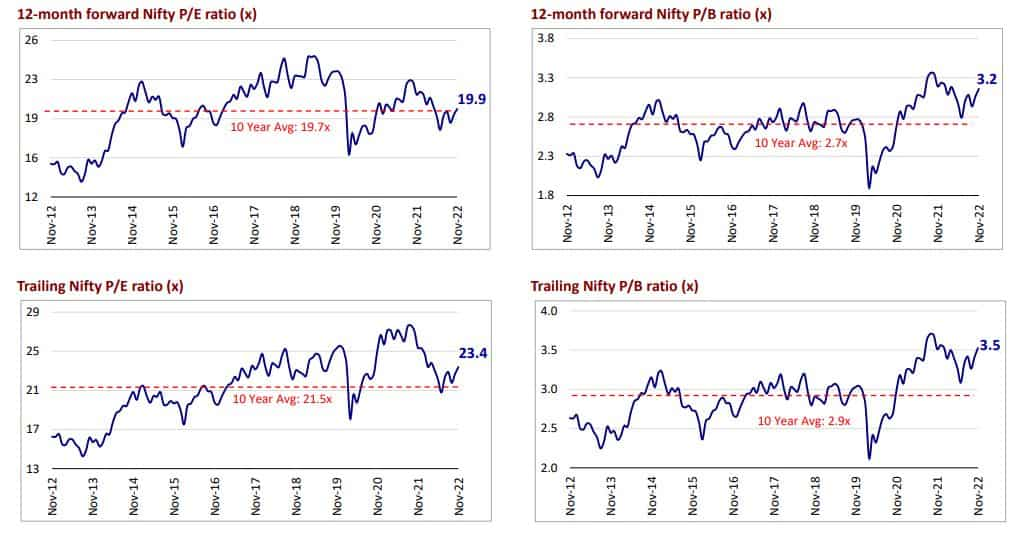

The market has bounced back smartly in the last two months, wiping out the entire YTD decline. With this rally, the Nifty is now trading at a P/E of 22.4x FY23E, comfortably above its LPA, and offers limited upside in the near term.

The upside from here on will be a function of stability in global and local macros and earnings delivery, Motilal Oswal said. The brokerage maintained an overweight stance on BFSI, Auto, Consumer, and IT and remained underweight on Energy, Pharma, and Utilities.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

07:29 PM IST

Return of investor interest to China, erratic monsoon poses challenges for Indian markets: Experts

Return of investor interest to China, erratic monsoon poses challenges for Indian markets: Experts As Fed holds key rate after 15 months, 10 things to know before opening bell on D-Street

As Fed holds key rate after 15 months, 10 things to know before opening bell on D-Street From global cues to US inflation, 10 things to know before the opening bell today

From global cues to US inflation, 10 things to know before the opening bell today From global cues to macro data, 10 things to know before the opening bell today

From global cues to macro data, 10 things to know before the opening bell today FPI flows will improve; multinationals have high interest in Indian markets: Ridham Desai

FPI flows will improve; multinationals have high interest in Indian markets: Ridham Desai