FPIs pull out Rs 31,100 crore from Indian market in November; consumer, unlock theme stocks see buying interest

Indian markets have been under immense pressure in the past one month. This was evident in Foreign Portfolio Investors (FPIs) as they sold in the Indian market to the tune of Rs 31,100 crore in November so far, as per a Zee Business TV report.

Indian markets have been under immense pressure in the past one month. This was evident in Foreign Portfolio Investors (FPIs) as they sold in the Indian market to the tune of Rs 31,100 crore in November so far, as per a Zee Business TV report. This has surpassed the October selling data by FPIs, which stood at Rs 25,000 crore.

Interestingly, FPIs have found new interest in consumer and unlock-themed stocks amid heavy selloff as they have been on buying spree in the stocks related to these themes. As per the report, FPIs spent Rs 8,800 crore in stocks related to these themes. The asset under management (AUM) of stocks related to consumer and unlock saw a 10 per cent jump in this month. Similarly, retail AUM surged whooping 3% in the last three months.

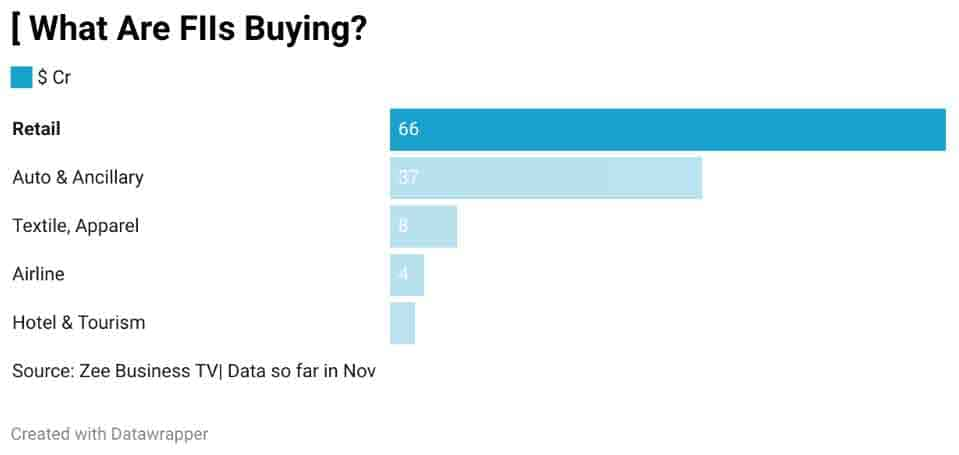

As per the same report, the retail, auto and ancillary, textile & apparel, airline stocks witnessed good buying interest. At $66 crore, the retail stocks witnessed maximum interest from FPIs, while auto and ancillary, textile & apparel, airline saw buying worth $37 crore, $8 crore and $4 crore, respectively.

Meanwhile, FPIs have pumped in a net sum of Rs 5,319 crore in Indian capital markets despite a massive correction seen in equities over the last fortnight, said a PTI report. As per depositories data, overseas investors put in a net Rs 1,400 crore into equities and Rs 3,919 crore into the debt segment between November 1-26. This translated into total net investment of Rs 5,319 crore.

"Since FPIs have been holding large quantity of banking stocks, they have been major sellers in this segment. Sustained selling has made banking stocks attractive from the valuation perspective," VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, told the news agency.

Earlier, on Friday, the Indian markets witnessed massive selloff amid weaker global cues in the wake of new Covid 19 variant detected in South Africa. In one of the worst closings so far this year on Friday, benchmark indices Sensex and Nifty both corrected nearly 3 per cent each on Friday. Sensex crashed 1650 points and Nifty closed below 17,050 level on Friday. The drag was led by Realty, metal, Auto, PSU Bank themed indices as they slipped between 3-6 per cent in a single day on Friday. The massive correction in the Indian markets came amid weaker global cues in the view of new covid variant detected in South Africa.

The indices extended the losses as the Nifty and the Sensex corrected over 1 per cent in the morning trade on Monday. However, market heavyweight Reliance Industries (RIL) and metal stocks led the revival as the headline indices traded with marginal gains around 10.50 am.

(Disclaimer: The views/suggestions/advices expressed here in this article are solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How many years it will take to reach Rs 10 crore corpus through Rs 10,000, Rs 15,000, and Rs 20,000 monthly SIP investments?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Highest Senior Citizen FD rates: See what major banks like SBI, PNB, Canara Bank, HDFC Bank, BoB and ICICI Bank are providing on special fixed deposits

11:20 AM IST

Global cues, FIIs key factors to watch, markets may react to assembly polls outcome: Analysts

Global cues, FIIs key factors to watch, markets may react to assembly polls outcome: Analysts  Indian markets will remain under pressure amid global rate cuts: Report

Indian markets will remain under pressure amid global rate cuts: Report FINAL TRADE: Sensex sinks 680 pts, Nifty hits 24,150 as markets slide for fifth session amid earnings slump and foreign outflows

FINAL TRADE: Sensex sinks 680 pts, Nifty hits 24,150 as markets slide for fifth session amid earnings slump and foreign outflows Sensex, Nifty poised to edge higher, GIFT Nifty futures up by nearly 70 pts

Sensex, Nifty poised to edge higher, GIFT Nifty futures up by nearly 70 pts  FINAL TRADE: Indices end mildly lower; Nifty above 25,350 levels, Wipro gains 4%

FINAL TRADE: Indices end mildly lower; Nifty above 25,350 levels, Wipro gains 4%