Royal Enfield Hunter maker's stock rebounds as investors digest parent Eicher's tepid Q3 results

Royal Enfield share price today: Shares in Eicher Motors, the parent of Royal Enfield, made a comeback on Wednesday a day after its largely-in-line financial results failed to woo the Street.

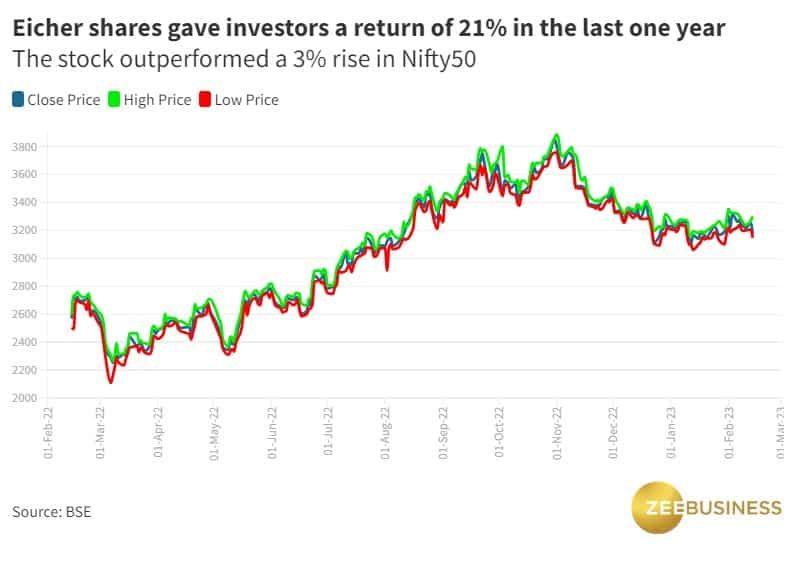

Eicher Motors shares rebounded on Wednesday, a day after the maker of Royal Enfield motorcycles reported a set of financial results that largely were in tandem with analysts' expectations. The Eicher Motors stock finished the day with a gain of Rs 143.7 or 4.5 per cent at Rs 3,318.5 apiece on BSE, having declined by Rs 77.6 or 2.4 per cent after the earnings announcement the previous day.

During market hours on Tuesday, Eicher Motors — the maker of Royal Enfield Classic 350 and Royal Enfield Himalayan motorcycles — reported a 62.4 per cent year-on-year jump in net profit to Rs 740.8 crore for the quarter ended December 2022, and revenue growth of 29.2 per cent to Rs 3,721 crore.

Both Eicher's topline and bottomline top analysts' estimates. According to Zee Business research, Eicher Motors' quarterly net profit was estimated at Rs 734 crore and revenue at Rs 3,659 crore.

The Royal Enfield parent's margin — a key measure of profitability for businesses — improved by 280 basis points to 23 per cent compared with the year-ago period. The margin, however, fell short of the analysts' estimates by 100 basis points.

What brokerages make of Royal Enfield maker after the parent's Q3 results

CLSA said the auto maker's quarterly performance was below expectations due to its lower margin. The brokerage, however, expects Royal Enfield sales volumes to grow in double digits. CLSA brought down its target for the Royal Enfield motorcycle maker by Rs 504 or 11 per cent to Rs 4,007, though still implying upside potential of 26 per cent from Tuesday's closing price.

| Brokerage | Rating | Target price |

| CLSA | Buy | Reduced to Rs 4,007 from Rs 4,511 |

| Morgan Stanley | Equal-weight | Rs 3,553 |

| JPMorgan | Neutral | Reuced to Rs 3,420 from Rs Rs 3,365 |

| Jefferies | Buy | Rs 4,250 |

| Citi | Buy | Raised to Rs 4,400 from Rs 4,300 |

| Nomura | Upgraded to 'neutral' from 'reduce' | Reduced to Rs 3,264 from Rs 3,438 |

| HSBC | Hold | Rs 3,300 |

Morgan Stanley pointed out a rise in the company's market share owing to the launch of Royal Enfield Hunter, but said its margin and market share are likely to peak in 2023.

The brokerage said the launch of Bajaj Triumph in 2023 and Hero Harley in 2024 will be key monitorables.

The stock lost more than 12 per cent of its value in the quarter ended December 2022, a period in which the 50-scrip barometer rose 5.9 per cent.

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How many years it will take to reach Rs 10 crore corpus through Rs 10,000, Rs 15,000, and Rs 20,000 monthly SIP investments?

Top 7 Large Cap Mutual Funds With Highest SIP Returns in 3 Years: Rs 23,456 monthly SIP investment in No. 1 fund is now worth Rs 14,78,099

Highest Senior Citizen FD rates: See what major banks like SBI, PNB, Canara Bank, HDFC Bank, BoB and ICICI Bank are providing on special fixed deposits

04:23 PM IST

VE Commercial Vehicles sales up 7.3% at 5,574 units in November

VE Commercial Vehicles sales up 7.3% at 5,574 units in November D-Street Newsmakers: Eicher Motors, Hero MotoCorp, Vodafone among 7 stocks that hogged limelight today

D-Street Newsmakers: Eicher Motors, Hero MotoCorp, Vodafone among 7 stocks that hogged limelight today Eicher Motors gain over 8% post Q2 earnings; Jefferies gives a 'buy' on signs of revival in RE volumes

Eicher Motors gain over 8% post Q2 earnings; Jefferies gives a 'buy' on signs of revival in RE volumes Royal Enfield parent Eicher Motors logs 8% growth in Q2 profit, in line with analysts' expectations

Royal Enfield parent Eicher Motors logs 8% growth in Q2 profit, in line with analysts' expectations  Eicher Motors Q2 preview: Profit seen up by 5.3%, revenue growth at 8.7% driven by higher ASPs and export mix

Eicher Motors Q2 preview: Profit seen up by 5.3%, revenue growth at 8.7% driven by higher ASPs and export mix