What is ASM framework in stock market and how it affects traders? Explained

ASM framework stock market, NSE, BSE: Stocks that are shortlisted for inclusion in the ASM list serve as a warning to investors about unusual price movement.

ASM framework stock market, NSE, BSE: The National Stock Exchange has placed three Adani Group stocks -- Adani Enterprises, Adani Power and Adani Wilmar under the short-term additional surveillance measure (ST-ASM) framework Stage 1 to check short selling, effective from Thursday, March 9.

The development came after NSE removed Adani Enterprises from the surveillance just the earlier day, after remaining under observation for nearly a month’s time.

It means that intraday trading will require a 100 per cent upfront margin. When a stock is placed under the ASM framework, traders are not allowed to avail intraday leverage and their 100 per cent traded value gets blocked as margin. This is done to check risky and speculative trades, thus minimising the loss.

Additional Surveillance Measure

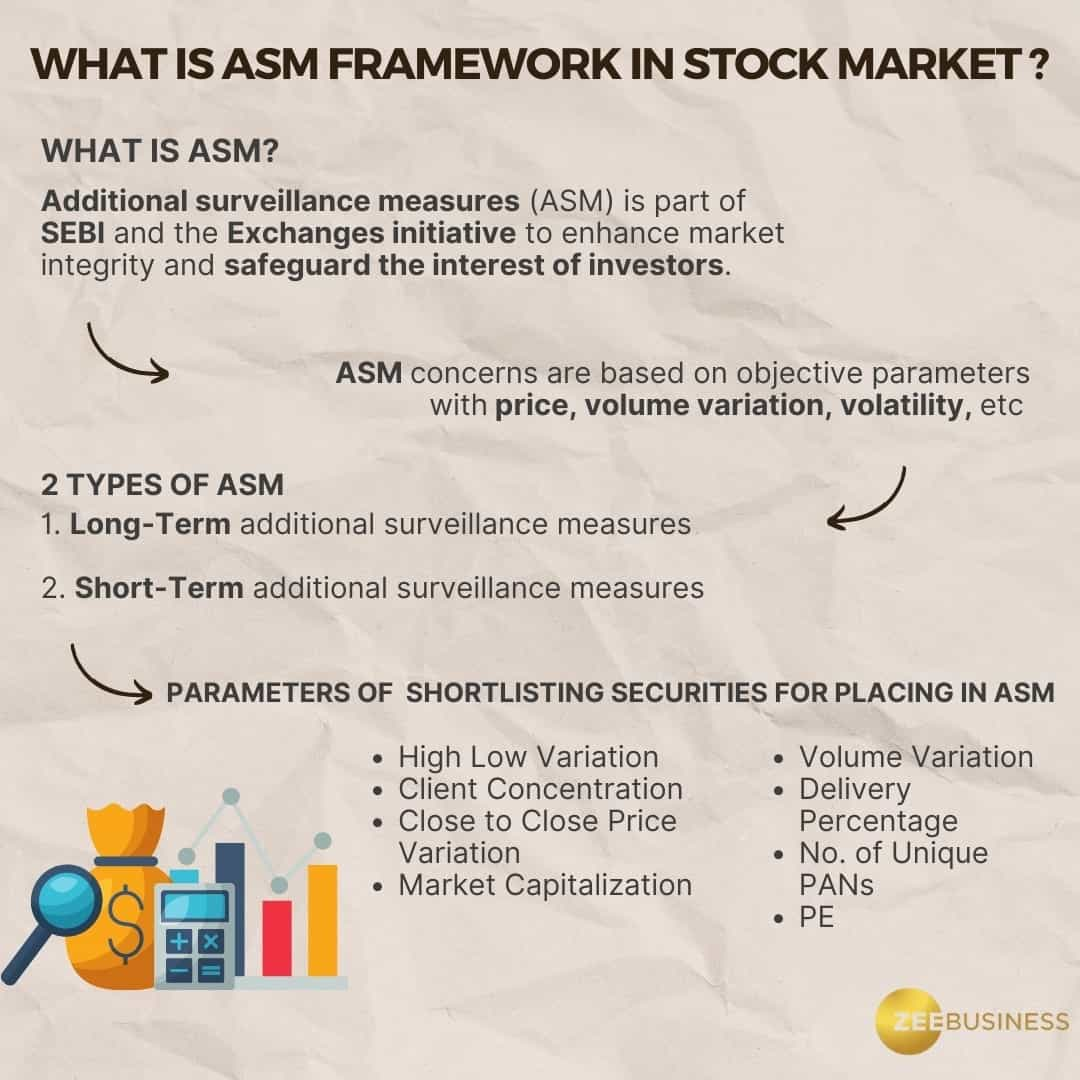

ASM is part of the Securities and Exchange Board of India (SEBI) and the Exchanges initiative to enhance market integrity and safeguard the interest of investors. ASM concerns are based on objective parameters with price, volume variation, volatility etc on Thursday.

Click Here For Latest Updates On Stock Market | Zee Business Live

Stocks that are shortlisted for inclusion in the ASM list serve as a warning to investors about unusual price movement. Certain trading restrictions are implemented to put an end to any potential conjecture in the future.

Following are 2 sections of Additional margins -

1. Long-term additional surveillance measures

2. Short-term additional surveillance measures

As per NSE, the shortlisting of securities for placing in ASM is based on an objective criterion as jointly decided by SEBI and Exchanges covering the following parameters:

- High Low Variation

- Client Concentration

- Close to Close Price Variation

- Market Capitalization

- Volume Variation

- Delivery Percentage

- No. of Unique PANs

- PE

Besides, SEBI and the exchanges introduce various enhanced pre-emptive surveillance measures such as reduction in price band, periodic call auctions and transfer of securities to trade for trade segment from time to time.

Also Read: 30% increase in women fund managers in Mutual Fund industry

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

01:19 PM IST

SEBI's new virtual payment mode for investors? Payright and sit tight!

SEBI's new virtual payment mode for investors? Payright and sit tight! Sebi bans 3 online bond platforms until further orders

Sebi bans 3 online bond platforms until further orders Emerging India Focus Funds pays Rs 64 lakh to settle FPIs violation case with Sebi

Emerging India Focus Funds pays Rs 64 lakh to settle FPIs violation case with Sebi  SEBI study reveals trends in royalty payments by listed companies to related parties

SEBI study reveals trends in royalty payments by listed companies to related parties Royalty payment by listed companies rises to Rs 10,779 crore in FY23: Sebi study

Royalty payment by listed companies rises to Rs 10,779 crore in FY23: Sebi study