Anil Singhvi Strategy January 13: Day support zone on Nifty is 17775-17825 & Bank Nifty is 41725-41875

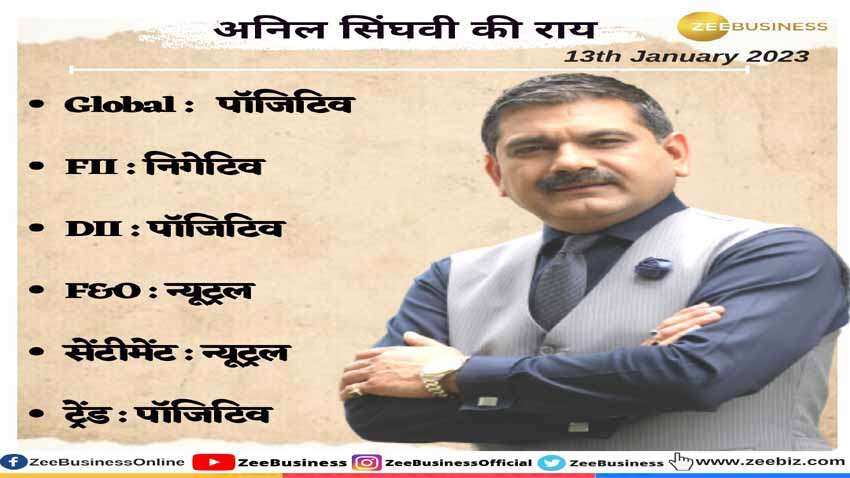

Amid positive global markets, positive domestic institutional investors (DIIs), negative foreign institutional investors (FIIs), neutral futures & options (F&O) and neutral sentiment cues, the short-term trend of the Indian stock markets will be positive on Friday, January 13, 2023

Indian marekts are set to open amid positive cues, Zee Business Managing Editor Anil Singhvi said while spelling out his strategy on Nifty and Bank Nifty. Cues remain favourable on three counts - benign US Inflation, lower than expected India CPI inflation and better results from IT majors Infosys and HCL Technologies, he added. He said that markets are near important support levels and one could expect positive action today, However, the trends will become directional only when Nifty ends above 18,000, he further said.

Amid positive global markets, positive domestic institutional investors (DIIs), negative foreign institutional investors (FIIs), neutral futures & options (F&O) and neutral sentiment cues, the short-term trend of the Indian stock markets will be positive on Friday, January 13, 2023.

Nifty support zone 17775-17825, Below that 17650-17725 Strong Support zone

Nifty higher zone 17925-17975, Above that 18000-18100 Strong Sell zone

Bank Nifty support zone 41725-41875, Below that 41575-41675 Strong Support zone

Bank Nifty higher zone 42325-42475, Above that 42575-42725 Strong Sell zone

Nifty support levels 17825, 17800, 17775, 17725, 17650

Nifty higher levels 17900, 17950, 17975, 18000, 18025, 18065, 18100

Bank Nifty support levels 41950, 41875, 41825, 41725, 41675, 41575

Bank Nifty higher levels 42175, 42225, 42325, 42400, 42475, 42575, 42675, 42725

- FIIs Index Long at 39% Vs 40%

- PCR at 0.92 Vs 0.75

- Bank Nifty PCR at 0.78 Vs 0.81

- India VIX down by 1% at 15.28

For Existing Long Positions:

Nifty intraday and closing STOP LOSS 17750

Bank Nifty intraday STOP LOSS 41700 and closing STOP LOSS 42000

For Existing Short Positions:

Nifty intraday STOP LOSS 18025 and closing STOP LOSS 18100

Bank Nifty intraday STOP LOSS 42350 and closing STOP LOSS 42625

For New Positions:

Buy Nifty:

STOP LOSS 17750 Target 17900, 17950, 17975, 18000, 18025, 18065

Sell Nifty in 17975-18065 range:

STOP LOSS 18150 Target 17950, 17900, 17850, 17825, 17800, 17775

For New Positions:

Buy Bank Nifty in 41675-41750 range:

STOP LOSS 41500 Target 41825, 41875, 41950, 42025, 42100

Aggressive Traders Buy Bank Nifty:

Strict STOP LOSS 41700 Target 42175, 42225, 42325, 42400, 42475, 42575, 42675

Sell Bank Nifty in 42575-42725 range:

STOP LOSS 42850 Target 42500, 42400, 42325, 42250, 42175, 42100, 42025

F&O Ban Update:

Already In Ban: GNFC, IBull Housing Finance

New In Ban: Nil

Out Of Ban: Nil

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Largecap PSU Stock for 65% Gain in New Year: Anil Singhvi picks PSU bank for long term; know reasons and target prices

SBI Latest FD Rates: PSU bank pays these returns to senior citizens and other depositors on 1-year, 3-year and 5-year fixed deposits

Largecap, Midcap Stocks To Buy: Analysts recommend buying L&T, Tata Motors, 3 other stocks for 2 weeks; check targets

PPF vs SIP: Rs 12,000 monthly investment for 30 years; see which can create higher retirement corpus

08:56 AM IST

Anil Singhvi Market Strategy January 2, 2025: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy January 2, 2025: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy January 1, 2025: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy January 1, 2025: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 31: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 31: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 30: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 30: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 27: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 27: Important levels to track in Nifty50, Nifty Bank today