Anil Singhvi’s Strategy April 26: Day support zone on Nifty is 14,250-14,300 & Bank Nifty is 31,150-31,375

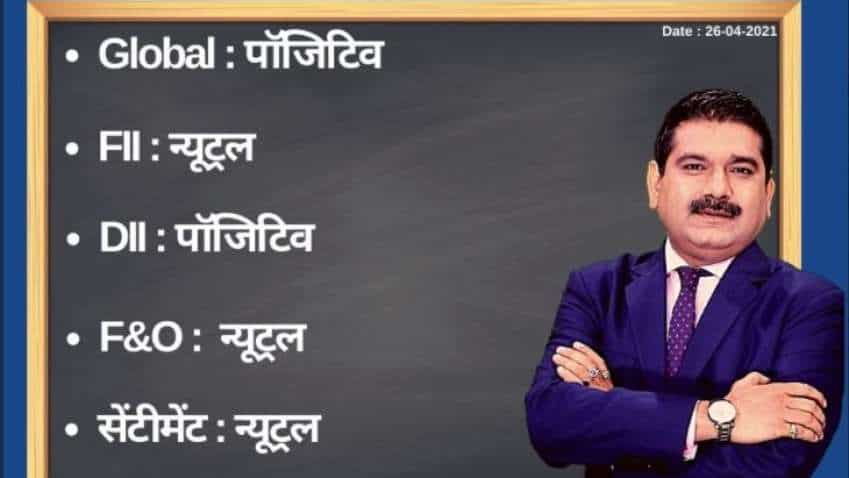

Amid positive global markets, domestic institutional investors (DIIs), neutral foreign institutional investors (FIIs), futures & options (F&O), sentiment cues, the short-term trend of the Indian stock markets will be neutral on Monday, April 26, 2021.

Amid positive global markets, domestic institutional investors (DIIs), neutral foreign institutional investors (FIIs), futures & options (F&O), sentiment cues, the short-term trend of the Indian stock markets will be neutral on Monday, April 26, 2021.

See Zee Business Live TV Streaming Below:

Benchmark indices ended a volatile session with modest losses on Friday, April 23, 2021. The S&P BSE Sensex declined 202.22 points or 0.42 per cent and settled at 47,878.45. The Nifty 50 index declined 64.80 points or 0.42 per cent to close at 14,341.35 while Bank Nifty lost 60.30 points or 0.19 per cent and closed at 31,722.30.

In the broader market, the S&P BSE MidCap index gained 0.16 per cent and S&P BSE SmallCap gained 0.51 per cent.

Zee Business’s Managing Editor Anil Singhvi’s Market Strategy for April 26:

Day support zone on Nifty is 14,250-14,300, below that 14,150-14,200 is a strong Buy zone.

Day higher zone on Nifty is 14,400-14,450, above that 14,500-14,575 is strong Sell zone.

Day support zone on Bank Nifty is 31,150-31,375, below that 30,725-30,900 is a strong Buy zone.

Day higher zone on Bank Nifty is 32,100-32,200, above that 32,325-32,500 is strong Profit-booking zone

The small day range for trading on Nifty is 14,300-14,400, while the medium and bigger day ranges are 14,250-14,450 and 14,200-14,500, respectively.

The small day range for trading on Bank Nifty is 31,400-32,150, while the medium and bigger day ranges are 31,225-32,325 and 31,000-32,450 respectively.

FIIs Index long at 64% Vs 66%

PCR at 1.27 Vs 1.37

India VIX up by 1% at 22.69

For Existing Long Positions:

Nifty intraday and closing stop loss are 14,250.

Bank Nifty Intraday stop loss is 31,500 and closing stop loss is 31,200.

For Existing Short Positions:

Nifty intraday and closing stop loss are 14,500.

Bank Nifty intraday and closing stop loss are 32,200.

For New Positions:

Buy Nifty in 14,200-14,275 range with a stop loss of 14,150 and target 14,300, 14,350, 14,400, 14,450.

Aggressive Traders Buy Nifty with strict stop loss of 14,150 and target 14,400, 14,450, 14,500, 14,525, 14,575.

Sell Nifty in 14,475-14,575 range with a stop loss of 14,625 and target 14,400, 14,350, 14,300, 14,275, 14,250.

For New Positions:

Buy Bank Nifty in 31,125-31,375 range with a stop loss of 31,000 and target 31,400, 31,700, 31,775, 31,975, 32,125, 32,200.

Aggressive Traders Buy Bank Nifty with strict stop loss with a stop loss of 31,400 and target 31,975, 32,125, 32,200, 32,325, 32,450, 32,500, 32,575.

Sell Bank Nifty in 32,325-32,500 range with a stop loss of 32,600 and target 32,200, 32,125, 32,025, 31,800, 31,725.

Aggressive Traders Sell Bank Nifty in 32,100-32,200 range with strict stop loss of 32,350 and target 32,000, 31,800, 31,725, 31,400, 31,225, 31,125.

F&O Ban Update:

New in Ban: Nil

Already in Ban: Indiabulls Housing Finance, Sun TV

Out of Ban: SAIL

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

08:58 AM IST

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today