World Bank has an advice for Mumbai locals; here's what

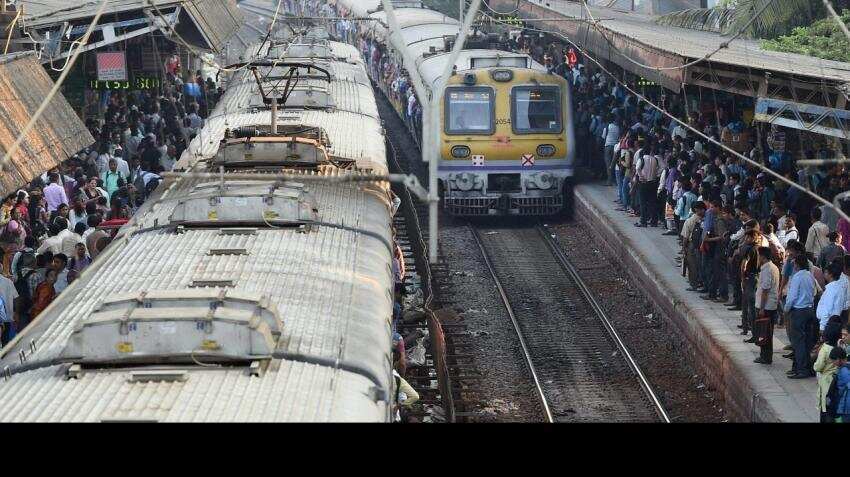

World Bank country director Junaid Ahmad while stressing on the need to create strong public institutions, rather than the 'project by project' approach adopted currently. At present, the suburban train network handles over 6 million passengers a day across the four lines. The services are operated by the state-run Railways and are administered by the Central Railway and Western Railway both headquartered in Mumbai

The World Bank, which has financed a slew of railway projects in the city, wants the megapolis' lifeline to be managed by a dedicated commuter railway company, a top official has said. "What Mumbai needs is a very efficient, sustainable and India's first commuter railway company," the multilateral body's country director Junaid Ahmad said speaking at an event in Mumbai over the weekend. He made the point while stressing on the need to create strong public institutions, rather than the 'project by project' approach adopted currently. At present, the suburban train network handles over 6 million passengers a day across the four lines. The services are operated by the state-run Railways and are administered by the Central Railway and Western Railway both headquartered in Mumbai.

The suburban traffic also contributes a large sum to the overall passenger earnings of the Railways. Ahmad made it clear that the company which he is suggesting can be state-run and added that having such a company will have a lot of advantages. He said the company will be an "agile institution" which will respond to market signals, raise money in the market and gives shares to its workers. Ahmad warned that if such a company is not created, it will be difficult to respond to the massive technological changes happening right now and such changes "will pass" the institution.

The World Bank has been associated with the Mumbai railway since 2002 and is widely credited for funding of the airy and less energy consuming rail rakes through two projects. Ahmad said it is necessary for other public and transport utilities as well to adopt the same approach, of moving to stronger institutions rather than have only projects.

"The next challenge is to move from creating good investment opportunities, to actually create bankable institutions in which you can bring in not only private finance, pension funds and institutional resources, but you create an impeccable institution which will be agile. "As the world of technology changes, that institution has an incentive to adopt that technology," he said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

04:03 PM IST

SBI named Best Bank in India for 2024 by Global Finance Magazine

SBI named Best Bank in India for 2024 by Global Finance Magazine  Uzbekistan's economy grows by 6.6% in past 9 months

Uzbekistan's economy grows by 6.6% in past 9 months Nirmala Sitharaman to visit Mexico and US from October 17 to October 26

Nirmala Sitharaman to visit Mexico and US from October 17 to October 26  World Bank expects 5.1% growth for Nepal

World Bank expects 5.1% growth for Nepal ISA, MIGA set up multi-donor trust fund to support solar projects

ISA, MIGA set up multi-donor trust fund to support solar projects