When poster boys turn rogue! India Inc developments that surprised, shocked everyone in 2018:

India Inc found out, much to its embarrassment, this year that it had quite a few who were not playing by the rule book.

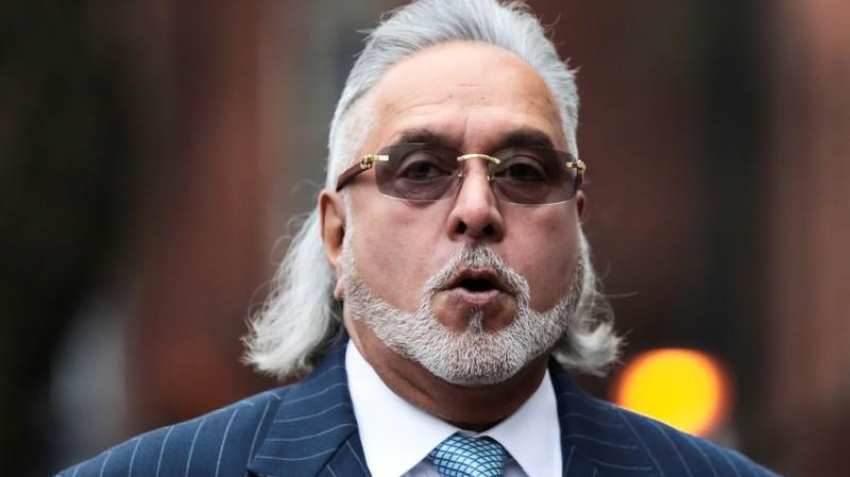

As the adage goes, there is a black sheep in every flock but India Inc found out, much to its embarrassment, this year that it had quite a few who were not playing by the rule book. When diamantaire uncle-nephew duo Mehul Choksi and Nirav Modi emerged as kingpins in the Rs 14,000-crore Punjab National Bank fraud upstaging Vijay Mallya, wanted in India for Rs 9,000-crore bank loan default, it was inevitable that the year belonged to the black sheeps of corporate India when it came to hitting the headlines.

Once the poster boys of the spirit of Indian entrepreneurship, the flamboyant Mallya, Choksi and Modi also became convenient tools to be used by political parties -- ruling and the Opposition alike -- to score brownie points over each other.

Giving them company were the absconding promoters of Gujarat-based pharmaceutical company Sterling Biotech Group Nitin and Chetan Sandesara, wanted in connection with a Rs 5,000-crore bank fraud and money laundering case.

While a London court has ordered for Mallya's extradition to India at the end of a year-long trial -- although he intends to appeal against the order, it remains to be seen in the coming year how many of the corporate-honchos-turned-fugitives will actually be brought back to India to face the law of the land.

2018 was also the year when the Singh brothers, former Fortis and Ranbaxy promoters and the erstwhile young icons of healthcare industry, fell out and literally coming to blows accusing each other of assault besides blaming each other for the downfall of their business.

Malvinder and Shivinder are also facing a criminal complaint filed by the another firm they promoted, Religare Enterprises with the the Economic Offences Wing of the Delhi Police for cheating, fraud and misappropriation of funds to the tune of Rs 740 crore.

While the brothers have appealed against the award of Rs 3,500 crore by an arbitration panel in Singapore in April 2016 to be paid to Japan's Daiichi Sankyo in a dispute related to the acquisition of Ranbaxy, the matter cast a shadow on IHH Healthcare's open offer for Fortis Healthcare with the Supreme Court ordering status quo with regard to the sale of controlling stakes in the Indian hospital chain.

Watch this Zee Business video here:

#ZbizHeadlines | एक नजर इस वक्त की बड़ी खबरों पर। pic.twitter.com/0dIVjBLFDk

— Zee Business (@ZeeBusiness) December 21, 2018

The saga of Tata-Mistry fight continued, moving from the Mumbai bench of NCLT to the NCLAT in the national capital as ousted Tata Sons Chairman Cyrus Mistry sought to slug it out, persisting with his allegations of oppression of minority shareholders and mismanagement by the company.

On the other hand, the National Company Law Tribunal (NCLT) witnessed heightened activities at its different benches took up insolvency proceedings of 12 stressed assets which were referred to it by the RBI last year.

While Tata Steel acquired debt-laden Bhushan Steel Ltd with a Rs 32,500-crore deal and Aditya Birla group firm UltraTech Cement bagging Binani Cement with a revised bid of Rs 7,950.34 crore, the proceedings had to reach all the way to the Supreme Court to decide the winner, thus exposing lacunae in the Insolvency and Bankruptcy Code (IBC).

In the case of auto component maker Amtek Auto, Liberty House won the bid offering to pay financial creditors Rs 3,225 crore upfront and make a fresh infusion of Rs 500 but lenders approached the Chandigarh bench of NCLT alleging failure on the part of the UK-based firm to comply with approved resolution plan.

It will only be known, hopefully, in the coming year who will bag the big-ticket stressed assets such as Essar Steel, Jaypee Infratech and Ruchi Soya which are still mired in litigations. Amid the frauds, default and legal battles, the telecom sector witnessed an all-out tariff war with the new entrant Reliance Jio continuing to disrupt the industry, which saw completion of merger of Vodafone India and Idea, while Bharti Airtel also got the nod from its shareholders for its acquisition of Tata Teleservices.

Jio's sustained disruptive pricing continued to put financial pressure on other operators who experienced erosion in profitability and deteriorating operational matrix. Such was the pressure of financial stress that Kumar Mangalam Birla, chairman of India's largest operator Vodafone Idea, approached the government seeking immediate relief for the sector.

At a time when many were following up on the happenings at the Westminster Magistrates' Court that was hearing the extradition case of Vijay Mallya, who left India for the UK in March 2016, state-owned Punjab National Bank on February 14 this year announced that it had detected a USD 1.77 billion fraud, making it possibly the biggest banking scam in the country.

It filed a complaint with the Central Bureau of Investigation (CBI). The focus immediately shifted from Mallya to high-profile jewellers Mehul Choksi and Nirav Modi, who were accused by the CBI for siphoning off of funds using fraudulent letters of undertaking (LoUs) issued from PNB's Brady House branch in Mumbai.

Following the script of Mallya, the uncle-nephew duo had already left India before the scam was unearthed and their whereabouts were unknown. Later on when reports emerged that Choksi had moved to Antigua and taken a local passport, the Congress didn't let go of the opportunity to blame the Bharatiya Janata Party again.

Adding fuel to the political fire was Mallya, who claimed he met Finance Minister Arun Jaitley before leaving India in 2016, only for the minister to vehemently deny it. Amid all the dramas, once in a while, big-ticket deals like Walmart's USD 16-billion acquisition of India's homegrown e-commerce major Flipkart; and merger of Hindustan Unilever, the Indian arm of Unilever, with GlaxoSmithKline Consumer Healthcare valuing the latter at Rs 31,700 crore managed to draw attention as well.

Likewise, the long-running saga of sale of cash-strapped Fortis Healthcare to Malaysia's IHH Healthcare for Rs 4,000 crore after scrapping two previous selected suitors -- TPG-Manipal combine and Munjals-Burmans, kept the headline writers busy.

Yet, none came close to Mallya, Nirav Modi and Chokshi in keeping the headline writers busy from all aspects. Maybe in 2019, they will write a different story.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Retirement Planning: In how many years your Rs 25K monthly SIP investment will grow to Rs 8.8 cr | See calculations

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

Top 7 Mid Cap Mutual Funds With up to 41% SIP Returns in 5 Years: No 1 fund has converted Rs 15,000 monthly investment into Rs 23,84,990

SBI 5-Year FD vs MIS: Which can offer higher returns on a Rs 2,00,000 investment over 5 years? See calculations

12:32 PM IST

Sebi attaches bank, demat, MF accounts of Mehul Choksi to recover dues

Sebi attaches bank, demat, MF accounts of Mehul Choksi to recover dues Sebi issues Rs 5.35-crore demand notice to Mehul Choksi

Sebi issues Rs 5.35-crore demand notice to Mehul Choksi Choksi will 'only' return to Dominica to face trial when fit, media reports citing bail conditions

Choksi will 'only' return to Dominica to face trial when fit, media reports citing bail conditions ED transfers attached assets worth Rs 8441.5 cr to PSBs which suffered losses due to bank fraud by Vijay Mallya, Nirav Modi and Mehul Choksi

ED transfers attached assets worth Rs 8441.5 cr to PSBs which suffered losses due to bank fraud by Vijay Mallya, Nirav Modi and Mehul Choksi Mehul Choksi case: India files impleadment applications in Dominica High Court; CBI to focus on PNB case, MEA on Choksi's Indian citizenship status

Mehul Choksi case: India files impleadment applications in Dominica High Court; CBI to focus on PNB case, MEA on Choksi's Indian citizenship status