What will India's FY18 GDP growth look like?

Demonetisation may have impacted India's GDP growth for the fourth quarter ended March 31, 2017 but its effects may not be over so soon.

On May 31, 2017, the Central Statistics Office (CSO) said that India's GDP growth dropped to 6.1% in fourth quarter ended March 31, 2017 (Q4FY17). For the full year, GDP growth stood at 7.1% from revised 8% in 2015-16.

Devendra Kumar Pant, Chief Economist, India Ratings & Research said, “The impact of demonetisation is clearly visible in fourth quarter GVA growth of manufacturing (declined to 5.3% from 8.2% in third quarter) and trade hotels, transport & communication and services related to broadcasting (declined to 6.5% from 8.3% in third quarter).”

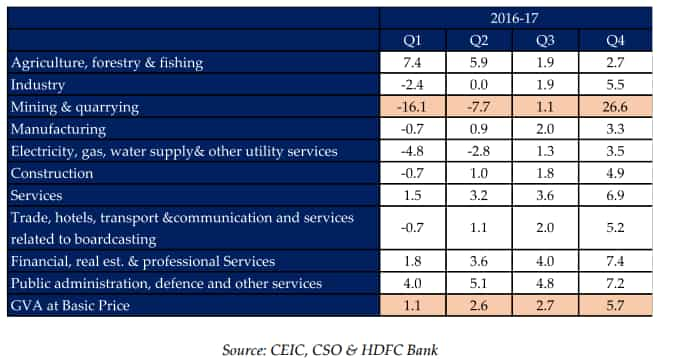

As per economists at HDFC Bank,data released by CSO explains two things – firstly an intra-year down-cycle through FY17 in industry and secondly, a clear break in the growth path post demonetisation that push down the growth particularly in the industrial sector.

Slowdown could have been in Q4 GDP due to higher deflator impact – which was visible in the difference between growth and real terms –nominal GVA expanded by 11.3% in Q4, but in real terms the growth fell down to 5.6% in Q4 reflecting a higher GVA deflator (5.7%).

Data in consideration with GVA deflator indicates that mining & quarrying sector has actually recorded a growth of 26.6% in Q4FY17 and 1.1% Q3FY17 compared to negative 8.7% and 15.4% of Q4FY17 and Q4FY16 respectively.

At the same time, manufacturing sector has been higher by 3.3% (Q4FY17) and 1.1% (Q3FY17) as against last two quarters of FY16 where it was negative 1% and 1.5%, respectively.

Service sectors has also risen by 6.9% in Q4FY17 verus marginal growth in Q4FY16. Construction sector also saw growth of 5% in Q4FY17 from negative 1.5% of Q4FY16.

Nikhil Gupta and Madhurima Chowdhury, analysts at Motilal Oswal said, “FY17 was supported by government consumption, without which the real GDP growth would have fallen to 5.6% much lower than the average growth of 7.2% for the previous four years."

"With fiscal policy reaching its limits and the external sector likely to deteriorate this year, we do not expect real GDP growth to pick up meaningfully in FY18," they said.

The duo of Motilal Oswal said, “Our detailed analysis of 2017-18 budgets for 17 states revealed that government's spending is budgeted to grow at the slowest pace in 2 years. As fiscal spending slows, their contribution to real GDP growth would obviously fall. This is what makes us skeptical on higher than FY7 real GDP growth for FY18.”

HDFC Bank too said, "In terms of our outlook for FY18 growth, we anticipate a very modest uptick of 40-50 basis points on FY17 growth numbers, assuming a normal monsoon out turn and a gradual pick up in investment cycle starting towards the latter part of third quarter."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

01:44 PM IST

India poised to surpass Japan in GDP ranking by 2025

India poised to surpass Japan in GDP ranking by 2025 India GDP growth at 7.8% in Q4, better than economists' expectations; FY242 expansion at 8.2%

India GDP growth at 7.8% in Q4, better than economists' expectations; FY242 expansion at 8.2% S&P revises India outlook to 'positive' from 'stable', expects reforms to continue

S&P revises India outlook to 'positive' from 'stable', expects reforms to continue Finance Minister Sitharaman at IMF meet says India projected to grow at 7% in 2022-23

Finance Minister Sitharaman at IMF meet says India projected to grow at 7% in 2022-23 India's GDP growth slows down to 4.4% in December quarter

India's GDP growth slows down to 4.4% in December quarter