RBI's task gets complicated as analysts lower India's GDP forecast

India's GDP growth came in at 5.7% above market expectation of 6.6% compared to 6.1% in Q4FY17 and 7.9% in Q1FY17.

Key Highlights:

- India's GDP growth at 5.7% in Q1FY18

- Gross Value Added growth came in at 5.6%

- Demonetisation and GST impacted Indian economy in Q1FY18

India's GDP growth in first quarter of current fiscal reached a three-year low, at 5.7%. In the previous quarter, GDP stood at 6.1% and at 7.9% in the corresponding period of the previous year.

Such tepid performance came in as a surprise as analysts and economist expected the number to be at 6.6%.

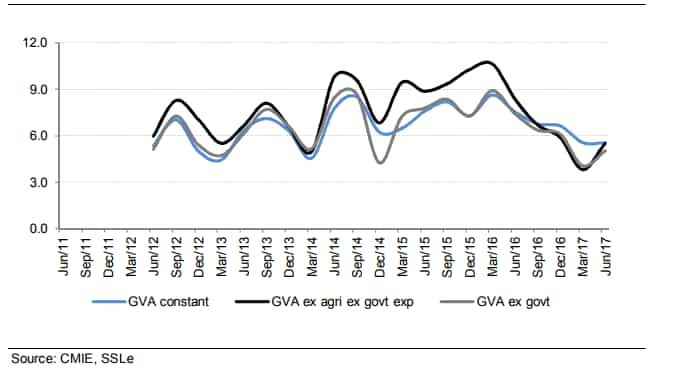

Both the nominal and real GVA saw deceleration in Q1 compared to Q4FY17.

Nominal GVA slowed down to 7.9% - lower from 11.3% in last quarter. Similarly, the GVA deflator which was evident in Q4FY17, has now declined from 5.4% to 2.2% due to negative deflator in agriculture (-2.0%).

Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor at State Bank of India said that economic growth plunged below 6% as gross value added (GVA) at basic prices grew by 5.6% in Q1FY18 – a sharp 200 basis points less than the corresponding quarter of the previous year.

Ghosh said, “We don't agree with the CSO narrative that the increase in WPI prices / higher GVA deflator was one of the reasons for slowdown in GVA growth. The decline of GVA could be due to the factors like lingering impact of demonetization and destocking activities undertaken ahead of GST implementation.”

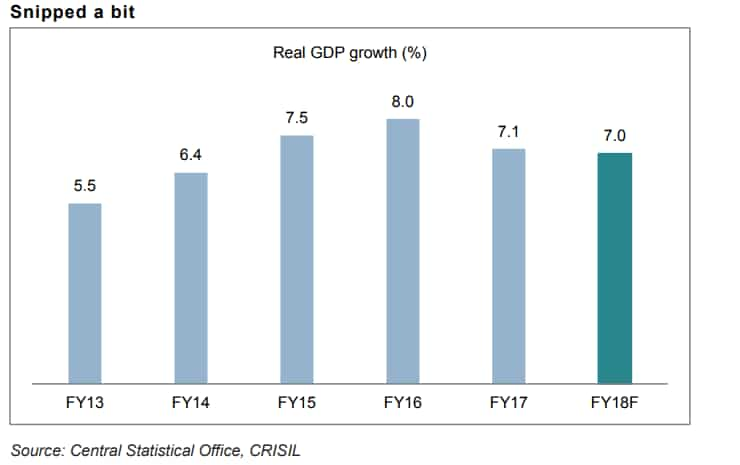

CRISIL has trimmed its FY18 growth forecast for India by 40 basis points to 7% from 7.4% earlier.

It said, “This fiscal would see some added headwinds in the form of GST related disruptions, even as the economy tries to recover from the impact of last year’s demonetisation drive.”

Similarly, Sutapa Biswas, Research Analysts at Stewart Mackertich said, "We believe GST will continue to weigh on the Q2 FY2017-18, GDP as seen from the July PMI number, which fell sharply. However, we expect this adjustment to be short-lived and production should normalise within the next 2-3 months."

According to Crisil, GST-related disruptions would limit the upside to growth for a few more quarters as there are uncertainties around the possibility of changes to the given tax structure, and as businesses adjust to this new regime.

Further uncertainties will be added through other factors like tepid consumption demand, lower private investment and low commodity prices, etc.

Analysts at SBICAP said, "While the pain caused by GST-related uncertainties and the export sector is likely to continue, there is an urgent need for fiscal spending on capital expenditure as well as an accommodative monetary policy."

Private final consumption expenditure dropped to 6.7% from 8.4% last year and government spending stood at 17.2% vs. 16.6% last year.

Indranil Pan and Sameer Narang, analysts at IDFC Bank believe that the government spending which has been the triggered factor in GDP growth in past data - would probably have to curtail back on its expenditures in Q3 and Q4, leading to some negatives for growth.

Thus, the duo at IDFC Bank trims down its GDP expectation at 6.6% in FY18 from 7.1% in FY17.

At the same time, Crisil stated that the benefit of extremely low commodity prices last year may not be available to the corporates this year and hence the bottom line may remain under pressure.

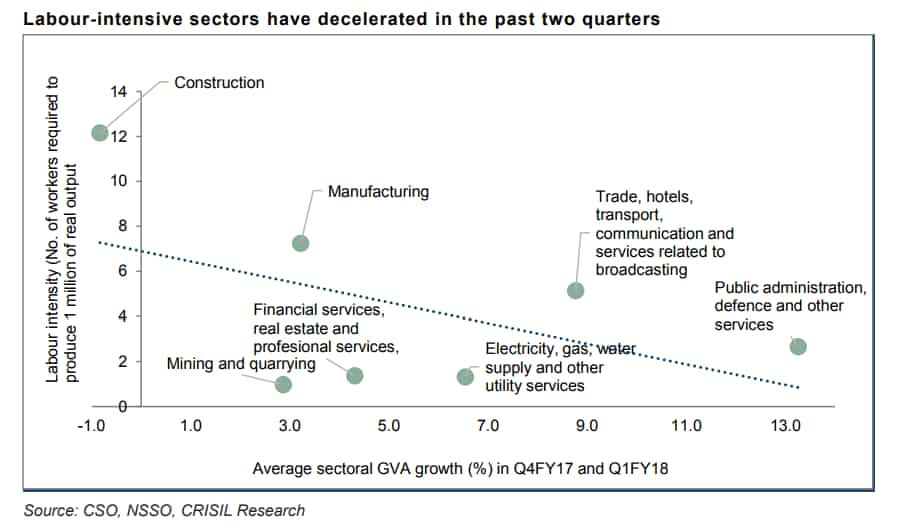

Another worrisome feature of the growth slowdown is that the sectors with high potential to absorb labour force have seen a sharper dip, added Crisil.

Most of the sectors that grew fast have low labour intensity and low share in overall output - suggesting that slower economic growth could also have shaved off employment growth in the economy.

Nikhil Gupta and Rahul Agarwal, analysts at Motilal Oswal expect real GDP to grow by 6.5% in 2QFY18, followed by 7% and 7.5% in the subsequent two quarters. For full-year FY18, it expect growth to decline to 6.7% from 7.1% in FY17.

Whether GDP numbers surprises analysts again or no in the coming quarters, it sure has complicated the task for the Reserve Bank of India (RBI) decision in forthcoming policy.

IDFC Bank said, "The lower growth numbers make the RBI task more complicated, as it is likely to be associated with higher inflation prints from now on. We do not think the Q1 growth print alone would trigger any rate reduction from the RBI in its October policy as it has probably already been factored into the 25bps cut in August."

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

06:22 PM IST

India poised to surpass Japan in GDP ranking by 2025

India poised to surpass Japan in GDP ranking by 2025 India GDP growth at 7.8% in Q4, better than economists' expectations; FY242 expansion at 8.2%

India GDP growth at 7.8% in Q4, better than economists' expectations; FY242 expansion at 8.2% S&P revises India outlook to 'positive' from 'stable', expects reforms to continue

S&P revises India outlook to 'positive' from 'stable', expects reforms to continue Finance Minister Sitharaman at IMF meet says India projected to grow at 7% in 2022-23

Finance Minister Sitharaman at IMF meet says India projected to grow at 7% in 2022-23 India's GDP growth slows down to 4.4% in December quarter

India's GDP growth slows down to 4.4% in December quarter