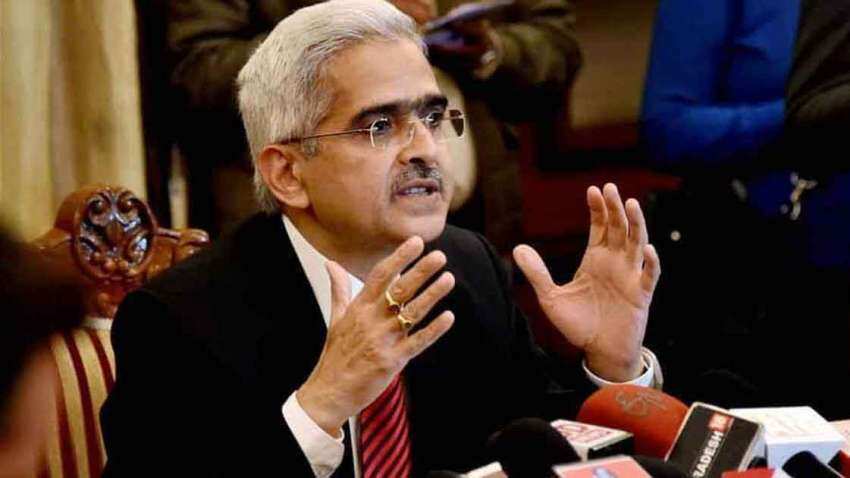

RBI monetary policy: Imperative that investor base is broadened, says Shaktikanta Das

Talking about the outcome of Monetary Policy Committee (MPC), Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday said the it has been decided to keep policy rates unchanged. The repo rate will remain at 4 percent and reverse repo rate at 3.35 percent.

Talking about the outcome of Monetary Policy Committee (MPC), Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday said the it has been decided to keep policy rates unchanged. The repo rate will remain at 4 percent and reverse repo rate at 3.35 percent.

See Zee Business Live TV Streaming Below:

Reserve Bank of India Governor also discussed about bad bank and said, "RBI discussed the idea of a bad bank and we will examine the formal proposal once it is made." Shaktikanta Das said.

RBI governor Shaktikanta Das also said allowing retail investors to G-sec market will not undermine flow of deposits to banks or mutual funds.

"It is imperative that investor base is broadened due to government borrowing size. We Will soon come out with details on retail participation in g-sec market." said Shaktikanta Das

Three bids for PMC Bank have been received and evaluation is underway, he said

The Reserve Bank on Friday decided to restore the cash reserve ratio (CRR) in a phased manner to 4 per cent in light of improved liquidity condition in the market.

The CRR is the percentage of the total deposit that banks have to mandatorily park with the apex bank. The move to raise CRR would suck about Rs 1.37 lakh crore primary liquidity from the banking system.

To help banks tide over the disruption caused by COVID-19, the CRR of all banks was reduced by 100 basis points to 3.0 per cent of net demand and time liabilities (NDTL) effective from the reporting fortnight beginning March 28, 2020.

The dispensation was available for a period of one year ending March 26, 2021.

"On a review of monetary and liquidity conditions, it has been decided to gradually restore the CRR in two phases in a non-disruptive manner. Banks would now be required to maintain the CRR at 3.5 per cent of NDTL effective from the reporting fortnight beginning March 27, 2021 and 4.0 per cent of NDTL effective from fortnight beginning May 22, 2021," RBI Governor Shaktikanta Das said.

RBI last reduced the CRR in November 2011 by 25 basis points from 4.25 per cent to 4 per cent.

RBI on March 27, 2020 allowed banks to avail funds under the marginal standing facility (MSF) by dipping into the Statutory Liquidity Ratio (SLR) up to an additional one per cent of net demand and time liabilities (NDTL), i.E., cumulatively up to 3 per cent of NDTL.

This facility, which was initially available up to June 30, 2020 was later extended in phases up to March 31, 2021 providing comfort to banks on their liquidity requirements and also to enable them to meet their Liquidity Coverage ratio (LCR) requirements.

This dispensation provides increased access to funds to the extent of Rs 1.53 lakh crore and qualifies as high-quality liquid assets (HQLA) for the LCR, he said.

With a view to providing comfort to banks on their liquidity requirements, it has now been decided to continue with the MSF relaxation for a further period of six months, i.E., up to September 30, 2021, he added.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

01:14 PM IST

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank  Reserve Bank amends master direction on KYC

Reserve Bank amends master direction on KYC  Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public

Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public Rupee settles on flat note, rises 1 paisa to 84.07 against US dollar

Rupee settles on flat note, rises 1 paisa to 84.07 against US dollar  Retail inflation likely to average 4.5% in FY25: RBI Deputy Governor

Retail inflation likely to average 4.5% in FY25: RBI Deputy Governor