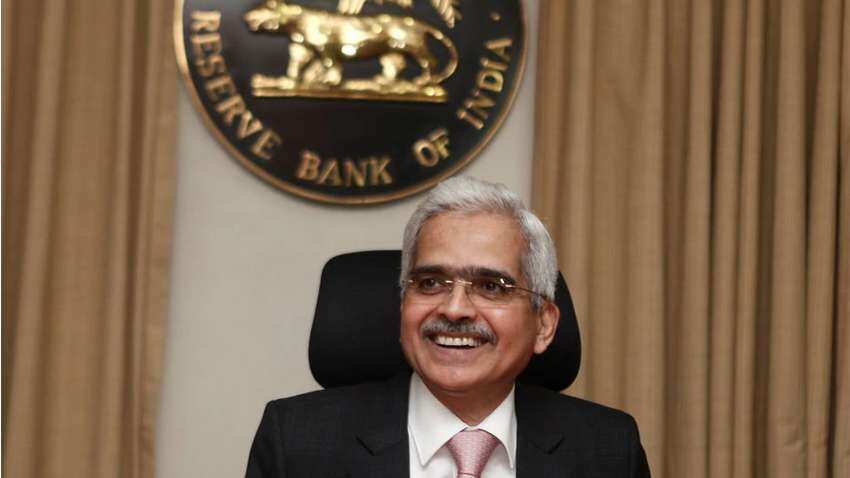

RBI Monetary Policy December 2021: Key announcements by Governor Shaktikanta Das - GDP, Inflation, Repo Rate, IPO UPI payments and more

- RBI mulls to launch UPI-based payment products for feature phone users, Governor Shaktikanta Das says.

RBI Monetary Policy December 2021: RBI on Wednesday kept repo rate and reverse repo rate unchanged at 4 per cent and 3.35 per cent, respectively. Also, it maintained its accommodative stance to ensure better economic recovery. Here are the top points from the RBI Governor Shaktikanta Das address on review by Monetary Policy Committee announcements: -

- It is proposed to enhance the transaction limit for payments through UPI for Retail Direct Scheme and IPO applications from Rs 2 lakh to Rs 5 lakh. Separate instructions to NPCI will be issued shortly, as per statement.

- RBI mulls to launch UPI-based payment products for feature phone users, Governor Shaktikanta Das says

- RBI to release a discussion paper on charges on digital payments, Launch Unified Payments Interface (UPI)-based feature phone products, says Guv Das

- Indian economy is relatively well positioned on path of recovery but it cannot be immune to global situation, says Governor Das.

- Globally, economies are opening up, activities level are reaching pre-pandemic level: Governor Das

RBI to permit banks to infuse capital in overseas branches, repatriate profit without its prior permission, says Governor Das

-RBI would endeavour to broaden growth impulses, encourage credit flow to productive sectors: Governor Das

-RBI Governor Das says central bank would continue to manage liquidity in a manner to maintain financial stability

-Price stability remains cardinal principle of RBI as it fosters growth, stability: Governor Das while announcing monetary policy

-RBI retains CPI inflation projection at 5.3% in 2021-22: Governor Das

-Cut in excise duty on petrol, diesel to bring down inflation rate on durable basis: Reserve Bank Governor Das

-RBI retains GDP growth target at 9.5% in FY22: RBI Governor Shaktikanta Das

-Recent reduction in taxes on petrol, diesel prices should support consumption demand, says RBI Governor Das

-Crude oil prices softening in November would alleviate domestic cost push build up: RBI Governor Das

-Indian economy hauled itself out of its deepest contraction; we are better prepared to deal with COVID-19: RBI Governor Das

-RBI to continue with accommodative stance to revive and sustain growth on durable basis: Governor Shaktikanta Das

-RBI keeps benchmark lending rate unchanged 9th time in a row at 4%

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

11:16 AM IST

RBI, Maldives Monetary Authority sign pact to promote use of local currencies

RBI, Maldives Monetary Authority sign pact to promote use of local currencies RBI cautions public about 'deepfake' video of governor being circulated on social media

RBI cautions public about 'deepfake' video of governor being circulated on social media RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank  Consumer inflation worsens to 6.21% in October from 5.49% in previous month

Consumer inflation worsens to 6.21% in October from 5.49% in previous month Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public

Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public