RBI Monetary Policy Announcements December 2021: How industry, experts reacted - Who said what

It kept the GDP growth projections unchanged at 9.5 per cent for the current fiscal and retained the inflation forecast of 5.3 per cent for the full year.

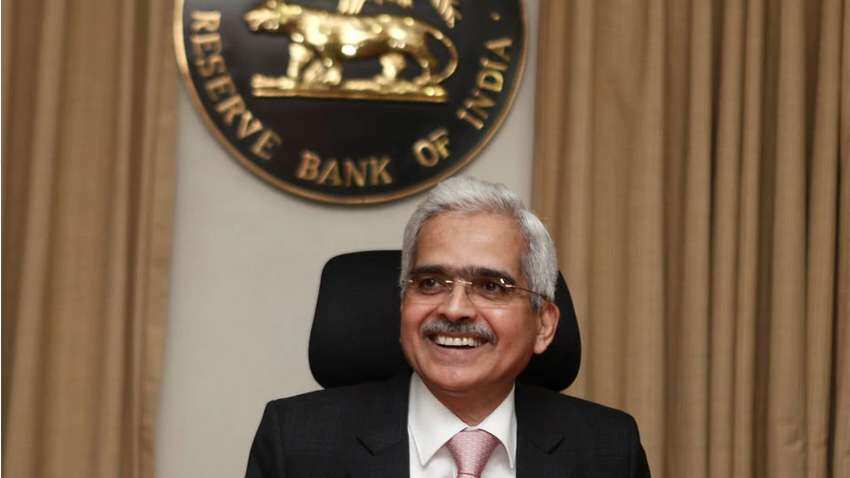

The Reserve Bank of India (RBI) on Wednesday kept borrowing costs at a record-low for the ninth consecutive time as it decided to continue supporting economic growth amid uncertainty over the impact of the Omicron strain of the coronavirus on the economy.

The six-member Monetary Policy Committee (MPC), which has paused rate changes since August last year, unanimously decided to keep the benchmark repurchase rate at 4 per cent and voted 5-1 to retain its accommodative policy stance as long as is necessary, reflecting a continued bias to support economic growth given that inflation was not a big worry. The reverse repo rate -- the level at which it absorbs excess cash from lenders -- was kept unchanged at 3.35 per cent.

It kept the GDP growth projections unchanged at 9.5 per cent for the current fiscal and retained the inflation forecast of 5.3 per cent for the full year.

How is how industry, experts reacted - Who said what:-

Madhavi Arora, Lead Economist, Emkay Global Financial Services.

"The MPC expectedly kept the key rates unchanged unanimously and reiterated its accommodative stance both on rates and liquidity. However, Prof Jayanth Varma’s possible dissent on continuation of accommodative stance for foreseeable future continues to keep MPC in split state. There were no material changes in growth and inflation outlook in near term. The focus was on communication on liquidity management key amid evolving market risks. As expected, the RBI did not opt for a reverse repo hike, and the policy is well used as a lever to prepare markets for a gradualist approach toward normalization through both communication and action. Liquidity repricing focus: The RBI reaffirmed longer tenor VRRRs as the preferred tools toward normalization amid current bumper liquidity surplus, especially as the redistribution/re-pricing of existing liquidity via VRRR tenor/quantum/cut-offs has smoothly helped the alignment of some money market rates toward the Repo rate. Missed opportunity on SDF: The overnight liquidity management CY22 onwards will happen through the auction route, making fixed overnight reverse repo irrelevant and thus making the Reverse repo floating. While this is welcome as far as liquidity repricing is concerned, we believe that SDF as a policy tool at the margin could have tried in this policy. The quantum of 14-day VRRRs for December calendar has been increased – going to Rs 7.5tn by end-Dec’21, while the governor stated higher tenor of 28-day or quantum would be used as per the need of the system. RBI to opt for gradual transition: In all, RBI will likely tread cautiously on market preparation. We do not rule out introduction of SDF as a tool at lower bound next year as Reverse repo becomes floating. In our view, the introduction of uncollateralized SDF could significantly enhance the central bank's sterilization capacity, especially as the liquidity deluge dilemma will continue in the coming months as well. The journey from current Rs8.5tn+ system liquidity to a pre-Covid Rs2tn+ will be a long-drawn one, which could push RBI to explore new tools to manage durable liquidity/any idiosyncrasies amid collateral constraints under VRRRs."

Rajiv Sabharwal, MD & CEO, Tata Capital Ltd

RBI maintains rate status quo and continues with the accommodative policy stance. The economy has gained growth momentum over the last 6 months, however RBI will want to further nurture a broad based recovery and will also aim at sustainability of the same.

There is no upward change in the reverse repo rate as contrary to market anticipations. Also, at this juncture, RBI remains guarded against any adverse impact that may arise on account of the new Omicron Covid-19 variant.

Although inflation remains a concern, moderation of crude prices and the recent cut in excise duty will work in favour for the inflation trajectory. Also, Inflation is expected to be within the comfort corridor of the RBI.

Over the last 2 months, RBI has been using various tools that has helped absorb excess liquidity from the system. The market has taken cue of this passive approach adopted by the RBI to normalize liquidity and we have seen rates move up across the yield curve. Further, RBI has once again assured the markets that adequate systemic liquidity will be maintained to achieve growth and stability.

Divakar Vijayasarathy, Founder & Managing Partner, DVS Advisors LLP

"The holding of rates by the MPC is on the expected lines but the statement by RBI Governor that growth is the priority indicates that RBI might continue to hold the rates even in the next review and beyond. The impact of new variant is a concern which would closely be followed and the inflation being within the range also facilitates being accommodative. Further, RBI expects inflation to peak in Q4 but ease thereafter. This observation also indicates that the RBI may not give a knee jerk reaction to increase in inflation and would continue to be accommodative. The growth projections for FY 22 was retained at 9.5% but with minor revisions for Q3 & Q4 numbers. It was also confirmed by MPC that excess liquidity would also be tackled in a nonabrasive manner. This also is expected to ease inflationary pressures."

YS Chakravarti, MD & CEO, Shriram City Union Finance Ltd

“RBI keeping interest rates unchanged is supportive of growth. While green shoots are beginning to show, private consumption continues to be below the pre-COVID levels. MSMEs have started stabilizing, and we expect MSMEs to bounce back in 2022. Spending will pick up at the middle and lower-income groups as COVID impact fades, and fuel tax cuts will likely aid purchasing power. Two-wheeler demand in rural India has been lagging and should gain momentum in 2022. Omicron poses a risk, if widespread lockdowns return, the outlook will alter substantially.”

Ram Raheja, Director at S Raheja Realty

“The decision to maintain the same repo rate and reverse repo rate by the RBI is in line with expectations which will act as a catalyst for economic growth. The MPC meeting took place at a time when the country is coping with high inflation, despite the fact that the rate has declined from its peak in June 2021, when it was above 6%. However, the economy grew at a record pace of 20.1 per cent in the April-June quarter compared to the same period last year, when a nationwide lockdown caused by the Covid-19 outbreak had halted almost all economic operations. The pandemic and lockdown was a silver lining for the real estate sector given it is a safe-haven and tangible asset at the time of crisis. This led to increased investment and home-buying in the last two years. A low home loan interest rate regime has been greatly instrumental in further stimulating India’s real estate sector, especially during the festive season. The sentiment for the real estate sector therefore remains positive and the same is also reflected in the S&P BSE realty index as it continues upward movement.”

Aman Sharma, Director, Spaze Group

"In the recent RBI MPC announcement, repo rates have been kept unchanged. However, the real GDP growth has been retained at 9.5% in 2021-22 with 6.6% in Q3, & 6% in Q4.In the previous MPC announcements, the apex bank has done everything possible to keep the inflation rates reined in, and economy did pick up pace even post the second wave. However, certain degree of challenges might be renewed with new variant in the picture and measures for mitigation had to be well-balanced out, thus unchanged repo rate comes across much on the expected lines and will be favorable towards the growth of real estate sector."

Deepak Kapoor, Director, Gulshan Group

"In the recent RBI bi-monthly meeting, MPC voted unanimously to keep repo rate unchanged at 4% while the vote to keep the reverse repo rate at 3.35% was taken by a majority of 5:1. We are all aware that the Indian economy has hauled itself from a deep economic crisis, and is still looking to attain a strong foundation. This will be possible only when authorities like apex bank continue with their support. Real estate being one of the directly affected sectors due to repo rate decision will thereby continue to witness sales as the New Year comes near, and extended festive offers coupled with low home loan interest rates continue to be strong attracting proposition for the end-users."

Navdeep Sardana, Chairman & Managing Director, Elite Landbase

"Since May 2020, the RBI has kept the repo rate unchanged, which is understandable. A tightened fiscal policy is counterintuitive in a time when the emphasis is on growth and spending. However, it is also a time, when a shift is needed from a number-centric fiscal approach to a more holistic and sector-specific policy roadmap. In real estate, there is a pressing need for tailormade subsidies and discounts to help the sector recover fast. We have seen how stamp duty reduction has boosted housing sales in the past and similar measures can be icing on the cake. Likewise, credit subsidies to developers and reviewing of GST on raw materials can also be highly helpful and optimize the overall housing supply chain."

Nayan Raheja, Raheja Developers

"The RBI has maintained a low repo rate, which would be helpful for the real estate sector. We have to understand that real estate does not work alone but depends on the growth of all other sectors/industries. The accommodative stance that RBI has taken will boost the economic environment and lead to a conducive situation for the real estate sector too. Looking at the increased demand for real estate, we urge the state governments to reduce stamp duty to be a gift to the homebuyers."

Uddhav Poddar, MD, Bhumika Group

"While the MPC expectedly maintained status quo on the policy rates, we would have hoped for a reduction in rates to uplift the sentiment, especially when customers have started regaining their faith back and have began treading towards making high-end purchases. Lower EMIs play a critical role in order to rekindle demand, and make real estate assets more appealing. RBI has also enhanced the transaction limit to Rs 5 lakh from Rs 2 lakh for UPI payments for RBI's Retail Direct scheme, which will be giving a significant boost to the particular segment."

Amit Modi, Director, ABA Corp, President (elect), CREDAI Western UP

"The repo rate being unchanged consistently for the ninth time, it is time that RBI and the governing agencies should come up with concentrated policies to help developers secure easy credits. Stuck amid the conundrum of the credit crisis and inventory overhang, many developers are subjected to the challenges. We hope the authorities should come up with novel financing policies coupled with timebound subsidies and discounts to help the developer community."

LN Jha, Director, SKA Group

"As the inflation is pegged at 5% (within the safe zone of 2-6%), RBI’s decision to keep the repo rate unchanged at 4% was very much on the expected lines. Simultaneously, the sustenance of accommodative stance also bodes well for the emergence of a strong economy, out of the sustained revival path. With new variant being found, these are crucial times which require high degree of monetary and fiscal support and RBI is dealing rightly with it. This decision will have a long-lasting impact in ensuring consistent growth to the entire real estate sector and its ancillaries".

Ashwinder R Singh, CEO Residential, Bhartiya Urban

"RBI by keeping rates unchanged with Repo at 4% and Reverse Repo at 3.35%, continues with its

Accomodative stance despite rising inflation. This will ensure healthy residential real estate sales to sustain with soft home loan rate regime continuing in the near future."

Rajat Goel, Joint Managing Director, MRG World

"The RBI repo rate announcement has been much on the expected lines, with new variant fear looming the market and the prospects of economic activity steadily improving; the support from government and its agencies was indeed needed. The continuing low home loan interest rate regime will bode well for the real estate sector and has been acting as a constant encouragement to push fence sitters closer towards home buying decisions."

Dhruv Agarwala, Group CEO, Housing.com, Makaan.com and Proptiger.com

"The decision of the RBI MPC to keep key policy rates unchanged is along expected lines. The ongoing growth-inflation trade off also requires the banking regulator to tread a careful path. Even though economic indicators are reflecting a positive trend, interest rates needed to be kept at the current level in order to continue to drive growth and boost demand in the real estate sector, a key contributor to economic growth in India. If home sales have shown consistent improvement over the past couple of quarters, much of this can be attributed to the record low interest rate regime. Upsetting the current momentum would have been highly detrimental to the overall economic recovery".

Ankit Kansal , Founder & MD, 360 Realtors

"RBI has maintained the status quo on Repo rates, as expected. Already, SENSEX and NIFTY are rallying ahead indicating positive sentiments. An unchanged repo rate, amidst most of the macro-economic factors remaining in the safe zone, will continue to foster economic recovery. RBI has also estimated an FY 22 GDP growth of 9.5%, which will further drive positive sentiments.However, the regulatory agency could have thought of reducing the repo rates by 25 basis points this time to further accelerate liquidity in the market. Increased liquidity and spending will help corporates, businesses, and SMBs in India, thereby spurring growth. Moreover, as the inflation is pegged at 5% (within the safe zone of 2-6%), RBI can think of slashing the repo rates. This will also help to mitigate any potential risk coming out of the Omicron variant."

Puneet Pal, Head-Fixed Income, PGIM India Mutual Fund on RBI Monetary Policy

"MPC remains Dovish with RBI Focus shifting to Liquidity management. The MPC meeting held today refrained from hiking the reverse repo rate, as we and a large section of the market had expected. Though MPC did not hike the reverse repo rate, RBI increased the amount of 14 day VRRR to INR 7.50 trn from Dec 31 2021, and also mentioned that “Liquidity Absorption will be undertaken mainly through the Auction route from January 2022 onwards”

This, in our view, means that the majority of the excess liquidity will be absorbed in VRRR Auctions near the policy repo rate at 4% and we continue to expect that the short term money market rates will inch higher.

We continue to advice investors to remain invested in short duration products like Banking PSU Funds and the Corporate Bond category for investment Horizon of 1-3 yrs and Ultra Short and Money Market funds for investment horizon of less than 1 year."

Rohit Poddar, Managing Director, Poddar Housing and Development Ltd

“The RBI’s decision to maintain the repo rate unchanged at 4%, point towards the road to economic recovery. An overall economic activity progressing towards retained inflation is a good news and showcases that the overall economic activity in the country has evolved. While the rise in commodity prices has put upward pressure on input material costs, economy's low-interest rate has been a major contributor to the housing sector's recovery. When the real estate industry was just getting back on its feet, it was slammed by the new variant. The new COVID variant Omicron has again pushed the global and Indian economy into a state of uncertainty and nervousness. In order to encourage consumption and investment in the real estate sector, consistent demand stimulant measures and favorable financing conditions would be required. Compare to last year, we are in a much better place owing to the proactive measures taken by the government which is resulting into achieving stability in the economic fundamentals of the country.”

Dhaval Ajmera, Director of Ajmera Realty & Infra India Ltd

“RBI’s announcement to continue with its accommodative stance is a welcome move to support recovery and safeguard economic fundamentals against the risks rising from any exponential outbreak of omicron variant. RBI maintaining status quo on rates augurs well for brining equilibrium in the demand-supply economics of the real estate industry. With low loan interest rate regime, the home sales velocity witnessed across key Indian cities will continue on upward trajectory. The stock markets are expected to remain buoyant and realty index will continue to advance with positive bias in the short to medium term. The revision of GDP and inflation targets are seen to be milder than expectation. The upcoming discussion paper to make the digital payments more affordable is a positive take-away from Governor’s speech. The announcements related to digital payments can offer disruption and bring dynamism in financial inclusivity expedition in the country”.

Shishir Baijal, Chairman & Managing Director, Knight Frank India.

“We welcome the decision of the MPC on maintaining status quo on the key policy rates as well as continuing its accommodative stance that has so far helped the Indian economy to beat the gloomy shadows of COVID – 19. Most high frequency indicators have bounced back to pre-COVID levels; however, some slack in the economy remains. The low interest regime and adequate liquidity into the system is critical to further strengthen the domestic market. Even while RBI has announced measures to further mop up excess liquidity, it has also convinced that adequate liquidity will be maintained as required. We hope, the monetary policy announced today will help maintain the economic growth momentum even in the wake of the new variant Omicron.

The low interest rate regime has been instrumental in reviving the real estate sector in the last 6 quarters through their systematic approach. RBI’s efforts, along with other demand stimulant measures, have helped revive demand that had been languishing for close to 7 years prior to 2020. The continuance of the accommodative stance will help further the cause for the sector.”

Ashish Sarangi, RIA and CSO of Pickright Technologies, Smart Investment Platform

"The much-awaited RBI Monetary policy is out and we welcome this move by MPC on maintaining the interest rate flat. This will further boost the auto sector mainly targeting 4 wheelers and CVS. This is currently the hot market as we are seeing many innovations and new players entering the space.

Let’s see how this will play out in different sectors, Housing sector which is currently reeling under mild depression will see a boost as investors will take advantage of low-interest rates and start investing. So, we see an upward move in the stocks of the housing sector in the near long term

We have already seen indicators on how the market reacted to the policy and there is already a buoyant of the needle going north. Blue-chip indices are trading with gains. We strongly feel that this quarter and next coming quarter will be very much positive in auto, Bluechip, Housing sectors and there will be continuous growth. Investors can remain cautiously positive and look forward to economic revival and come out of omicron’s fear."

Sonam Srivastava, Founder at Wright Research, SEBI RIA

"In line with the market expectations, the RBI has kept an accommodative stance on growth by not changing the repo rate and reverse repo rate. The RBI governor also gave a commentary that supported recovery and stood cautious on inflation expectations. While in line with other global markets that have started reducing liquidity to fight inflation, RBI could have increased the reverse repo rate as some economists expected. The RBI has kept a focus on keeping growths up with the new omicron virus being a threat and also been optimistic on inflation expectations as the crude prices have eased up and seasonal correction of prices is expected. The governor also said that the RBI would keep the proactive measures of liquidity absorption open as it has been doing through the VRRR auction and introduce a prepayment option for banks, which is again very prudent from the inflation control point of view.

The markets will meet this policy with a cheer as it is very accommodating to growth, and the country’s inflation expectation analysis remains very positive.

This is in line with the expectations of the markets and thus, positive sentiment is likely to bolster growth in sectors such as banking, real-estate, export/imports and manufacturing. The stock prices of companies in these domains are likely to see a rise in price. It is indeed a great time for investors to be invested in the market."

Abhay Agarwal, Founder, Piper Serica, SEBI Regd. PMS

"RBI has maintained its policy of ‘first do no harm’, kept its stance accommodative and kept its liquidity management options open. This policy stance has been clearly communicated by RBI and should be lauded. It has largely maintained the near-term GDP growth rate and inflation estimates with some minor changes. With a fall in crude prices, the worry about a sharp spike in core inflation has abated. This has allowed RBI to not only maintain the repo rate but also the reverse repo rate. There was a worry that RBI will sharply normalize the reverse repo rate to 3.75% over next 2-3 months. This worry has reduced now.

Clearly, RBIs focus is on making sure that the nascent post-Covid recovery is resilient and not just short-lived. So, it is quite sensibly pursuing flexible inflation targeting to ensure a ‘soft-landing’ rather that a hard one. At the same time, it has started to suck out excess liquidity that was infused in the system after the first wave and has kept the options open to do one-time OMOs and operation twists.

Overall, we expect that stock markets will be relieved that there are no negative surprises, and the stance stays accommodative. The recent fragile recovery in consumer discretionary space like real estate and automobiles is expected to continue as there is greater certainty on borrowing costs and EMIs that drive consumer decisions. The short-term funds are expected to yield slightly higher returns now. The fixed-income investors should continue to stay in the shorter duration funds as the long-term funds may see a price erosion in case of an increase in long-term GSec rates."

Jyoti Prakash Gadia, Managing Director, Resurgent India Limited

"Reposing faith in the visible growth impulses and control on projected inflation, a status quo on the policy rates has been maintained by RBI on expected lines.

Simultaneously, the continuation of accommodative stance also bodes well for the emergence of a vibrant economy, out of the sustained revival path. This will, however, require the additional capital expenditure in the desired sectors, besides the steps already initiated on boosting demand and removing supply-side constraints.

On the liquidity front also, RBI has indicated a calibrated approach, with an additional amount of Rs 1.50lac crore for 14 days VRRR, and allowing prepayment of TLTRO aiming at a rebalancing of liquidity in a phased manner. Overall a hand holding policy for growth with a hawkish eye on inflation."

Sandeep Bagla CEO TRUST Mutual Fund

"RBI Policy more dovish than expected. Focus is clearly on supporting growth. Fears over inflation flare up, global changes in interest rate policy, and high commodity prices are ignored. Policy appears to be falling behind the curve Good for short end bonds and mutual fund schemes like short term bond funds and roll down funds with current maturity lower than 3 years".

Honeyy Katiyal, Founder-Investors Clinic

"The repo rate is being unchanged as I believe it is important to maintain the monetary accommodation at this point of time. It is an important step to enable the economic recovery to remain sustained. With the second wave of Covid 19, the economic recovery looks uneven again and the speed of improvement might slow down after the sharp rebound from the lows. The rising cases of Covid across the country is again posing a challenge to the economy and the sectors all across. The continued repo rate accommodation is a good step."

Shiv Parekh, Founder of hBits

"This year the RBI kept the repo rate unchanged, it's the ninth consecutive time that there is no change within the Repo rate. This decision has been taken by the government for economic stability and in some terms it will help the realty sector. It's likely that the RBI will hold on to the present regime in reaction to the flare-up of new variant of covid, Omicron which is a growing concern at the time of generalised economic recovery. While we may infer from experience that every subsequent Covid variant has had an less severe impact on economic activity, there is no guarantee on Covid till the wave actually hits. On the expa

Amar Ambani, Senior President & Head of Institutional Equities, YES Securities

“Though a status quo on the repo rate was in line with the market expectations, no move on the reverse repo was not what the money markets were pricing in. Yields in the money markets have been firming up, given that variable reverse repo auctions are being conducted at rates proximal to 4%. The status quo on the reverse repo is construed to be dovish. The central bank justified the status quo given the emerging uncertainty over the new COVID variant and lagging private investments. RBI is sticking with a tailored policy stance that balances growth and inflation. Meanwhile, RBI will continue to absorb excess liquidity in a non-disruptive manner, primarily through variable reverse repo auctions. On the demand side, RBI reckons frequency indicators portends traction in consumption, though it needs to sustain and needs policy support. Govt spending will provide support to aggregate demand. On projections, FY22 GDP growth is retained at 9.5%, while Headline CPI inflation is seen peaking in Q4 FY22 and then softening thereafter. CPI average of 5.3% is seen for FY22, falling to 5% in Q1 and Q2 FY23.

On the interest rate trajectory, we see that RBI has simply kicked the can down the road in terms of normalizing the LAF window. It seems that RBI is content with the fact that VRRR auctions have been efficacious in absorbing excess liquidity and do not want to tinker much with the policy rates now given the nascent economic recovery and still looming uncertainty of the pandemic. We think the normalization of the LAF window is now subject to the durability of the economic recovery and mitigation of the pandemic uncertainty. Meanwhile, normalization of the repo rate is completely ruled out till most of the H1 FY23."

Manju Yagnik, Vice Chairperson, Nahar Group and Senior Vice President, NAREDCO

"With the RBI keeping the repo rate unchanged for the 9th consecutive time, homebuyers can still continue to enjoy the low-interest rates on their housing EMIs. The Apex Bank's continuous status quo is yet another opportunity for all those first-time buyers and fence-sitters eyeing for home considering safety and security with the ongoing pandemic. RBIs decision to keep Repo Rate unchanged since the onset of pandemic and now with Omicron threat looming large is aimed to aid homebuyers with the lowest interest rate regime and maintain adequate liquidity. The increased affordability due to unchanged Repo Rate, developer offers and schemes, festival benefits has worked in the favour of developers with the sector recording growth of 15 – 20% over the last few quarters. The new variant, as well as the continued lowest interest rates, are the two main triggers that will drive the sales for the next few quarters due to the increased interest of home buyers to own dream homes."

Sarvatra Technologies: Mandar Agashe, Founder, Vice-Chairman and MD

"This year interestingly, despite record purchase transactions during Diwali, cash in circulation did not increase, a rare occurrence since 2014 clearly indicating - digital payments have become the mode of choice for masses. Considering more than 50% of the transactions conducted on UPI are of value below Rs. 200, low value transactions, there is significant utilisation of system capacity and resources, leading to customer inconvenience owing to connectivity issues and transaction failures. Therefore enabling small value transactions through an ‘On-device’ wallet in UPI app will not disturb the banking system every time a transaction is conducted, which will help conserve banks’ system resources. Additionally facilitating UPI-based digital payment solutions on feature phones will promote wider digitisation offering a quantum leap in driving small value transactions especially in the tier II, III markets. Today UPI is the single largest retail payment system in the country and has risen by almost 70 times in the last 4 years growing into an institution itself. Therefore as the industry has matured the current move of upscaling the transaction limit for payments from 2 lakh to 5 lakh will help encourage retail investors to comfortably indulge in high-value transactions such as Retail Direct Scheme and IPO applications. Additionally, the paper seeking feedback on issues related to charges applicable on digital payments will further drive collaboration among stakeholders to resolve challenges and take timely measures to make digital transactions affordable to end users and economically remunerative for service providers."

PayNearby: Anand Kumar Bajaj, Founder, MD and CEO

"The pandemic boosted the need for contactless payments and led to the increased adoption of UPI as the preferred digital mode of payment, even at the last mile. Today, UPI has become the single-largest retail payment system in the country in terms of volume of transactions, signifying its wide acceptance, particularly for small-ticket transactions. The recent announcement to enhance the transaction limit for payments through UPI from Rs 2 lakh to Rs 5 lakh will fuel the use of UPI by retail investors. This move will further deepen the reach of digital payments in the country and make them more inclusive, catapulting us towards a less-cash economy. In addition, the idea to launch UPI-based payment products for feature phone users will offer ease of transactions for consumers, facilitate greater participation of retail customers across various segments, and enhance the capacity of service providers."

Dilip Modi, Founder, Spice Money.

"The proposed launch of UPI-based payment products for feature phones is a significant step towards a more inclusive digital payments infrastructure in India. Over the past couple of years, UPI has crossed several milestones in India as its popularity has increased exponentially among smartphone users. However, a large portion of mobile users in rural India still use feature phones. Combined with a lack of internet connectivity and digital literacy, this has resulted in rural India making a limited contribution towards the advent of UPI in the country. This proposed move by the RBI will enable those with feature phones and poor or no internet connectivity to easily conduct transactions.

UPI has found widespread adoption in India due to its simplicity and convenience. This was further accelerated post the outbreak of the pandemic. It’s vast success has also caught the attention of several global policy makers. So, UPI’s availability on feature phones will only further expand its reach to the deeper corners of Bharat, strengthening India’s position as a leader in building inclusive payments infrastructure. We, at Spice Money, have been working towards digitising the largely cash-driven rural economy and have witnessed the appetite for seamless digital financial services in rural India. We’ve also noticed the high frequency of small value transactions. I believe the implementation of UPI on feature phones and the introduction of on-device wallets will tap into this demand and make the Indian digital payments infrastructure more robust."

George Alexander Muthoot, Managing Director at Muthoot Finance

“We welcome RBI's decision to continue with accommodative stance as long as necessary and maintain status quo on rates, the RBI also remains committed to broaden growth impulses and preserve financial stability. I concur with RBI’s stance that while the recovery impacted by the pandemic is gaining traction, Private consumption is still below pre-Covid levels, private investment is still lagging and hence the nascent growth still needs policy support. The RBI also continues to rebalance liquidity conditions in a non-disruptive manner. While the challenges interms of managing growth-inflation dynamics, uncertainty with regards to Omicron continue, we are hopeful that the continued policy support will bode well for sectors like MSME, Agriculture and housing. We are also hopeful that pick up in Government spending and pent up demand will ensure that the market sentiment remains positive and demand revival continues to pick up pace thereby supporting demand for gold loans.”

Umesh Revankar, Vice Chairman & MD, Shriram Transport Finance

“The RBI on expected lines kept the key rates unchanged for the ninth consecutive time and retained accommodative stance as long as necessary. While rebalancing liquidity conditions in a non-disruptive manner, the Governor reiterated commitment to support the nascent economic recovery and preserve financial stability. The Governor once again retained FY22 GDP growth forecast at 9.5% and stated that while the recovery is gaining traction, it is not strong enough and private investments are still lagging. Amidst the challenges with respect to inflationary pressure, global supply chain bottlenecks, high commodity prices, uncertainty caused due to Omicron, the RBI’s motto is to ensure a soft landing that is well timed. While we need to be cognisant about sticky core inflation, continued benign interest rates will be positive to support broader economy particularly SMEs, small businesses and unorganised sector. As we look forward to 2022, the business activities have resumed pan-India, Government spending is picking up, we are hopeful that this will give fillip to urban demand conditions thereby supporting vehicle finance industry.”

Ankit Bhatnagar, Head of Product, Mswipe

“UPI is one of the most popular digital payments method in India. In November 2021 alone, 4.1 billion transactions worth ₹6.68 lakh crore were carried out by UPI. At Mswipe, we witnessed this trend too with our merchants seeing an uptick in UPI transactions. Mswipe merchants clocked transactions worth INR 810 crore in September 2021, a significant increase over the year from INR 132 crore in October 2020. RBI’s proposal of introducing UPI-based payment products for feature phones will further boost the acceptance of digital payments and also boost financial inclusion. This will not only benefit users in terms of flexibility and convenience but also ensure to bring more small merchants into the digital economy while also strengthening the payments infrastructure of the country. Additionally, RBI’s decision on forming a panel to study digital payments charges will mitigate the concerns of customers over the reasonability of various charges incurred by them and will bring in more transparency and regulation in the system as a whole.”

Ramani Sastri - Chairman & MD, Sterling Developers Pvt. Ltd.

"The RBI’s decision on keeping the repo rate unchanged will certainly bode well for all interest-sensitive sectors ahead of the New Year when the economy is on its road to recovery. For home buyers, this decision will help reinstate confidence and further access to affordable home loans and help foster housing demand. It has also helped the sector to regain its strength as well as stay afloat during these unprecedented times. The homebuyers should take advantage of the current situation because there are chances that the prices might go upwards later on account of reducing supply and the pressure of increased costs of raw materials. There has been a fundamental change in buyers’ expectations and attitude towards homeownership, which has already resulted in the residential real estate sector perform exceedingly well across all segments in the post Covid era. We are also seeing a lot of first-time home buyers, who were not able to reach a decision earlier are eager to conclude the deal now. Real estate is definitely an asset class that one must remain invested in today and in the long term and looking ahead, we do believe that markets will see sustained growth. With economic recovery on a positive note, growth needs to be carefully nurtured. This can be done by giving a fillip to the economy by incentivizing real estate. With improved GDP growth estimated in the near future, we expect that the real estate sector will contribute a substantial share to overall economic development."

Yesha Shah, Head of Equity Research, Samco Group

The RBI maintained status quo and remained accommodative, in line with expectations, given the gloominess around Omicron and uneven recovery between unorganized and organized India. As “Growth” remains the linchpin of the policy and inflation concerns seems to be comparatively mellow, the policy seems reassuring to an extent. However, the decision may be influenced by the Fed stance as the MPC ensures not to “rock the boat.” There are some central banks across the globe who have already stepped up and pulled the plug on liquidity. RBI seems to be a backbencher on this front with no clarity on when the rate hikes might start. Other policy announcements in terms of liquidity management and progressively increasing VRRR are all moves in the right direction but at the end of the day is it enough only time will tell.

Rajee R, Chief Ratings Officer, Brickwork Ratings:

"RBI has retained rates and maintained its accommodative stance, which is a welcome move to support growth oriented to domestic circumstances and augurs well for interest-sensitive sectors. In view of the evolving economic scenario and uncertainties associated with the scale of recovery especially in view of the possible economic impact due to the Omicron variant and concerns on the supply side challenges to meet the catchup demand, RBI has reiterated its policy support to broaden growth impulses and encourage credit flow to productive sectors. Continuing with its calibrated liquidity management policy to maintain financial stability, RBI emphasized that VRRR would be the main tool for liquidity adjustment indicating gradual policy normalization on the liquidity front. While stating that headline inflation will peak in Q4 of this fiscal year, RBI maintained its inflation projections at 5.30% for FY22 and a dovish forecast at around 5% thereafter. The decision to allow banks to infuse capital in their overseas branches and subsidiaries and repatriate profits without seeking prior approval of RBI will provide much needed operational and financial flexibility to the banks. Announcement of discussion papers on charges on digital payments in India and on prudential norms for investment portfolio of banks are positive steps."

Dr Samantak Das, Chief Economist and Head of Research & REIS (India), JLL

"The unexpected global headwinds propelled by the new Covid-19 variant to the economic recovery prompted Reserve Bank of India to maintain the policy rates. RBI has kept the policy rate unchanged for the ninth time as it has been trying to support growth and rein inflation. Indian economy grew better than expected by posting 8.4% growth during Q2 FY22 indicating the strength of the economy. The accommodative stance and gradual normalisation measures also signal that economy is on the firm path of growth. Indian economy has demonstrated its resilience to uncertainty in the past and it is expected deal with it more prudently in future."

"The growth registered by the real estate sector in Q3 2021 is likely to continue and to end this year on a positive note. In Q3 2021, residential sales witnessed an upward trajectory, increasing by 65% on a sequential basis. This sector is expected to benefit from a regime of low mortgage rate, coupled with duty waivers, realistic property pricing and attractive offers leading to affordable synergy."

Pritam Chivukula, Co-Founder & Director, Tridhaatu Realty and Hon. Secretary, CREDAI MCHI

"We welcome the RBI's decision to continue with their accommodative stance keeping in mind the economic uncertainty due to the new COVID-19 variant Omicron. The low interest rates have been a crucial factor in the revival of the demand in the real estate sector. The sector saw a good festive season on the back of rock-bottom interest rates on home loans along with festive offers from good developers. The buyers are already coming back to the market and we feel that this might be the last opportunity for the homebuyers to purchase property with low interest rates before RBI decides to hike it in their next policy announcement. Also, to keep the prices down on the account of rise in raw materials prices will be a huge challenge in front of the developers."

Shraddha Kedia-Agarwal, Director, Transcon Developers

"RBI maintaining status quo on key policy rates was expected given the inflationary concerns in recent months. The decision will help to sustain liquidity for some period amid the rising fear due to the new Omicron variant of Covid-19. The low interest rates for the last few months has already given a boost to the real estate sector upticking the demand in the last few quarters and enhancing the confidence of the homebuyers. The decision will also help in sustaining economic stability as well as keep the real estate sector stay afloat during these unprecedented times."

Kaushal Agarwal - Chairman, The Guardians Real Estate Advisory

"The RBI and the MPC's decision to maintain an accommodative stance amid global scare due to new coronavirus variant Omicron was very much expected. Their approach towards tackling the situation created by the pandemic and steps taken to help revive the economy will go down in history as being one of the finest. The various policy reforms along with the all-time low housing loan rates have given the much-required fillip to sales activity in the last few quarters. The all-time low rates regime has boosted the housing demand and helped the economy to get back to the pre-COVID levels."

Bhushan Nemlekar, Director, Sumit Woods Limited

"The RBI's decision to maintain its accommodative stance was on the expected lines in light of the rising cases due to the Covid-19 new variant Omicron and its potential to cause the on-going economic recovery to stumble. The prevailing low home loan rates are already enticing for homebuyers which has immensely benefited the real estate sector. The Government will continue taking affirmative measures as long as it is necessary to revive the economy and alleviate the Covid-19 impact."

Lindsay Bernard Rodrigues, CEO & Co-Founder, The Bennet and Bernard Company

"We welcome RBI's status quo on policy rates. Economic growth needs to be supported through monetary policy and this is the foremost reason that the RBI has continued its accommodative stance which has invoked a sense of optimism. With the positive growth of the economy over the last few months, the RBI leaving the repo rate unchanged means home buyers would continue to reap the benefits of a record low interest rate regime. Keeping in mind the current scenario, a reduction in the key rates would have been widely celebrated as low interest rates have been a crucial factor in the revival of demand in the real estate sector. For any investor, it’s a time of great opportunity and for the end-customer. it’s a good time to buy. People are looking for own homes and are purchasing second homes in the context of the pandemic as they would have a secure and safe home and would also be a good alternative to their primary abode. The green shoots of economic revival coupled with the prevailing low interest rates will be conducive for the residential sector in the short to mid-term. Overall, we hope that the government continues to take measures that will strengthen the real estate sector and affirm robust infrastructure growth."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Hybrid Mutual Funds: Rs 50,000 one-time investment in 3 schemes has grown to at least Rs 1.54 lakh in 5 years; see list

Rs 5,000 SIP for 40 years vs Rs 50,000 SIP for 20 years: Which can create higher corpus? See calculations to know it

PPF For Regular Income: How you can get Rs 78,000 a month tax-free income through Public Provident Fund investment?

11:49 AM IST

Indian economy is recovering from slowdown witnessed in July-September quarter: RBI

Indian economy is recovering from slowdown witnessed in July-September quarter: RBI RBI: After another status quo year, all eyes on a growth-propping rate cut with new Guv at helm By Ashish Agashe

RBI: After another status quo year, all eyes on a growth-propping rate cut with new Guv at helm By Ashish Agashe Electricity distribution companies continue to remain a burden on state finances: RBI

Electricity distribution companies continue to remain a burden on state finances: RBI RBI imposes penalties on IndusInd Bank and Manappuram Finance for non-compliance of certain norms

RBI imposes penalties on IndusInd Bank and Manappuram Finance for non-compliance of certain norms Forex reserves drop $2 billion to $652.86 billion

Forex reserves drop $2 billion to $652.86 billion