RBI allows fresh moratorium for some small borrowers amid COVID-19 crisis

The Reserve Bank of India asked banks on Wednesday to let certain borrowers have more time to repay loans, among other support measures, amid a major second wave of COVID-19 infections in the country that has led to strict lockdowns in several states.

WATCH | Click on Zee Business Live TV Streaming Below:

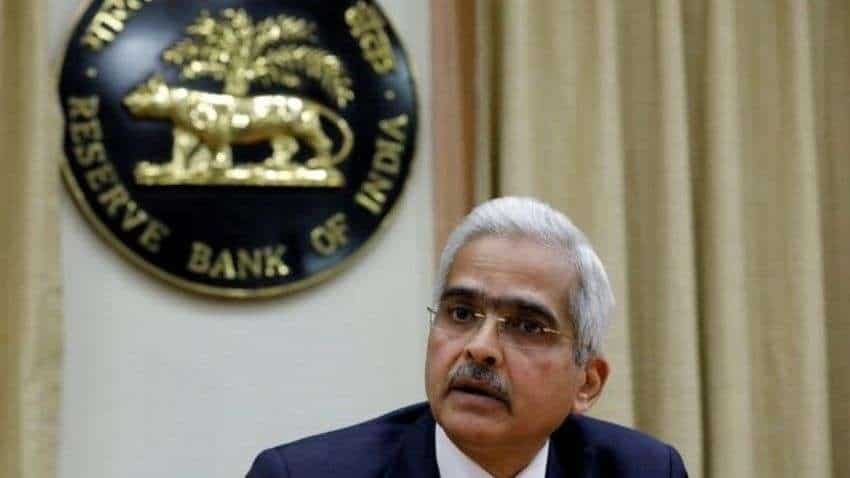

The moratorium will be available to individuals and small and medium enterprises that have not restructured their loans in 2020 and were classified as standard accounts till March 2021, RBI Governor Shaktikanta Das told reporters.

Also, the Reserve Bank of India Governor, Shaktikanta Das, in a speech at 10 AM on Wednesday said, "Indian economy was advantageously poised against other countries at the end of the last fiscal. The situation has done a U-turn and India is fighting against the 2nd wave of Covid-19. Restoring normalcy has become imperative. RBI will deploy all its resources in the services of the nation. The devastating speed of covid-19 pandemic spread has to be matched by relevant steps by the central bank."

RBI Governor announces Rs 50,000 cr priority lending by banks for hospitals, oxygen suppliers, vaccine importers, COVID-19 drugs by March 31, 2022.

In a relief that is welcome, Governor Shaktikanta Das said RBI has provided 2nd window to individual, small borrowers having up to Rs 25 cr loans for restructuring loans if not availed earlier.

RBI Governor also announced rationalisation of KYC compliance norms, provides for video-based KYC for certain categories.

Special long term repo operations for small finance banks to provide further support to micro, small & other unorganized sector entities, 3-yr repo operations of Rs. 10,000 crore at repo rate, for fresh lending up to Rs 10 lakh per borrower facility up to 31 Oct' 21, said RBI Governor.

In view of fresh challenges, Small Finance Banks are now permitted to regard fresh on-lending to MFIs with asset size up to Rs 500 crore, as priority sector lending, facility available up to 31 March, 2022, announced RBI Governor.

Given the positive response from the market, it has been decided that the second purchase of govt securities for an aggregate amount of Rs 35,000 crores under G-SAP 1.0 will be conducted on 20th May, said RBI Governor Shaktikanta Das.

(WITH INPUTS FROM REUTERS)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

11:05 AM IST

RBI, Maldives Monetary Authority sign pact to promote use of local currencies

RBI, Maldives Monetary Authority sign pact to promote use of local currencies RBI cautions public about 'deepfake' video of governor being circulated on social media

RBI cautions public about 'deepfake' video of governor being circulated on social media RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank  Consumer inflation worsens to 6.21% in October from 5.49% in previous month

Consumer inflation worsens to 6.21% in October from 5.49% in previous month Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public

Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public