One big reason why strong rally expected on TCS, Infosys, other IT stocks

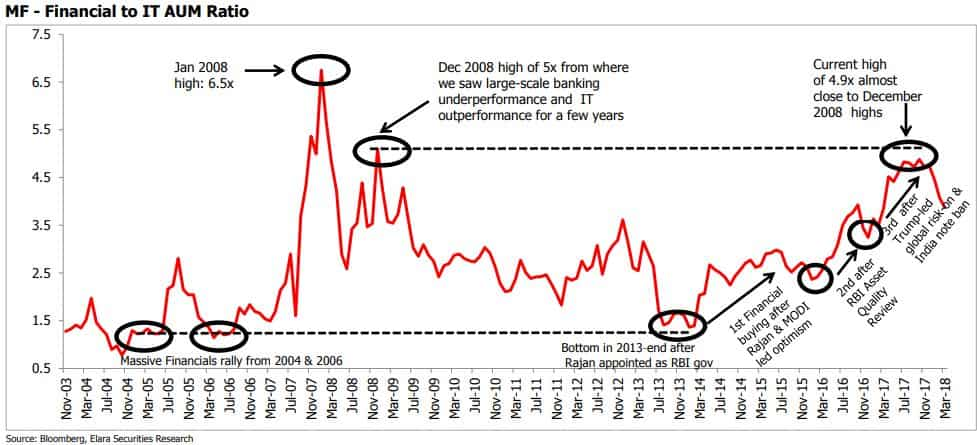

Elara Capital had highlighted in its March 2018 report that the risk of multi-decade heavy over-ownership by mutual funds (MF) into Financials, which was built at the cost of massive under-ownership in IT. MF allocation into IT had dropped to more than a decade’s lows in November 2017 from where initial reversal has begun.

Information Technology (IT) stocks, which remained a laggard for last two years, are back in favour with the Nifty IT index hitting a record high thanks to a strong surge in Tata Consultancy Services, Infosys, Cyient and MindTree post their March quarter 2018 results. If a latest report by Elara Capital is anything to go by, 'bigger and sustained upside' on IT stocks is still expected as the sector is massively under-owned by mutual fund institutions, which look all set to move holdings from heavily-owned Financials to IT sector as clouds of uncertainty loom over banking stocks, while tech firms hold potential to record promising growth going forward.

Elara Capital had highlighted in its March 2018 report that the risk of multi-decade heavy over-ownership by mutual funds (MF) into Financials, which was built at the cost of massive under-ownership in IT. MF allocation into IT had dropped to more than a decade’s lows in November 2017 from where initial reversal has begun. "In our view, the realignment process back from Financials into IT has just begun, and if history is anything to go by, it will pick up pace further," pointed out Elara Capital in a research note dated April 23, 2018.

Post 2014, MF Nifty allocation into Financials increased by 10 per cent, from 28 per cent to nearly 38 per cent, following four big events: RBI governor Raghuram Rajan appointment (2013), Prime Minister Narendra Modi's victory in 2014, the RBI Asset Quality Review (end-2015), and Demonetisation (end-2016) and US President Donald Trump-led global Risk-On (from January 2017). Allocation moved out of IT, with MF holding reducing by 11 per cent, from 22 per cent to 11 per cent.

Among index names, the largest allocation moved out from TCS, Reliance & ITC into ICICI Bank, SBI and HDFC Bank.

MF IT allocation into non-Nifty names has also dropped to the lowest range in two decades. "This is another sign of unfavoured & under-allocated sector among local funds portfolios. In the past, such lower readings have resulted in stronger upside move once the reversal began," noted Elara Capital.

The brokerage further noted that for the last three months, the realignment has already started back into IT, mostly from Financials. "There has begun a shift into IT & Consumer Goods from Financials, Auto & Metals. This is also an indication of RISK-OFF trends emerging in the market," it said.

Nifty IT index has outperformed the broader Nifty50 by a massive margin. On a year-to-date basis, the Nifty IT index gained 19 per cent. By comparison, Nifty50 added just 0.7 per cent. Largecap IT firm TCS on Monday became the first technology company to cross the $100 billion mark in terms of market capitalisation. The IT giant is the second only firm in India to acheive this milestone. Energy-to-telecom conglomerate Reliance Industries had already registered this fiat way back in 2007.

TCS share price slipped nearly 1 per cent in Tuesday's at Rs 3388.80, while RIL share price was trading 2 per cent higher at Rs 954.20 ahead of its Q4 FY18 results later this week on Friday.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

11:55 AM IST

TCS, Infosys, Mphasis fall up to 4%: Good time to buy IT stocks?

TCS, Infosys, Mphasis fall up to 4%: Good time to buy IT stocks? Are bulls anticipating a Trump win? IT stocks rally up to 5%

Are bulls anticipating a Trump win? IT stocks rally up to 5% Coforge shares jump 12% to hit new 52-week high after strong Q2 show

Coforge shares jump 12% to hit new 52-week high after strong Q2 show Tech Mahindra Q2 preview: PAT likely to climb 16% QoQ; margins may increase by 60 bps

Tech Mahindra Q2 preview: PAT likely to climb 16% QoQ; margins may increase by 60 bps  LTTS Q2 FY25 Results Preview: Net profit likely to rise 9% vs Q1, margin may expand by 80 bps

LTTS Q2 FY25 Results Preview: Net profit likely to rise 9% vs Q1, margin may expand by 80 bps