No inconsistency in data on taxpayers post demonetisation, CBDT clarifies

Clarification by the government regarding number of taxpayers added after demonetisation.

Key Highlights

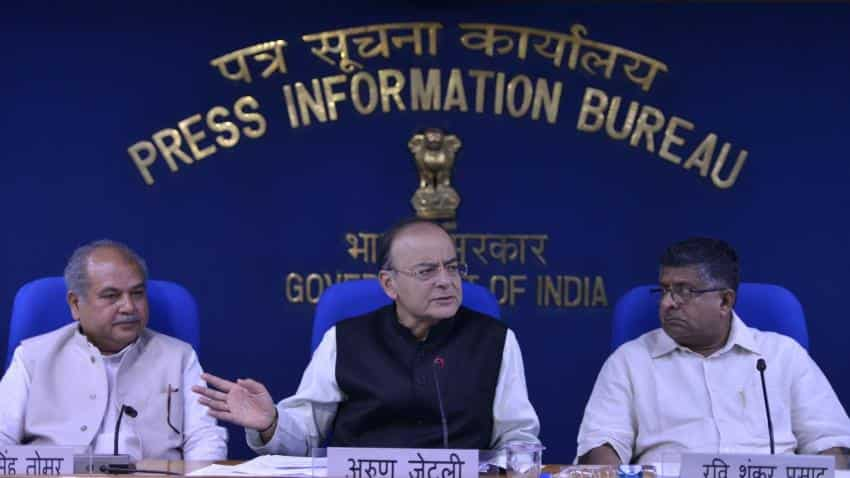

- CBDT along with Ministry of Finance sought to clarify the misconceptions over taxpayers in India post demonetisation.

- Taxpayer data by government officials were provided from different time periods, CBDT said.

- FM Jaitley said there were 91 lakh taxpayers post demonetisation.

Inconsistency in official data given by the government on number of taxpayers in the country post demonetisation were clarified by Ministry of Finance and Central Board of Direct Finance on Friday. The CBDT issued a statement clarifying that all data provided by the government were true and reflected amounts calculated for different time periods.

“There is no inconsistency in the data provided by the Government in the statements referred to above as these are in different contexts and for different time periods,” CBDT said.

The government was referring to the multiple reports on inconsistency by the government in announcing the number of taxpayers post demonetisation.

“The data maintained by the IT Department shows that during 1st April, 2017 to 5th August, 2017, 2.79 crore e-returns of Individual taxpayers were received as against 2.23 crore e-returns received during 1st April, 2016 to 5th August, 2016,” the report said.

This the report said adds up to the same figure spoken by Prime Minister Narendra Modi during his Independence Day speech.

“The Prime Minister’s speech referred to the increase in number of e-filed Personal Income Tax Returns (ITRs) filed from 1st April, 2017 to 5th August, 2017 over the ITRs filed in corresponding period of earlier years. Thus, the additional ITRs received in 2017 works out to be 56 lakh,” CBDT said.

In the Economic Survey released last week, the report said there were 5.4 lakh new taxpayers.

“The analysis given in Table-6 on page 22 of the Economic Survey (Vol.2) is based on the data for the period of 9th November to 31st March of 2016-17 and corresponding periods of last two financial years,” CBDT said.

It further added, “Moreover, the growth in the number of taxpayers discussed in the Economic Survey is based on the number of new taxpayers assuming the previous year’s growth rate as the reference growth rate.”

CBDT cited other official data which was delivered by Finance Minister Arun Jaitley on May 17, 2017 who said there were 91 lakh taxpayers post demonetisation.

Also,in reply to an unstarred question during the parliament session in Rajya Sabha on August 1, it was stated that 33 lakh new taxpayers have been added to the tax net post demonetization.

However, CBDT clarified on the earlier two mentions alone.

“On the other hand, the growth of Individual return-filers referred to in PM’s speech is with respect to new as well as old taxpayers. Thus, the data used in Economic Survey is different from data referred to in PM’s speech in respect of the period of filing as well as the type of taxpayers and the two are not comparable,” CBDT added.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

07:48 PM IST

Continue focus on 'responsive and fair' administration for taxpayers: CBDT chairman to I-T dept

Continue focus on 'responsive and fair' administration for taxpayers: CBDT chairman to I-T dept Himachal withdraws free electricity for tax payers

Himachal withdraws free electricity for tax payers ITR Refund Fraud Alert: Scammers are sending this message to cheat taxpayers

ITR Refund Fraud Alert: Scammers are sending this message to cheat taxpayers Tax department reduces time for taxmen to decide on refund adjustment

Tax department reduces time for taxmen to decide on refund adjustment About Rs 400 crore tax deposited by filing updated ITRs so far

About Rs 400 crore tax deposited by filing updated ITRs so far