Nifty to slide to 14,500 by year-end, rupee to depreciate to 81: BofA Securities

The rupee slumped 21 paise to a record low of 78.35 against the greenback on Wednesday.

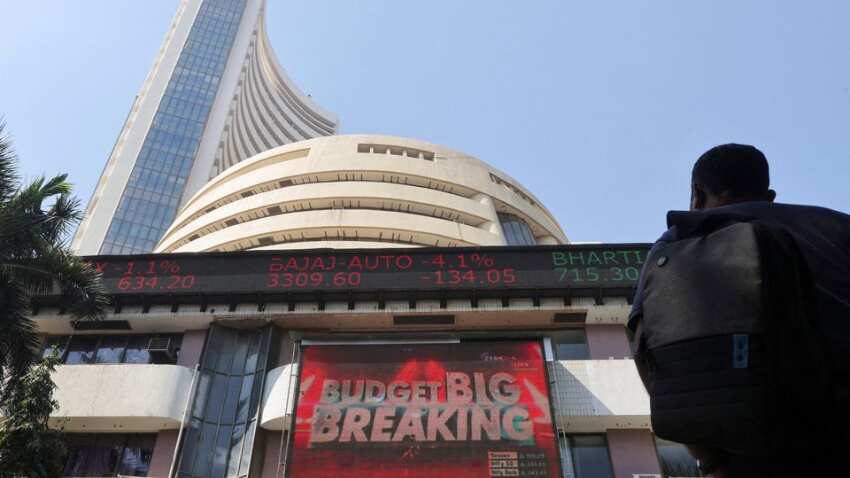

Indian equities will bottom-out only in August or September and the 50-share benchmark Nifty will fall by another 6 per cent to 14,500 points by the end of this year, an American brokerage said on Wednesday.

A cut in companies' earnings as the advantage from cheaper inventory buffer wears off, continuing headwinds on crude oil prices and "vulnerable" valuations of Nifty stocks even after the recent correction were cited by BofA Securities as the factors which will drag down the markets.

The brokerage had initially estimated the Nifty will rise to 19,100 by the end of the year and revised the target down to 17,000 after the sell-off.

The benchmark, which closed 1.44 per cent down at 15,413.30 points on Wednesday, has been losing ground over the past few weeks, driven by factors like monetary policy tightening globally and higher commodity prices following the Russian invasion of Ukraine.

See Zee Business Live TV Streaming Below:

"We are cautious on markets despite the recent market correction. In addition to globally tightening monetary conditions and a slowing economic outlook, including fears of a recession in the US, we see other risks," analysts at the brokerage said.

Other factors driving the brokerage to be cautious include earning cuts of up to 4 per cent with the risk of more downgrades and crude prices, which it said can spike to USD 150 per barrel.

Meanwhile, the brokerage said the rupee will depreciate beyond its own expectations to Rs 81 against the US dollar by the end of 2022.

The rupee slumped 21 paise to a record low of 78.35 against the greenback on Wednesday.

"We believe the risks are still skewed towards more depreciation for the rupee as the fundamental outlook has deteriorated further primarily due to higher oil and other commodities," it said.

However, the analysts were quick to add that the RBI's reserves of nearly USD 600 billion will be a mitigating factor against the risks.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Latest SBI Senior Citizen FD Rates: How much senior citizens can get on investments of Rs 5,55,555, Rs 7,77,777, and Rs 9,99,999 in Amrit Vrishti, 1-, 3-, and 5-year FDs

Power of Rs 3,000 SIP: In how many years, Rs 3,000 monthly investment can generate corpuses of Rs 2 crore and Rs 3 crore? Know here

Top 7 ETFs With Highest Returns in 1 Year: No. 1 ETF has turned Rs 8,78,787 investment into Rs 13,95,091; know how others have fared

Power of Compounding: Rs 5 lakh lump sum investment in 3 flexi schemes has grown to at least Rs 15.5 lakh in 5 years; see list

Rs 1,000 Monthly SIP for 40 Years vs Rs 10,000 Monthly SIP for 20 Years: Which can give you higher corpus in long term? Calculations inside

06:44 PM IST

Weekly Market Wrap: Indices end nearly 1% higher; M&M top Nifty gainer

Weekly Market Wrap: Indices end nearly 1% higher; M&M top Nifty gainer  Final Trade: Sensex gains over 250 points; Nifty tops 23,800 led by auto and financial

Final Trade: Sensex gains over 250 points; Nifty tops 23,800 led by auto and financial Sensex climbs 300 points; Nifty holds above 23,850 as auto stocks rally

Sensex climbs 300 points; Nifty holds above 23,850 as auto stocks rally Anil Singhvi Market Strategy December 27: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 27: Important levels to track in Nifty50, Nifty Bank today GIFT Nifty futures up by 50 points; markets set to start on a positive note

GIFT Nifty futures up by 50 points; markets set to start on a positive note