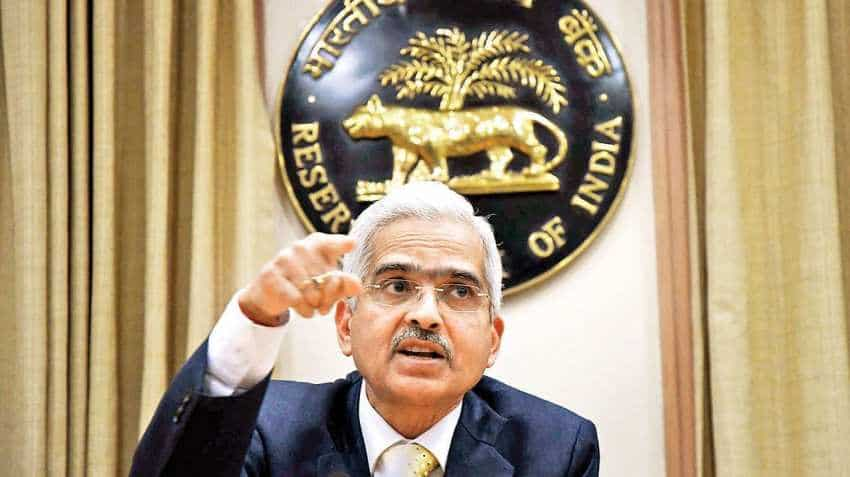

Monetary policy 2019: Shaktikanta Das says RBI will not hesitate to take any measure required to maintain financial stability

Warning the retail bankers for not passing on the rate cut benefits to the customers the RBI Governor vowed to take stringent actions against the retail banks.

Addressing the media after Reserve Bank of India's second bi-monthly policy meeting, RBI Governor Shaktikanta Das said that the central bank will not hesitate to take any measure which is required to maintain the financial stability of the system including, shot-term, medium-term and long term. Thanking the MPC members, Das said, "I thank the MPC members and pleased to inform that all MPC members have agreed to reduce the key Repo Rate by 25 bps to 5.75 per cent and change its stance from neutral to accommodative."

#RBIPolicy | #RBI क्रेडिट पॉलिसी की अन्य बड़ी बातें।#CreditPolicy @AnilSinghviZEE @FinMinIndia @DasShaktikanta pic.twitter.com/9kVSAryWSR

— Zee Business (@ZeeBusiness) June 6, 2019

Das added that the central bank is going to wave off RTGS and NEFT charges being levied on online fund transfer via netbanking citing, "The MPC has decided to waive-off RTGS and NEFT charges being levied for online bank transfer." The statements came after the central bank decided to move its stance from 'neutral' to 'accommodative' as all six members of the committee agreed to cut the Repo Rate by 25 bps to 5.75 per cent. The RBI Governor said that southwest monsoon has been predicted by the IMD to be normal that is good for the foodgrain production.

On Exim status, Shaktikanta Das said that Indian exports grew in 0.6 pct in April 2019 citing, "Exports grew by 0.6 per cent in April 2019 while imports grew at a somewhat accelerated pace leading to widening of the trade deficit."

Warning the retail bankers for not passing on the rate cut benefits to the customers the RBI Governor vowed to take stringent actions against the retail banks if needed citing, "As far as the liquidity is concerned, the RBI won't hesitate taking action in regard to the liquidity."

On February 7 and April 4, the central bank had reduced the key lending rate by 25 basis points to infuse liquidity and push growth. Repo rate is the rate at which the RBI lends money to commercial banks. A repo rate cut allows banks to reduce interest rates for consumers on loans, and lowers equal monthly instalments on home loans, car loans and personal loans.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

01:06 PM IST

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank  Reserve Bank amends master direction on KYC

Reserve Bank amends master direction on KYC  Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public

Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public Rupee settles on flat note, rises 1 paisa to 84.07 against US dollar

Rupee settles on flat note, rises 1 paisa to 84.07 against US dollar  Retail inflation likely to average 4.5% in FY25: RBI Deputy Governor

Retail inflation likely to average 4.5% in FY25: RBI Deputy Governor