List of factors to surround RBI decision on monetary policy

RBI has kept policy repo rate unchanged at 6% in the past two monetary policy meetings along with accommodative stance due to fear of higher inflation and macro-economic data.

As the RBI is set to announce FY18’s last monetary policy today, analysts expect a ‘status quo’ on interest rate along with tone turning

RBI has kept policy repo rate unchanged at 6% in the past two monetary policy meetings along with accommodative stance due to fear of higher inflation and macro-economic data.

The policy meet will be keenly watched, but for now here’s a list of factors that may surround the central bank’s decision, as per Care Ratings.

Bank Credit

Bank credit growth has been better than last year with growth (up to January 19) at 4.2% (1.9%) over March and 10.6% (4.7%) on y-o-y basis.

Pick up in credit has however been skewed towards non-manufacturing credit.

During the financial year (December over March), growth has been driven largely by the retail segment with 10.8% growth (8.4%) followed by services 0.5% (2.5%), agriculture 0.6% (3.2%). Growth to manufacturing was -1.7% (-5.6%).

Bank deposits growth

Deposits at Rs 109.8 lakh crore as of January 19 , had grown at a lower rate of 2% (12%) over March and 5.1% (13.1%) on y-o-y basis.

Reason behind this lower rate were last year numbers include the impact of demonetization where deposit flows increased sharply.

Also in the current year, there has been migration of household savings to mutual funds on account of better returns in the market.

Banks' interest rates

The banks' 1-year deposit rate has remained unchanged at 6- 6.75%, as RBI maintained status quo in the last policy.

Base rate of banks has moved down marginally from a range of 8.85-9.45% to 8.65-9.45%.

Overnight MCLR too has moved down in a similar manner from 7.70-8.05% to 7.65-8.05%.

Commercial Paper (CP) market

Outstanding CPs increased from Rs 3.98 lakh crore on 31st March 2017 to Rs 4.70 lakh crore as of 15th Jan 2018, registering an increase of 18%.

However, this was lower than that last year where o/s CPs increased from Rs 2.60 lakh crore in March 2016 to Rs 4.07 lakh crore in Jan 2017.

Government Securities (GSec) rates

GSec rates have increased sharply since the last policy with the 10-year benchmark increasing from 7.06% to 7.56%.

CARE says “This has been driven by a combination of factors.”

Firstly, the RBI had signalled that inflation was going to be a concern which the market interpreted as being an indication that there will be no rate cut for the financial year.

Secondly, the government announced an increase in its borrowing programme towards the end of December which indicated fiscal slippage.

Liquidity Surplus

Government has stated in the Budget that the gross borrowing programme for the year FY18 was higher than budgeted by Rs 17,000 crore (Rs 5.99 lakh crore as against Rs 5.82 lakh crore last year).

As of January 26, market borrowings was at Rs 5.66 lakh crore.

CARE said, “Substantial liquidity which flowed through the deposits surge post demonetization had gotten absorbed over time.”

Currently, outstanding funds in reverse repo are around Rs 1.27 lakh crore while o/s repo is around 0.72 lakh crore.

Thus, there is surplus net liquidity in the system.

RBI sold securities of almost Rs 90,000 crore through its Open Market Operations (OMO) in the course of year.

Forex position

Between December 2017 till February 02, rupee continues to be strong with the dollar rate improving from Rs 64.39 to Rs 64.06.

Continued increase in forex reserves has kept the rupee stronger.

While the dollar index has weakened against the euro from 1.18 to 1.25 which has worked in favour of the rupee.

Data suggests that forex reserves have increased by around $ 17 billion during this period, while foreign institutional investors (FII) inflows remained strong in January at $ 3.5 billion after falling in December.

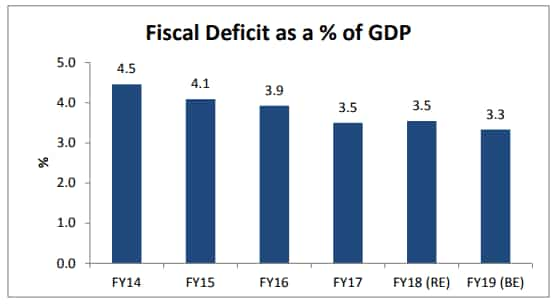

Fiscal deficit

For nine months of Financial Year 2018, India's fiscal deficit stands at Rs 6,20,949 crore, overshooting the budgeted estimate (BE) target by 113.6%.

The government has estimated Rs 5,46,532 crore of fiscal deficit for FY18 which during the same period of the last year stood negative at 93.9%.

Looking at the fiscal slippage, the Finance Minister during his Budget 2018 speech stated revised Fiscal Deficit estimates for 2017-18, Rs 5.95 lakh crore at 3.5% of GDP.

The government expects to bring this target down to 3.3% in the next fiscal (FY19).

Gross Domestic Products

India's GDP numbers came in at 6.3% in the second quarter of FY18 (Q2FY18) from 5.7% in Q1FY18, but experts were not convinced that the country's economy is moving on a sustainable path.

source: tradingeconomics.com

The Economic Survey 2018, projected the country’s gross domestic product (GDP) will grow by 6.75% this fiscal. While the Central Statistics Office (CSO) estimated growth rate of 6.5% for 2017-18 versus 7.1% in 2016-17 for India's GDP.

Consumer Price Index (CPI)

The retail inflation or CPI, however, surged to 5.21% in December 2017 - from 4.88% in November 2017, and 3.41% in the similar month of the previous year.

Clocking over 5% mark, the CPI is now at 17-month high, mainly driven by primarily by vegetables, house rent and fuel.

source: tradingeconomics.com

Inflation in vegetables shot up to a four-year high of 29.1% in December 2017, from 22.5% in November, contributing 22 basis point to the MoM rise in headline inflation.

If we exclude vegetables, inflation was 150 basis points lower at 3.7%, as per Motilal Oswal data.

CARE said, "Further, the CPI inflation number came in at all year-high which buttressed the feeling that there could be a rate hike instead of a rate cut during calendar 2018."

Wholesale Price Index (WPI)

The WPI inflation in December 2017 was at 3.58%, gradually lower 3.93% to November 2017, and higher 2.10% a year ago the same period.

source: tradingeconomics.com

Correction in WPI was largely led by food inflation, partly mirroring the trends shown in CPI inflation.

Index of Industrial Production (IIP)

IIP or factory output for the month of November 2017 overshooted at 8.4% compared to 2.2% in the month of October 2017 and 4.10% in September 2017.

source: tradingeconomics.com

The current IIP numbers easily surpassed market expectations of 4.4%, as it was the steepest increase in industrial production since June 2016.

With this, the IIP has reached at 5-year high, indicating that factory output might be reviving from the government's Goods and Services Tax (GST) and Demonetisation impact.

Other highlights

According to CARE, the bank recap programme announced earlier by the government would find mention in the policy as it does clear the way for putting PSBs on a stronger footing.

It said, “The tone on the progress made on NPAs would also be important as it will give an idea on whether or not this level has peaked or whether we have to wait for one more quarter.”

Apart from this, at the macro level crude oil prices, action by other central banks and global economic prospects would also be an integral part of the discussion.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

12:47 PM IST

RBI, Maldives Monetary Authority sign pact to promote use of local currencies

RBI, Maldives Monetary Authority sign pact to promote use of local currencies RBI cautions public about 'deepfake' video of governor being circulated on social media

RBI cautions public about 'deepfake' video of governor being circulated on social media RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank  Consumer inflation worsens to 6.21% in October from 5.49% in previous month

Consumer inflation worsens to 6.21% in October from 5.49% in previous month Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public

Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public