Income Tax Return (ITR) filing: If ITR filed after July 31, you may end up paying Rs 5000 penalty; find out more

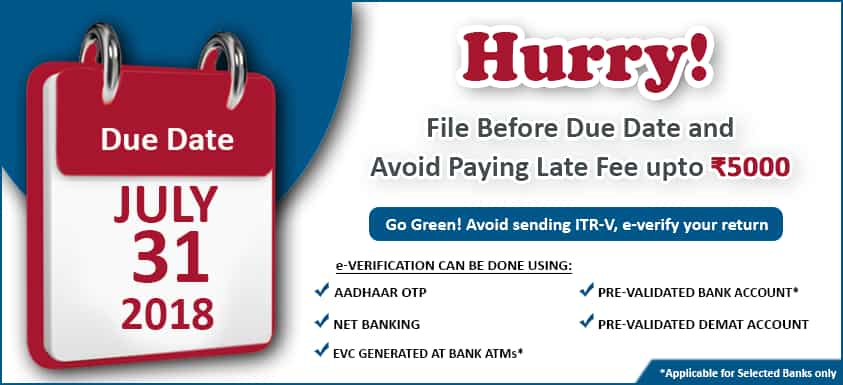

On the official website, the IT department stated that, file before due date and avoid paying late fee upto Rs 5000.

As the deadline nears for Income Tax Return (ITR) filing on July 31, the Income Tax Department has been issuing advertisement guiding taxpayers over their ITR filing on multiple occasion. In latest move, the department has now issued a warning to taxpayers who will to fail to file their ITR before the scheduled deadline. The Income-Tax department has opened an e-filing window for income tax return (ITR) for assessment year 2018-19 on its website for salaried employees.

While some try to still get cracking and follow proper procedures for filing ITR, either online or taking help of Chartered Accountants (CAs), some simply get frustrated by the fact that it requires them to recall and keep track of what they spent their money on or saved. Thus this may result in laziness and in the process ITR does not get filed - some forget it for years. Other reasons can also be that an individual may simply not have the time to devote to this even as they have to focus on their daily jobs, and not filing ITR for nearly 2 years or more can be a possibility among all.

On the official website, the IT department stated that, file before due date and avoid paying late fee upto Rs 5000.

The department has emphasized on the word Hurry in regards to filing ITR before deadline, as last minute filing can lead to various problems or errors.

Also you really might want to take filing ITR on a serious note before deadline, as the government has introduced a maximum penalty of Rs 10,000 for delayed filing by tax payers. This new penalty is in effect from April 01, 2018.

A new section named as 234F has been enforced by the government in the IT Act, which indicates an individual would have to pay a fee of upto Rs 10,00 for filing ITR after due dates which are specified in section 139(1).

This new section is divided in two parts. First a Rs 5,000 penalty for those who file their ITR after July 31, but before December 31. Secondly a Rs 10,000 penalty comes after December 31 on taxpayers delay.

Therefore, if you do not want to end up paying penalties, then buckle up and file your ITR before due date.

How to file

Step 1. Login to e-filing website with User ID, Password, Date of Birth /Date of Incorporation and Captcha.

Step 2. Go to e-File and click on "Prepare and Submit ITR Online".

Step 3. Select the Income Tax Return Form ITR 1/ITR 4S and the Assessment Year.

Step 4. Fill in the details and click the "Submit" button.

Step 5. Upload Digital Signature Certificate (DSC), if applicable. One needs to ensure the DSC is registered with e-Filing.

Step 6. Click on "Submit" button.

Step 7. On successful submission, ITR-V would be displayed (if DSC is not used). Click on the link and download the ITR-V, which will also be sent to the registered email. If ITR is uploaded with DSC, the Return Filing process is complete.

File ITR online (on Income Tax website)

The notified ITR Forms are available on the official website of the department www.incometaxindia.gov.in. The last date for filing the ITR is July 31.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

LIC Saral Pension Plan: How to get Rs 64,000 annual pension on Rs 10 lakh one-time investment in this annuity scheme that everyone is talking about

Gratuity Calculation: What will be your gratuity on Rs 45,000 last-drawn basic salary for 6 years & 9 months of service?

Rs 1,500 Monthly SIP for 20 Years vs Rs 15,000 Monthly SIP for 5 Years: Know which one can give you higher returns in long term

Income Tax Calculations: What will be your tax liability if your salary is Rs 8.25 lakh, Rs 14.50 lakh, Rs 20.75 lakh, or Rs 26.10 lakh? See calculations

8th Pay Commission Pension Calculations: Can basic pension be more than Rs 2.75 lakh in new Pay Commission? See how it may be possible

SBI Revamped Gold Deposit Scheme: Do you keep your gold in bank locker? You can also earn interest on it through this SBI scheme

Monthly Pension Calculations: Is your basic pension Rs 26,000, Rs 38,000, or Rs 47,000? Know what can be your total pension as per latest DR rates

02:29 PM IST

New Income Tax Law: Small business owners & professionals set to get relief, says sources

New Income Tax Law: Small business owners & professionals set to get relief, says sources Only 6.68% of population filed income tax return in 2023-24 fiscal

Only 6.68% of population filed income tax return in 2023-24 fiscal Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources

Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources  ITR Filing Deadline Extended: I-T Dept extended the last date of income tax filing by 15 days

ITR Filing Deadline Extended: I-T Dept extended the last date of income tax filing by 15 days Made a mistake in ITR filing? No need to file revised ITR; check out this new feature

Made a mistake in ITR filing? No need to file revised ITR; check out this new feature