IIP Conundrum: Factory output at over two-decade low; what's next?

Despite the continuous decline in IIP data, analyst yet believe it will see nearly 3% growth in FY17, on the back of 7th Pay Commission, government spending, festive season and favourable monsoon.

India's Index of Industrial Production (IIP), or factory output, contracted by 0.7% in August 2016 as against an expansion of 6.3% in the same month of last year.

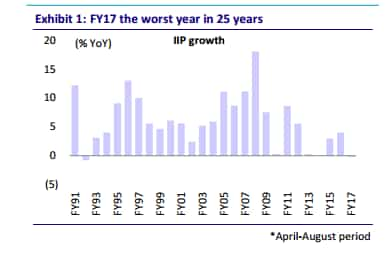

However, for the first five month of current fiscal, i.e. April to August 2016, IIP’s cumulative growth have declined by 0.3%, lower than the 4.1% in the corresponding period last fiscal. This would be the first decline in 25 years, Nikhil Gupta of Motilal Oswal, in a report on October 10, said.

Mining activity in the country, during this five-month period, declined to its 39-month low of negative 5.6%. Capital goods contracted by 22.2% YoY in August, marking tenth decline in a row.

Consumer durables growth at 2.3% was also pretty weak (considering its historical pace ‐ fifteen months average at 12.7%), led by contraction in furniture output.

Despite the continuous decline in IIP data, analyst yet believe it will see nearly 3% growth in FY17, on the back of 7th Pay Commission, government spending, festive season and favourable monsoon.

Gupta said, " While a decline of 0.3% in IIP (over April-Aug 2016) reflects weak production activity in the economy, it is in clear evident contrast to 50% YoY growth in excise duty collection by the central government. Since the central government’s tax base is exponentially broader than IIP, industrial activity may not be as weak as reflected by IIP."

Festive season may help IIP to grow by 1.7% YoY in September 2016, he said.

Anjali Verma of Philip Capital said,"While August growth is better than last month’s significant weakness, industrial activity continues to be weak. We expect some improvement in the next two months due to festive stocking."

"Weak industrial activity is weak it is a reflection of persisting weak demand and resultant employment generation, which in turn will keep demand tepid," she said.

"We expect demand to improve triggered by 7th pay commission payouts and lagged impact of good monsoon. More growth in consumption will be led by the state’s implementation of 7th PC recommendations," she added.

While Care Ratings said, “India having recorded normal monsoons this year, thus industrial output is likely to go up in the coming months.”

It expects the industrial growth of around 3% in FY17.

“Further consumption data is expected to improve from their exiting levels, while investments should stay paused. Better‐than‐expected IIP data will augur well for our FY17 GVA expectation at 7.8%, which we believed were at risk after last month’s data,” said Gupta of Philip Capital.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

03:27 PM IST

Key infra sectors growth rises 6.3% in May against 6.7% in April

Key infra sectors growth rises 6.3% in May against 6.7% in April IIP growth slows marginally to 4.9% in March; grows 5.8% in FY24: Govt Data

IIP growth slows marginally to 4.9% in March; grows 5.8% in FY24: Govt Data Industrial production growth: IIP grows to 4-month high of 5.7% in February on good mining show

Industrial production growth: IIP grows to 4-month high of 5.7% in February on good mining show IIP Data: Industrial production growth rate rises to 16-month high of 11.7% in October

IIP Data: Industrial production growth rate rises to 16-month high of 11.7% in October IIP Data: Industrial production rises 10.3% in August

IIP Data: Industrial production rises 10.3% in August