GST Bill: Here's how it will impact India Inc

Last week, the Union Cabinet had cleared the changes in the Bill by dropping 1% additional tax on inter-state sales as proposed in the Bill.

The much-awaited Goods and Service Tax (GST) Bill is set to be tabled today in Rajya Sabha. After many proposed changes, several regional parties have cleared the way for the passage of the Bill.

Last week, the Union Cabinet had cleared the changes in the Bill by dropping 1% additional tax on inter-state sales as proposed in the Bill. Congress had indicated its acceptance of government proposal.

Once the Bill is passed, it is expected to positively impact the sectors like automobiles, consumer durables, pharmaceuticals, Kotak Mahindra said in a report titled "Economy: GST: Godot is on his way".

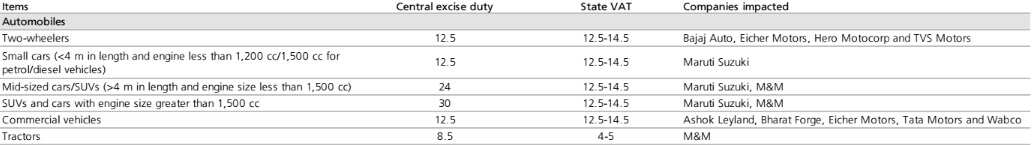

Automobile sector

Suvodeep Rakshit of Kotak Mahindra said that in case the GST Council puts UVs in the ‘standard’ category (instead of ‘high’ rate of 40%), there could be significant benefits to the automobiles sector.

Commenting on the impact of GST, Bajaj Auto informed Kotak Mahindra that the overall tax rate on two-wheeler industry could come down to 18% of ex-showroom price from 24% depending on the actual GST rate.

Apart fro Bajaj Auto, other two-wheeler companies like Eicher Motors, HeroMotoCorp and Tata Motors shared the similar views on the decline of overall tax.

Under the SUVs/cars segment, talking about the impact of GST on companies' portfolio, Maruti Suzuki said that assuming 40% GST rate, the prices of mid-sized vehicles are likely to increase by 6%. "Weighted average price benefit on company's product portfolio is 5%. The prices of small cars/SUVs would come down by around 7%".

While, Mahindra & Mahindra said that the prices of large SUVs/cars and tractors will remain largely unchanged assuming 40% and 12% GST rate on large vehicles and tractors respectively.

Pharmaceuticals

Looking at the "Neutral" impact of GST, pharma major, Cipla said that the domestic formulations may have a minor, positive impact due to streamlining of distribution. However, this will likely be offset by higher GST rates on various services.

Other pharmaceutical companies like Dr Reddy's Laboratories, Lupin, Sun Pharmaceuticals shared the similar views like Cipla.

Consumer durables

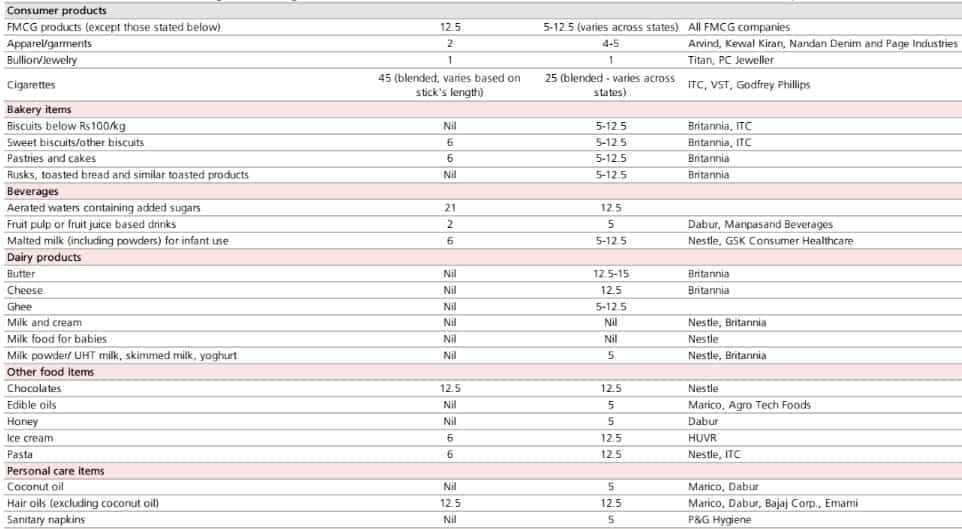

"Consumer durables could also see benefits as overall tax rates fall. The gains to the consumer sector could also be derived through a pan-India market, which can help lower logistics and warehousing costs", Rakshit said.

Asian Paints and Hindustan Unilever believed to have a positive impact of GST Bill on their respective companies. The companies said that the overall tax incidence may come down if GST rate is fixed at 18%. The benefits would also accrue from improved competitive positioning versus the unorganized segment and some logistics cost savings.

Moreover, FMCG major, ITC said that passage of GST Bill will have "Neutral" impact on the company's revenue. "Revenue-neutral rate is around 70%. In a scenario where central excise continues and state VAT (around 26% weighted average at this point) goes up to sin tax rate of 40%, we expect central excise rates to be cut. Centre will still remain revenue neutral as there would not be any excise collection sharing with the states under GST".

Overall economy

According to the Kotak Mahindra report, the impact of GST may not be seen on short term. But, in the medium and long term, the reforms like company-specific advantages through lower costs, simpler tax rules, and advantages over the informal sector will play a key role.

Further, the report suggested that the higher services tax rate may increase CPI inflation by 30-40bps with 14% of the CPI basket.

"The impact on food products and, in general, other goods will remain uncertain until the GST Council decides on exemption on goods. We expect marginal impact on inflation".

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Gratuity Calculation: What will be your gratuity on Rs 45,000 last-drawn basic salary for 6 years & 9 months of service?

SBI Senior Citizen FD Rates: Want to invest Rs 3,00,000 in SBI FD? You can get this much maturity amount in 1 year, 3 years, and 5 years

No penalty for early loan repayment? Key takeaways from RBI's new foreclosure guidelines for lenders

EPS Pension Calculation: Rs 40,000 basic salary, 30 years of service, what will be your monthly EPS pension amount?

Retirement Planning: How one-time investment of Rs 11,00,000 can create a Rs 3,30,00,000 retirement corpus

New Tax Regime Calculations: Is your annual income Rs 12,76,000? Will you be taxed on Rs 1,000, or Rs 12,76,000 in proposed new tax regime? Know rules

SIP Calculation at 12% Annualised Return: Rs 1,000 monthly SIP for 20 years, Rs 4,000 for 5 years or Rs 10,000 for 2 years, which do you think works best?

09:42 AM IST

Maharashtra, UP Show India What To Expect From GST

Maharashtra, UP Show India What To Expect From GST India's biggest tax reform GST looms, many companies unprepared

India's biggest tax reform GST looms, many companies unprepared One nation, one tax; Sachin tweets: looking forward to GST bill

One nation, one tax; Sachin tweets: looking forward to GST bill GST in Rajya Sabha: Here's a list of amendments

GST in Rajya Sabha: Here's a list of amendments Will GST be a game changer for India?

Will GST be a game changer for India?