GST in Rajya Sabha: Here's a list of amendments

If passed, the Government is hopeful of implementing the new tax code from April 1, 2017.

After many consultations with regional and national parties, the Government has introduced nine changes to the Goods and Services Tax (GST) Bill.

The Bill is listed to be debated in the Rajya Sabha on Wednesday, August 3, 2016. If passed, the Government is hopeful of implementing the new tax code from April 1, 2017.

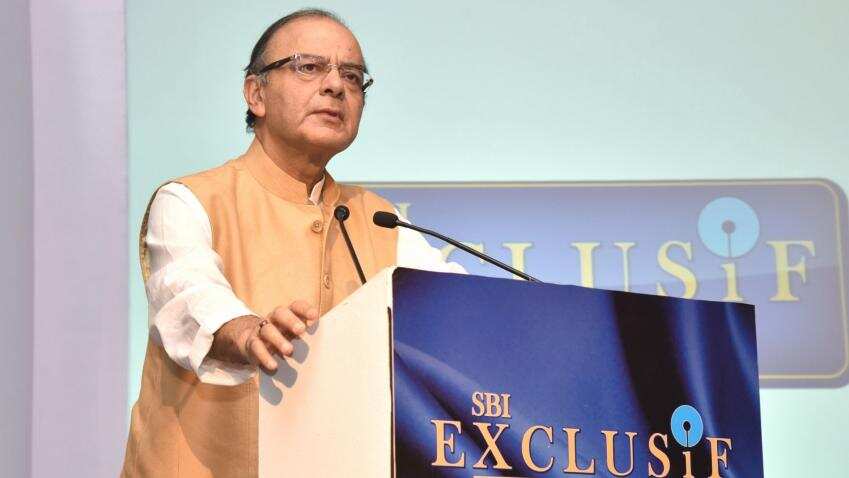

Finance Minister Arun Jaitley, has introduced a notice of amendments in the Rajya Sabha hoping for opposition's support and clearance of the Bill.

Below are the changes proposed by Jaitley:

1. That at page 1, line 1, for the word "Sixty-Sixth", the word "Sixty-Seventh" be substituted.

2. That at page 1, lines 3 and 4, for the words, for the words, bracket and figure "the Constitution (One Hundred--- Amendment) Act, 2015", the words, bracket and figure "the Constitution (One Hundred and First Amendment) Act, 2016" be substituted.

3. That at page 3, after line 23, the following be inserted namely,

-- The amount apportioned to a State under clause (1) shall not form part of the Consolidated Fund of the State.

--Where an amount collected as tax levied under clause (1) has been used for payment of the tax levied by a State under Article 246A, such amount shall not form part of the Consolidated Fund of India.

--Where an amount collected as tax levied by a State under Article 246A has been used for payment of the tax levied, such amount shall not form part of the Consolidated Fund of India.

4. That at page 4, for lines 1 to 8, the following be substituted, namely:

--Tax collected by the Union under clause (1) shall also be distributed between the Union and the States in the manner provided in clause (2).

--The tax levied and collected by the Union under clause (2) of Article246A and article 269(A), which has been used for payment of the tax levied by the Union under clause (1) of Article 246 (A) and the amount apportioned to the Union under clause (1) of Article 269A, shall also be distributed between the Union and the States in the manner provided in clause (2).

5. "That at page 4, lines 17 and 18, for the words, bracket and figure "the Constitution (One Hundred--- Amendment) Act, 2015", the words, bracket and figure "the Constitution (One Hundred and First Amendment) Act, 2016" be substituted.

6. That at page 5, line 16, for the words "Integrated Goods and Service Tax", the words, figure and alphabet "Goods and Service Tax levied on supplies in the course of inter-State trade or commerce under Article 269A", be substituted.

7. That at page 7, for lines 10 to 12, the following be substituted with: "The Goods and Service Tax Council shall establish a mechanism to adjudicate any dispute (a) between the Government of India and one or more States (b) between the Government of India and any State or States on one side and one or more other States on the other side (c) between two or more States, arising out of the recommendations of the Council or implementation thereof".

8. That at page 10, lines 7 to 31, be deleted.

9. That at page 10, for line 32 shall be substituted with "Parliament shall, by law, on the".

Last week, the Union Cabinet had cleared the changes in the Bill by dropping 1% additional tax on inter-state sales as proposed in the Bill. Congress had indicated its acceptance of government proposal.

As ZeeBiz had earlier reported, Jaitley met the Empowered Committee of State Finance Ministers to discuss some of the demands of the States for the passage of GST Bill.

The cap on the GST was something that the Congress Party has been pushing for, however many of the other opposition parties have not been so keen on it.

The state finance ministers also said that the GST rate should not be so much that the State loses revenues.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

06:04 PM IST

'One nation one tax' to eliminate corruption: Jaitley on GST

'One nation one tax' to eliminate corruption: Jaitley on GST Will GST be a game changer for India?

Will GST be a game changer for India? Congress shows support for GST Bill

Congress shows support for GST Bill Cabinet drops 1% additional tax on inter-state sales for GST bill

Cabinet drops 1% additional tax on inter-state sales for GST bill Can Centre and state govts find middle ground over GST?

Can Centre and state govts find middle ground over GST?