Fewer and stronger PSU banks but what about their stressed assets?

The Government of India is all set to make fewer and stronger PSBs in the coming months - as an move to tackle their non-performing assets (NPAs). A list of total 21 PSBs are considered to become 10 - 12 banks.

Key Highlights:

- SBI post merger accounts for 23% of total banks NPAs

- Five PSBs hold half of total gross NPA in the banking system

- Govt to set up ministerial panel for consolidation of PSU Banks

Recently a Union Cabinet chaired by Prime Minister Narendra Modi gave in-principle nod for an “alternative mechanism” to oversee proposals for speedy consolidation among the nationalised banks to create 'strong and competitive banks'. A ministerial panel will be soon set up by the Government of India to facilitate consolidation in the public sector banks.

“A formal communication to CEOs of the banks from the Department of Financial Services last week has set in motion the consolidation process," a senior finance ministry official said.

Motive behind public sector banks (PSBs) consolidation is to create fewer and stronger banks.

The move is taken as credit positive for public sector banks.

Moody's Investor Services said that poor corporate governance has been a structural credit weakness at public-sector banks and managing all 21 has proven to be unwieldy for the government, which has been unable to pay sufficient attention to key issues such as long-term strategies and human resources.

“Consolidation would address some of these issues,” said Moody's.

According to Viral Acharya, Deputy Governor of RBI, consolidation would offer the opportunity to rejig management responsibility away from those who have under-performed or dragged their feet the most. Synergies in lending activity and branch locations could be identified to economize on intermediation costs, allowing sales of real estate where branches are redundant.

Considering this it is clear that consolidation is one positive move for PSBs, but there is still one major problem that needs to be answered - Can a bank that is highly stressed with non-performing assets be merged with a bank which is considerably better - or already tangled in NPA mess?

Only one bank has successfully amalgmated with other PSBs. Largest lender State Bank of India merged with its six associate banks with effects from April 01, 2017.

As expected SBI saw its gross NPA book rising in its balance sheet post merger – as NPAs of its associates were more than half of SBI alone before March 2017.

Gross NPAs of SBI post merger, in percentage terms stood at 9.97% in Q1FY18 compared to 9.11% in Q4FY17 and 7.40% in Q1FY17. In value terms, gross NPAs of SBI post merger stood at Rs 1,88,069 crore in Q1FY18 as against Rs 1,12,343 crore as on March 2017 (When the SBI was solo).

Nilesh Parikh, Kunal Shah, Prakhar Agarwal and Malav Simaria, analysts at Edelweiss Financial Services said, "Q1FY18 reflected integration challenges. Henceforth, key will be merger transition. Given the scale of transition, we expect recovery trend during merger to be gradual, which will weigh on SBI’s core performance."

Now apart from SBI and its associates, there are a total 21 PSBs – who might soon become 10 – 12 PSBs.

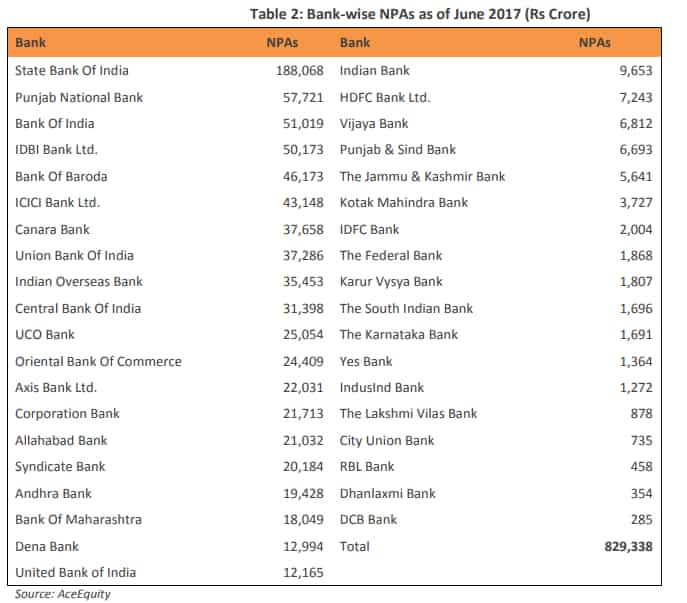

On year-on-year (YoY) basis, banking system have seen a sharp rise of 34.17% to Rs 8,29,335 crore in June 30, 2017 compared to Rs 6,18,109 crore in the corresponding period of the previous year.

Five public sector banks (PSBs) namely SBI, Punjab National Bank, Bank of India, IDBI Bank and Bank of Baroda (BoB) bagged the top five spots in highest NPA. Together they accounted a share of 47.4% totalling up to Rs 3,93,154 crore.

11 of the top 12 banks in terms of NPAs were of PSBs with the exception being ICICI Bank which has NPA of Rs 43,148 crore as on June 2017. Out of the 38 banks – 20 banks had NPA higher than Rs 10,000 crore – most of them PSBs.

Among 21 PSBs – a total of 12 banks have seen between 2% - 13% rise in their gross NPAs between June 2016 – June 2017.

IDBI Bank whose gross NPAs stood at 12.19% in June 2016 – reached to 21.25% in March 2017 and further to 24.11% in June 2017. Also Bank of Maharashtra and Dena Bank which hold gross NPAs at 12.64% and 11.88% in June 2016 – climbed in June 2017 to 18.59% and 17.37% respectively.

In the list of highly stressed PSBs as on June 2017 were – Central Bank of India at 18.23% (from 13.52% in June 2016), Punjab & Sind Bank at 11.33% (from 7.23% in June 2016), Andhra Bank at 13.33% (from 10.30% in June 2016), Oriental Bank of Commerce at 14.83% (from 11.45% in June 2016), Indian Overseas Bank at 23.60% (from 20.48% in June 2016) and United Bank of India at 17.17% (from 14.29% in June 2016).

However, the pain is not expected to end anytime soon. India Ratings expects impaired assets to peak at 12.5%-13% by FY18/FY19 while credit costs will show an extended recovery period as a large proportion of the recently acquired higher–bucket non-performing loans keep aging.

Jignesh Shial, analyst at Quant Broking said, "Though the government as well as RBI is consistently pushing for faster resolution of stressed accounts as well as bringing more transparency in stressed asset recognition, considering large pile of existing stressed assets as well as weak demand environment domestically, higher quantum of NPAs are likely to stay."

Shial added, "For PSU banks, rise in provisioning charges along with inability to raise capital, consistent loss of marketshare and rising probability for sector consolidation through mergers would keep pressurizing earnings and market valuations.”

Earlier a Moody's Investors Services report stated that merging will do a little to resolve the issue of a high level of stressed assets on the books of banks and will not result in any meaningful release of capital.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

04:25 PM IST

Bank Unions hold protest march; Here's are the list of demands

Bank Unions hold protest march; Here's are the list of demands Here's how banks can save themselves from NPA stress

Here's how banks can save themselves from NPA stress