Demonetisation hits small loans as sectoral growth more than halves

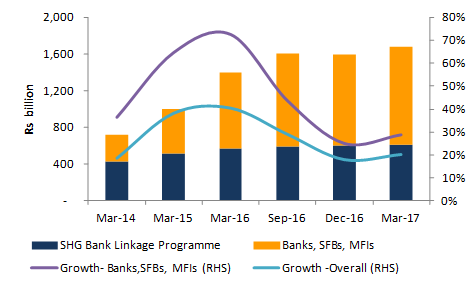

ICRA said, "The Indian micro loan sector with a size of around Rs 1.7 lakh crore as on March 31, 2017, has grown at a healthy compounded annual growth rate of 32% during FY2013-2016. Of this NBFC-MFIs, Small Finance Banks (SFBs) and Banks (excluding the SHG Bank linkage programme) had grown at a much faster pace of 57%. However, the growth trajectory for NBFC-MFIs/SFBs and banks changed post-demonetisation with the portfolio growth slowing down from 72% in FY2016 to 29% in FY2017."

India's micro loans sector grew at 29% in FY2017 as against 72% in the year previous to last, ICRA said on Monday. Fresh disbursements slowed down substantially in H2FY2017, consequently, leading to their overall portfolio growth shrinking considerably, it said.

MFIs and SFBs raised an aggregate of Rs. 4,713 crore of equity capital in FY2017, of which Rs 1,155 crore was raised after demonetisation, indicating continued support from equity investors.

ICRA said, "The Indian micro loan sector with a size of around Rs 1.7 lakh crore as on March 31, 2017, has grown at a healthy compounded annual growth rate of 32% during FY2013-2016. Of this NBFC-MFIs, Small Finance Banks (SFBs) and Banks (excluding the SHG Bank linkage programme) had grown at a much faster pace of 57%. However, the growth trajectory for NBFC-MFIs/SFBs and banks changed post-demonetisation with the portfolio growth slowing down from 72% in FY2016 to 29% in FY2017."

Rohit Inamdar, Group Head Financial Sector Ratings, ICRA said, “Overall collection efficiencies for the industry as a whole came down from around 99% before demonetisation to 82% in December 2016, and improved to around 85-88% till March 2017."

"Consequently, the 0 days past due delinquencies that had peaked to 23.6% in February 2017 improved to 19% in June 2017. However, further flows from softer buckets led to deterioration in 90 days past due delinquencies from 4.9% as on February 28, 2017 to 11% as on June 30, 2017," he said.

“Based on the present recovery trends from delinquent buckets, 70-75% of the portfolio delinquent more than 90 days is likely to be written off, therefore mean credit costs for the industry as a whole are likely to be in the range of 5.5-8% for FY2018," Inamdar said.

"Given their higher expected credit costs for FY2018, ICRA estimates that MFIs and SFBs together would need external capital of Rs 9,000-11,000 crore for growing at a CAGR of 25-30% over the next three years, while maintaining a leverage at around 5 times. Therefore, present leveraging levels, expected credit losses and ability to raise capital will be a critical distinguishing factors for MFIs in the near to medium term,” he said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

03:44 PM IST

Year Ender 2022: A year of revival for the Microfinance sector, more growth expected in 2023, say experts

Year Ender 2022: A year of revival for the Microfinance sector, more growth expected in 2023, say experts Microfinance industry to grow 22% in FY20, needs Rs 4,700-cr external capital in 3 years

Microfinance industry to grow 22% in FY20, needs Rs 4,700-cr external capital in 3 years