Year Ender 2022: A year of revival for the Microfinance sector, more growth expected in 2023, say experts

The loans disbursed by banks under microfinance institutions witnessed a growth of more than 65 per cent between 2018-19 and 2021-22, the official RBI data showed.

Data released by the Reserve Bank of India (RBI) on Tuesday shows that the year 2022 has brought remarkable credit growth for the microfinance sector. The RBI data reveals that the number of loans disbursed by the MFIs or microfinance institutions almost doubled between 2020-21 and 2021-22. Not only in terms of credit growth, but rather the entire sector witnessed 20 per cent growth in Q2 of FY 22-23, revealed the recent data combined by Sa-Dhan, a Self-Regulatory Organization for the Microfinance Sector.

Contribution of each segment to the overall growth

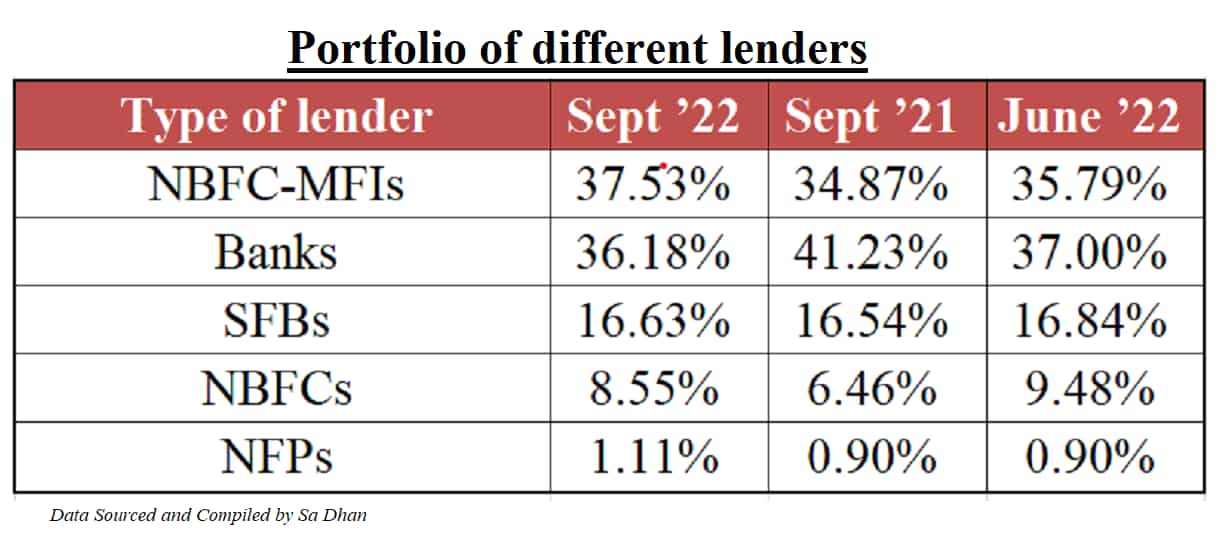

The portfolio of all lenders including non-banking financial companies (NBFC), NBFC-MFIs, and small finance banks (SFB) recorded double-digit growth. NBFCs and NFPs have shown significant growth of 59.22 per cent and 48.36 per cent respectively, while NBFC-MFIs and SFBs have posted growth of 29.42 per cent and 20.84 per cent respectively.

“The growth of the overall industry can be attributed to the revival of pent-up demand after the receding of the adverse impact of the pandemic. Moreover, specialized microfinance institutions have tried to build up their outreach to new customers, besides catering to increased credit requirements with the gradual revival of the semi-urban and rural economies,” said Jyoti Prakash Gadia, Managing Director at Resurgent India, a financial advisory firm.

The data of Sa-Dhan showed that the top 5 states in terms of the portfolio are Bihar, Tamil Nadu, West Bengal, Uttar Pradesh and Karnataka, and these 5 states account for approximately 56 per cent of the total portfolio of the micro-finance Industry.

“The need for working capital and market growth has led to an increase in credit demand. With its penetration in otherwise neglected rural and semi-urban areas, the microfinance industry has become an integral part of the economic development of India,” added HP Singh, Chairman, and Managing Director, Satin Creditcare Network Limited, an NBFC-Microfinance company.

Consistent Credit growth

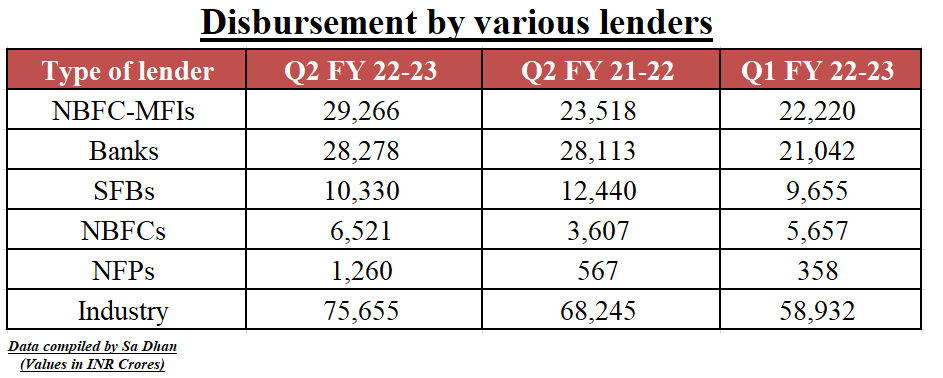

The loans disbursed by banks under microfinance institutions witnessed a growth of more than 65 per cent between 2018-19 and 2021-22, the official RBI data showed. Total disbursement of all lenders during Q2 (July’22 – Sept’22) is Rs 75,655 Crore, whereas it was Rs 68,245 Crore during the same quarter of the previous year, showing an overall 11 per cent Y-o-Y growth. Among the lenders, NBFC-MFIs disbursed a maximum of Rs 29,266 Crore (24 per cent growth Y-o-Y), as per the data compiled by Sa-Dhan.

Despite witnessing overall credit growth, Gross Loan Portfolio (GLP) fell for banks and NBFCs in the last quarter.

“This may be primarily due to the crunch faced by NBFCs in accessing funds from banks. The banks rely on Business Correspondence and Securitisation to grow their portfolio which suffered due to the pandemic and they went slow in extending fresh credit lines,” Singh added.

Experts also pointed out that the MFI sector is specifically impacted adversely due to the vagaries of weather and economic uncertainties and the incremental fall in GLP for this sector seems to be due to the seasonality factor.

“Banks & NBFC GLP is dipping because the institutions are operating mainly in Urban market Tier 1 & Tier 2 cities. The banking system in India dates back centuries, hence urban markets are getting saturated, which is the prime reason for the fall,” mentioned Nehal Gupta, Director of AMU Leasing Private Limited, a tech-enabled NBFC.

Budget 2023 will further improvise the sector

Experts believe that the government will increase its spending on rural development framework and create more job opportunities in rural sectors. Steps taken in direction of developing rural infrastructure, rural educational institutes, and improving rural healthcare will invariably impact the microfinance industry and more measures are likely to be announced in the upcoming budget.

According to several industry leaders, more jobs will be created as a result of agricultural reforms and the development of an efficient rural-urban logistics network. The overall rural and semi-urban development will contribute to the rural economy, thereby creating a positive impact on the microfinance industry.

Click Here For Latest Updates On Stock Market | Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

03:04 PM IST

RBI modifies average base rate for NBFC, MFIs

RBI modifies average base rate for NBFC, MFIs