DDA Housing Scheme 2017 to allot 13,000 houses; Compare best home loan rates offered by banks

DDA Housing Scheme will be launched by end of June 2017 offering about 13,000 houses this time.

Key Highlights:

- DDA Housing Scheme to be launched by end of June 2017, offering 13,000 houses

- DDA housing scheme includes flats which were rejected in DDA 2014 lottery

- Applicants apply through both online and offline mode for this scheme

Every year the Delhi Development Authority (DDA) launches a housing scheme for allotting homes.

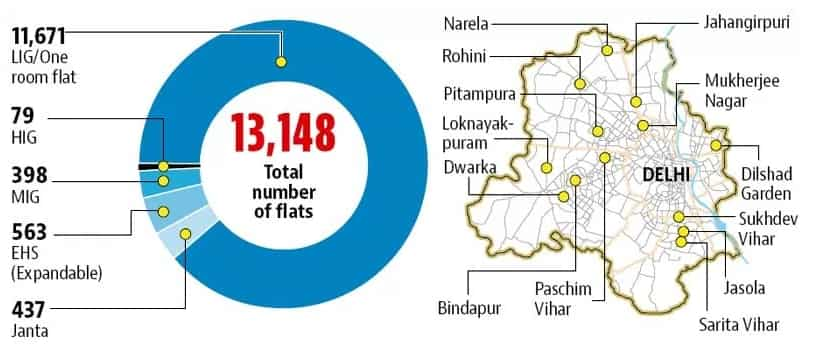

This time the DDA Housing Scheme 2017 which is set to be launch by end of June 2017, will see 13,000 houses being constructed and delivered.

Once the scheme is launched officially, applicants will have to apply either through online or offline modes. A person interested in this scheme will have to collect brochure which will cost around Rs 150 to Rs 200 from the DDA sales counter which situated at Vikas Sadan, New Delhi.

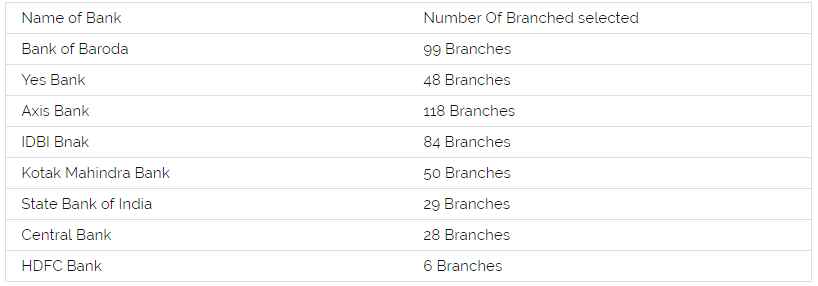

Brochures can also be collected from branches of banks that are being appointed by the DDA.

Lucky draw of DDA flats scheme 2017 will take place in the first week of July or August 2017.

According to the DDA housing scheme land owning agencies has already started offering different packages under that scheme which has not been launched yet.

The scheme was delayed because of Demonetisation as according to a senior DDA Official. Land owners refer is as a housing new year Bonanza for interested applicants, added the site.

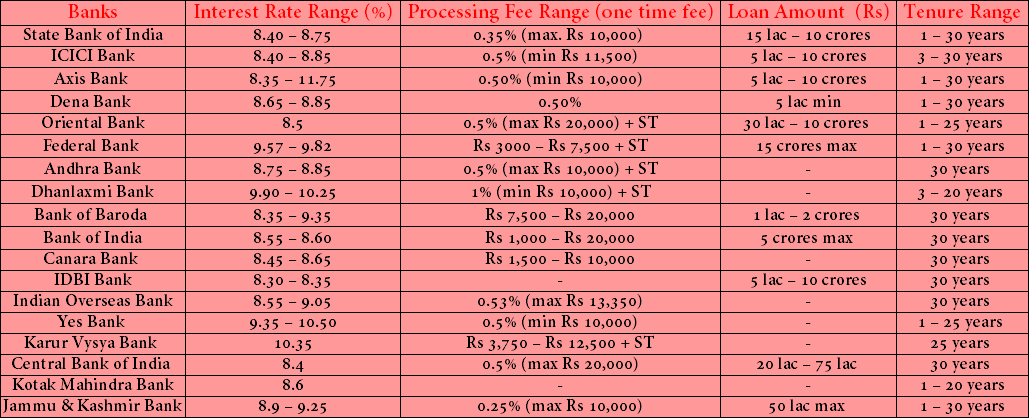

As affordable housing has been one of the major push this year of not only NDA government but also the Reserve Bank of India, we bring you an comparison of home loan interest rates offered by both PSU and private banks for DDA flats.

Here's how can get best deals for home loans under DDA flats, as per BankBazaar.

Check the amount you have to pay under various sections being offered under this current scheme.

HIG stands for – higher income group, while MIG – Medium Income Group, LIG – lower income group.

Who are eligible to opt for these flats.

- Any citizen of India who is atleast 18 years old during the time of filling the form.

- An applicant who does not own any residential plot or flat in Delhi under his/her name or under thier spouse or children name.

- Both husban and wife are eligible to apply separately but if both get successful with homes then only one can retain it.

One application will be accepted per applicant. PAN card is the only identity proof needed for applying under this scheme.

After getting the house, you need to remember this.

One month time will be given to applicants for completing all the formalities.

Possession of the homes to winners will be given in October 2017.

Unsuccessful applicants refunds will also be handled by the appointed 13 banks. The only electronic mode will be used with no paper transaction in case of refund or transaction.

If the buyer denies then the land owning agency will forfeit the entire registration money which is Rs 2 lakh for HIG and MIG flats and Rs 1 lakh for LIG and Janta flats.

Another key thing to note while applying under DDA housing scheme 2017, includes those flats which were rejected in DDA 2014 lottery.

In the year 2014, the DDA launched the scheme with 25,000 flats on offer. However, the scheme saw flats being surrendered – 10,700 to be exact. Reasons like small sizes of flats, their location and many other reasons were mentioned while returning.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

02:36 PM IST

Delhi rains: Lieutenant Governor holds emergency meeting, officials' leave cancelled

Delhi rains: Lieutenant Governor holds emergency meeting, officials' leave cancelled DDA Housing Scheme 2023: Registration for 32,000 flats starts; eligibility, online registration process, price, location, other key details to know

DDA Housing Scheme 2023: Registration for 32,000 flats starts; eligibility, online registration process, price, location, other key details to know  Over 650 flats booked under DDA's FCFS scheme

Over 650 flats booked under DDA's FCFS scheme Delhi CM announces policy for redevelopment of notified non-conforming industrial areas

Delhi CM announces policy for redevelopment of notified non-conforming industrial areas DDA launches housing scheme for 5,500 flats on first-come, first serve-basis

DDA launches housing scheme for 5,500 flats on first-come, first serve-basis